China's sharp drop in corn imports this marketing year, a key factor weighing on projected global corn imports in 2024-25, has made Ukrainian corn exporters double down on offering to other buyers, such as Turkey, Egypt and the EU.

Despite Ukraine's corn exports forecast to fall on the year in 2024-25 (October-September), slower exports since December are adding to pressure on sellers of Ukrainian corn to seek outlets for their product.

China demand looks to domestic crop, Brazil

Global corn imports are forecast to fall to 183.2mn t in 2024-25, down from 197.1mn t the previous year, according to the US Department of Agriculture (USDA).

For Ukraine's exports, the main challenge stemming from lower global imports is the sharp drop in purchases from the main buyer of Ukrainian corn — China.

Chinese corn imports are projected to fall to 13mn t in 2024-25, down from 23.4mn t a year earlier, according to the USDA. Argus forecasts China's 2024-25 corn imports even lower — at 7.2mn t, with some of China's local analysts expecting imports lower still.

The forecasted drop in China's import demand comes largely from the country's record domestic corn production in 2024-25, estimated by the USDA at 295mn t.

Before China's domestic corn harvest, Chinese demand focused on Brazil.

As for Ukraine, from the start of the 2024-25 season in October to the end of December, exporters declared only one Panamax vessel carrying corn for export to China. While the trade captured the attention of Ukraine's market participants, further volumes did not follow.

Turkish corn demand to weaken further out

In the absence of Chinese purchases, Turkey was the largest buyer of Ukrainian corn in October-December 2024, booking 1.6mn t — nearly as much as the 1.7mn t it had purchased throughout the whole of 2023-24. That said, shipments to Turkey for the remainder of the season may struggle to offset the drop in China-bound demand, given lower imports forecast for the whole of the season. Turkey is projected to receive 2.4mn t in 2024-25, down from 3.2mn t a year earlier.

The higher volumes of Ukrainian corn shipped to Turkey in October-December were at least in part driven by a notable drop in Russia's corn exports in 2024-25, which are forecast to halve on the year to 3.3mn t, according to the USDA.

Sellers of Ukrainian corn eye Egypt

Exports to Egypt in the first three months of the 2024-25 marketing year reached only around 540,000t, compared with a total of 3.64mn t exported to the country in 2023-24. This, despite the USDA forecasting Egypt's total corn imports this marketing year at 8.2mn t, slightly up from 8mn t a year ago, suggesting that Egypt could bring forward purchases in 2025. That said, buyers looking to secure Egypt-bound corn this marketing year have also looked towards South America, pushing sellers of Ukrainian corn to keep their offers competitive against Brazilian and Argentinian corn.

EU demand for Ukrainian corn mixed

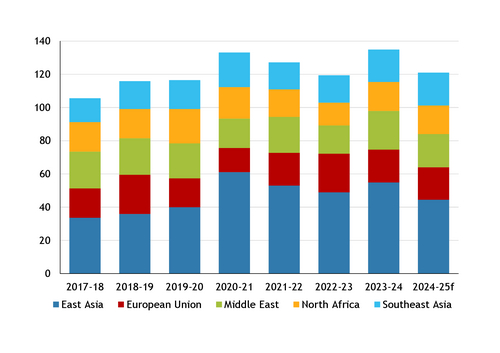

In line with trends in previous marketing years, EU members have been among the top five buyers of Ukrainian corn so far in 2024-25.

Italy ramped up purchases of Ukrainian product significantly compared with the previous season, booking 1.1mn t of Ukrainian corn for the first three months of 2024-25. This compares with the 1.8mn t of Ukrainian corn booked by Italy throughout the whole of 2023-24.

Greater demand from Italy partly offset weaker demand from Spain. Ukraine exported only 1.1mn t of corn to Spain in October-December 2024, a fifth of the 5.5mn t of Ukrainian corn shipped to Spain throughout the whole of 2023-24. And corn exports to Portugal dropped sharply in October-December 2024 to only 30,000t, compared with a total of 1mn t shipped throughout 2023-24.

The drop in Ukraine's exports to some of the EU's largest corn importers is unlikely to come from weaker overall corn demand — the USDA forecasts the bloc's 2024-25 corn imports at 19.5mn t, down only slightly from 19.8mn t a year earlier. Instead, EU member states are more likely to be weighing up Ukrainian corn against some of its main competitors this season — the US, Brazil and Argentina.