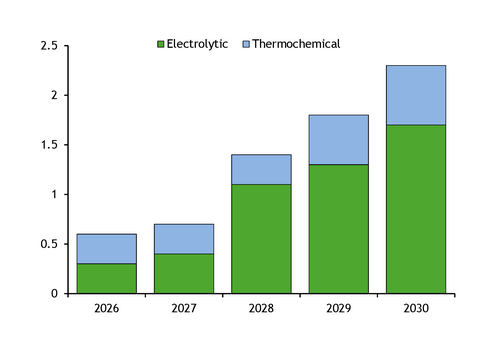

Industry group Hydrogen Europe has lowered its 2030 European clean hydrogen supply outlook to 2.3mn t/yr, from 2.5mn t/yr made last year, as it expects less than 20pc of announced capacity to be online by then.

In its Clean Hydrogen Monitor 2025, the group projects 1.7mn t/yr of output from electrolysis and 600,000 t/yr of "thermochemical" capacity, which is primarily production from natural gas with carbon capture and storage (CCS).

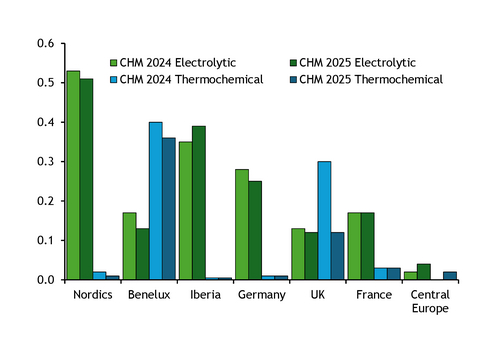

The latter accounts for most of the reduction compared with last year's iteration. Hydrogen Europe revised this down by 25pc because of expected delays to CCS-based projects in the UK and in the Benelux region.

The group projects electrolysis capacity to reach 15GW by 2030, down from a 16.4GW forecast it made last year. The EU in 2020 set a target of having 6GW of electrolysis capacity installed by 2024 but had just 600MW operational and 2.8GW under construction as of July 2025.

Of the 2.3mn t/yr potential capacity for 2030, only 26pc is under construction, with around 300,000 t/yr each from electrolytic and thermochemical projects.

Hydrogen Europe tracks 862 projects across the continent, down from 900 last year. These have combined capacity of 12.7mn t/yr, down by 12pc from last year. But the 2.3mn t/yr forecast represents just 18pc of this as Hydrogen Europe expects a substantial number of projects to materialise only after 2030 or not at all.

Its supply outlook is based on a "bottom-up approach" that takes into account factors such as project maturity, funding and demand incentives.

Paris-based energy watchdog the IEA and global hydrogen body the Hydrogen Council recently made slightly higher estimates for global realisation rates up until 2030, but also revised down their supply projections from 2024.

Hydrogen Europe cites the slow transposition of the EU's revised renewable energy directive (RED III), weak demand signals, high production costs caused by stringent regulations and fragmented public funding efforts as key challenges for project developers.

Production potential is spread unevenly across Europe. The Nordic countries — Sweden, Finland, Norway and Denmark — could provide more than 20pc of European supply by 2030 at 510,000 t/yr, slightly down from last year's projections. Hydrogen Europe increased the outlook for Portugal and Spain to a combined 390,000 t/yr, from 350,000 t/yr last year, because of stronger project pipelines and RED III progress. It sharply cut projections for the UK because of expected delays to CCS-based capacity, decreased slightly its outlook for Germany and remained stable for France.