Cutting methane emissions could be the energy sector's quickest, most cost-effective path to climate action, writes Rhys Talbot

Countries and energy firms made wide-ranging pledges to cut planet-warming emissions of methane at the Cop 28 climate conference in Dubai last month, but some promises might do little to bind those who make them, while others largely repeat previous commitments.

Emissions of methane, a potent greenhouse gas (GHG), are responsible for around 30pc of the rise in global temperatures since the beginning of the industrial revolution, according to the IEA. Of these emissions, 40pc comes from the energy sector, through leaks, venting and incomplete flaring of methane from hydrocarbon production and transport, as well as methane seeps from coal mines.

And the Global Methane Pledge (GMP) group of countries, whose aim is to reduce methane emissions by 30pc by 2030, announced at Cop 28 that it had added new members, including the symbolically important giant gas producer Turkmenistan. The central Asian country's very large methane leaks rose to prominence in late 2022 and 2023, based on internet search analytics.

Although Turkmenistan accounted for only 1.4pc of methane emissions worldwide in 2022 and 11 other countries had higher total emissions, leaks from the country's ageing gas infrastructure made up a third of very large emissions events recorded by satellite in 2021. Almost all — 93pc — of Turkmenistan's methane emissions come from the energy sector, and the country's hydrocarbon sector is the most methane-intensive in the world, emitting 1.3kg of methane per GJ of oil and gas output, far higher than 0.2kg/GJ in the US or China.

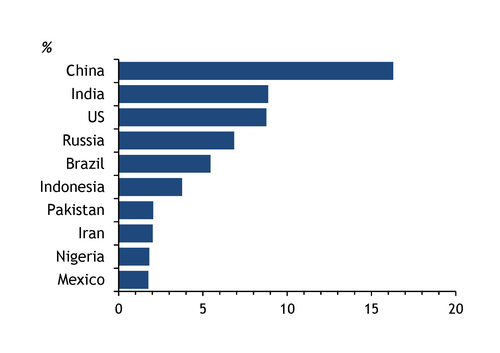

Other new members of the GMP announced at Cop 28 included Kazakhstan, Kenya, Romania and Angola, bringing total membership to 155 countries. The five new members accounted for 3.5pc of global methane emissions in 2022, according to IEA data. But the world's largest methane emitter, China, did not join the group. And other major methane emitters remained outside. India and Russia, the second and fourth-largest emitters, respectively, have not signed up. The three countries accounted for roughly a third of global methane emissions in 2021.

The GMP framework is voluntary and does not include mechanisms for enforcing emissions reductions targets. But at the conference, US climate envoy John Kerry announced $1bn in funding — raised from governments and the private sector — to help developing countries reduce methane emissions. And national regulations announced at Cop 28 could have more teeth. The US and Canada announced regulations to cut methane emissions from the oil and gas industry by 80pc and 75p, respectively, by the end of the decade, while Egypt and Brazil said they would introduce methane-reduction regulations in 2024.

Cashback!

In parallel, a group of 50 firms representing 35pc of combined global oil and gas production signed the "oil and gas decarbonisation charter", committing them to "near-zero" methane emissions by 2030. Many of the signatories were already part of the Oil and Gas Climate Initiative group, which has similar goals. But firms including the UAE's Adnoc have joined the second group without being a member of the first. That said, some major methane emitters, including gas exporters Russia's Gazprom and Algeria's Sonatrach, remain outside both groups.

Many interventions to cut methane emissions could be cost-positive, the IEA says, as methane formerly leaked or vented could be sold as natural gas. Based on 2021 hydrocarbon prices, interventions to cut 31mn t of methane emissions — of 135mn t from the global energy sector in 2022 — would be cost-positive, the agency says. And prices in line with 2022's record highs would shift the whole cost curve, making many more interventions — almost 50mn t worth — cost-positive.