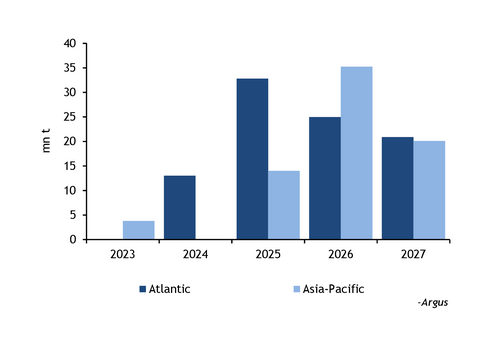

Global liquefaction capacity is set to grow by about 47mn t/yr in 2025, a sharp increase compared with the 13mn t/yr of capacity that came on line in 2024, based on Argus calculations.

New export facilities that have reached a final investment decision (FID) and are expected to begin commissioning this year total 46.8mn t/yr of capacity, largely driven by projects in Canada and the US, which account for 42.1mn t/yr (see table).

The capacity boost expected this year is, in practice, a more than sevenfold increase compared with the newly commissioned capacity in 2024, as broadly half of the capacity that came on line last year has remained mostly idle. The 13mn t/yr of capacity that officially came on line last year includes the first 6.6mn t/yr liquefaction train at Novatek's 19.8mn t/yr Arctic LNG 2 complex, which has remained largely idle because US sanctions limited demand for loadings.

Arctic LNG 2 has only loaded eight cargoes to date, with none delivered owing to risks of secondary sanctions, according to shiptracking data from Kpler.

New export capacity is slated to start commissioning as early as this month. Train one of Cheniere's Corpus Christi 11.5mn t/yr stage three expansion reported first production of LNG in late December, and might be able to load its first cargo soon.

Venture Global's Plaquemines LNG project — which has a peak capacity of 27.2mn t/yr and a nameplate capacity of 20mn t/yr — could be entirely operational this year after blocks 1-4 of its phase one stage started producing LNG in mid-December. Its first cargo was loaded on 26 December.

Plaquemines has received a quicker ramp-up of feedgas deliveries than anticipated, and market participants expect the entire project to be able to export close to capacity much faster than previously anticipated. That said, the operator still expects the commissioning phase to last until the third quarter of 2026.

Nearly all projects with 2024-25 operational dates are based in the Atlantic basin, with the exception of Canada's 14mn t/yr LNG Canada export terminal, located off the coast of northern British Columbia. Operator Shell plans to start loadings in mid-2025.

Atlantic capacity well-placed for structural Europe demand

Atlantic basin projects have an embedded incentive to supply Europe owing to shorter transit times and lower shipping costs, and new capacity this year could alleviate any supply-side pressure from the end of Russian gas transit through Ukraine and minimum storage level requirements ahead of next winter.

Gas withdrawals across Europe have increased this year, with EU-wide storage less than 65pc full based on data from Gas Infrastructure Europe at the time of reporting. Several countries, including Croatia and the Netherlands, have dipped below the 50pc mark. Gas flows have been reshaped, with flows going eastwards to bridge the gap from the halt in Russian flows through Ukraine, which served central and eastern Europe. German storage withdrawals averaged 1.7 TWh/d for the week ending 11 January, compared with withdrawals of 1.2 TWh/d a week earlier.

EU regulations mandate a 90pc storage fill level by 1 November, which is likely to drive strong fundamental demand for LNG cargoes later in the year.

| New LNG export capacity, 2024-25 | mn t | |||

| Operational timeline | Project | Geography | Country | Capacity |

| 2025 | ||||

| Jan-25 | Corpus Christi stage 3 (trains 1-2) | Atlantic | US | 3.3 |

| Feb-25 | Plaquemines LNG Phase 1 (blocks 5-8) | Atlantic | US | 4.4 |

| Mar-25 | Tortue | Atlantic | Senegal | 2.3 |

| Apr-25 | LNG Canada T1 | Asia-Pacific | Canada | 7.0 |

| Apr-25 | Plaquemines LNG Phase 1 (blocks 9-12) | Atlantic | US | 4.4 |

| Jun-25 | LNG Canada T2 | Asia-Pacific | Canada | 7.0 |

| Jul-25 | Plaquemines LNG Phase 2 (blocks 13-15) | Atlantic | US | 3.3 |

| Sep-25 | Corpus Christi stage 3 (trains 3-4) | Atlantic | US | 3.3 |

| Oct-25 | Plaquemines LNG Phase 2 (blocks 15-18) | Atlantic | US | 3.3 |

| Dec-25 | Golden Pass LNG T1 | Atlantic | US | 6.0 |

| Dec-25 | Congo LNG (Phase 2) | Atlantic | Republic of Congo | 2.4 |

| Total | 46.8 | |||

| 2024 | ||||

| Mar-24 | Congo LNG (Phase 1) | Atlantic | Republic of Congo | 0.6 |

| Jul-24 | Altamira fast LNG (Phase 1) | Atlantic | Mexico | 1.4 |

| Oct-24 | Arctic LNG 2 T1 | Atlantic | Russia | 6.6 |

| Dec-24 | Plaquemines LNG Phase 1 (blocks 1-4) | Atlantic | US | 4.4 |

| Total | 13.0 | |||

| — Argus | ||||