UK hot-dip galvanised importers are increasing imported order volumes in some instances because of the government's imposition of a 15pc cap on the other countries' quota.

The UK business secretary, Jonathan Reynolds, imposed the cap on 24 June, days before the quota reset on 1 July, stranding supply from South Korea and Vietnam.

HMRC has now suspended clearances into the quotas for Vietnam and South Korea — the main users of the other countries' quota — until 1 August, meaning steel cannot be accessed even where buyers are willing to pay a duty. This is contributing to storage issues at major ports, particularly Liverpool.

One service centre said major construction companies are worried about delays to some projects because of availability issues on particular gauges and coatings. Because of the potential disruption, some buyers have booked material elsewhere, in particular from Turkish rerollers, to avoid supply issues.

The government's action, designed to protect the domestic producer Tata Steel, has "increased the amount of imports, as we are having to go elsewhere aside from South Korea and Vietnam", one service centre said.

Tata does not produce all the necessary sizes and specifications for domestic buyers, sources suggest. There is typically abundant EU quota for HDG, but European mills, like Tata, struggle to compete with Asian sellers because of their higher energy costs.

Simone Jordan, the director of the International Steel Trade Association (ISTA), called on the secretary of state to "address this catastrophic situation and reconsider his determination".

Import volumes not rising

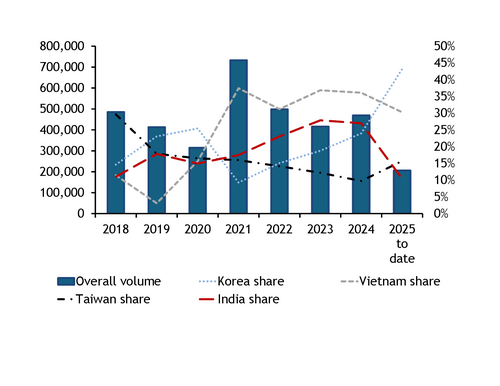

There has been no real increase in third-country hot-dip galvanised coil imports into the UK since the US imposition of Section 232 in 2018.

The country imported 468,500t of HDG last year, compared with just over 485,000t in 2018; there was a large jump in 2021, to over 732,000t, as buyers scrambled to source material following the Covid-19 pandemic, when demand increased much more sharply than European supply.

The most notable change in imports is the increased share of South Korea, which has risen from around 15pc of non-EU imports in 2018 to over 43pc today. Much of that growth started last year, when a leading producer in the country started to divert automotive material into the general industrial market in the UK. Vietnamese volumes have also ratcheted up in recent years, partly because it was exempt from the safeguard on HDG for a period, before it came into scope. Vietnam is the largest importer of Chinese hot-rolled coil, whose low-priced exports have reshaped global trade flows in the last year. Turkey, which is now exempt from the UK safeguard on HDG, is also a large buyer of Chinese HRC; indeed, the country's rerollers can avoid dumping duties on Chinese material, provided it is re-exported.

Vietnam and South Korea shipped over 281,000t of HDG to the UK last year, accounting for over 60pc of third country volumes, and account for almost three-quarters of third country imports over January-May this year.

India has been the cheapest supplier of HDG into the UK on average this year, according to customs data. The average landed Indian price has been £587/t cfr, followed by Taiwan at £607/t and Vietnam at £618/t. Vietnam is the cheapest import source on average, at £472/t, closely followed by India at £475/t. Tata Steel is the largest buyer of Indian coil in the UK at present.