Scandinavia is advancing with plans to expand graphite production capacity, responding to rising demand from the battery industry and for raw materials with a lower carbon footprint. But time will tell how these higher-cost facilities compete against the traditional influx of graphite from China, and whether western end-users are willing to pay a so-called green premium.

Norwegian producer Vianode — which was founded in 2021 and is backed by Elkem, Hydro and Altor — claims it can cut up to 90pc of the carbon footprint with its synthetic graphite production process, which does not rely on open-pit furnaces. It is building on technology previously introduced by Elkem and Hydro for the low-carbon production of metals including aluminium and silicon, and taking advantage of Norway's geographical advantages — proximity to European customers and renewable energy sources.

"Norway has several advantages to succeed in the battery industry, including access to renewable power, process industry competence, a proven track record of engineering, constructing, operating and continuously improving large processing industry plants for advanced materials with global competition, and materials and energy competence, including know-how from organisations like the global materials companies Hydro and Elkem," Vianode interim chief executive and chief operating officer Hans Erik Vatne told Argus.

The result is anode grade synthetic graphite made to various, customisable requirements using hydropower from Norwegian rivers. The feedstock is still anode grade petroleum coke, meaning the process cannot become totally carbon free.

Meanwhile, Sweden's Talga Group — a natural graphite producer — recently received an environmental permit for a commercial scale plant at the Lulea Industrial Park. The company previously received funding approval from the European Investment Bank in 2021 and has signed nonbinding offtake agreements with gigafactories including Automotive Cells and Verkor.

Talga said it benefits from some of the world's lowest emission electricity in Sweden — again using hydropower — and high anode per tonne ore yields to minimise its CO2 footprint.

There is no shortage of demand for graphite as the energy transition fuels huge buildouts of battery and electric vehicle (EV) manufacturing capacity. An EV battery contains around 1kg of graphite per kwh, located within the anode. On average, 60-100kg is used in most commercial passenger EVs. By volume, batteries typically contain more graphite than any other metal. In all, graphite usually accounts for around 28pc of the battery weight.

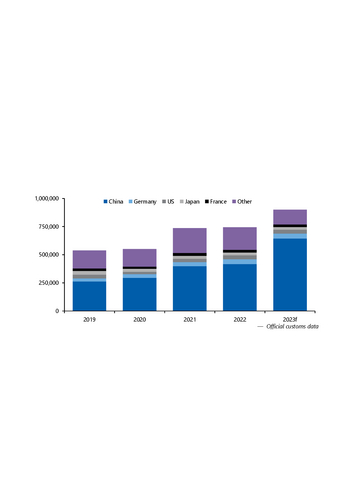

Overall, Argus Consulting expects global graphite demand to hit 2.895mn t in 2030, up from 1.098mn t in 2022. Around 82pc of all global graphite supply comes from China, according to the US Geological Survey (USGC), and it typically carries a sizeable carbon footprint.

Synthetic graphite — as opposed to natural — is gaining popularity among end-users, in part because of its homogeneity and performance. But it too can carry a significant carbon footprint unless the operation is tailored accordingly.

Strong competition from China

Competition from China, with its economies of scale and less stringent environmental restrictions, will remain a major challenge in building and sustaining a "low-carbon" graphite industry in Europe.

"We are entering a market where China has a head start of 10-15 years with industrial production supported by government incentives. We need arrangements that support local production in the EU to get up to speed quickly enough, like start-up incentives, duties and requirements for local content," Vatne said. "Through tough requirements on carbon footprint and other sustainability parameters, including emissions from open-pit furnaces, the technology that is used to produce most of today's synthetic anode graphite materials."

The EU has already proposed a carbon border adjustment mechanism, which will transitionally enter into force on 1 October 2023, applying to products such as cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. The bloc plans to expand this scope to other materials later on, which could include graphite and other battery materials.

"We believe that batteries with high requirements for fast charging will persist to favour synthetic graphite as an anode material," Vatne told Argus. "We will require far more industrial production in Europe than existing plans to meet expected demand."