Demand for biopropane will remain weak without government-mandated use, writes Evelina Lungu

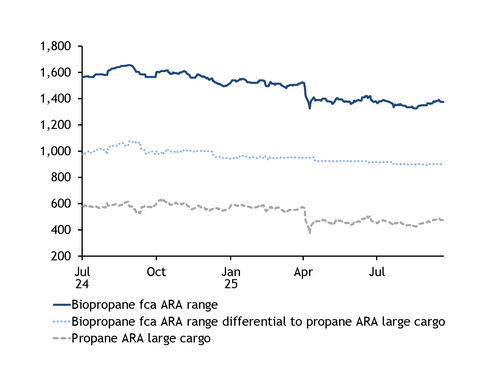

Northwest European biopropane premiums to equivalent propane prices at the Amsterdam-Rotterdam-Antwerp (ARA) hub declined in the third quarter to their lowest since Argusbegan assessing the market in October 2023 on weaker demand and soft propane values.

Used cooking oil-based biopropane prices averaged $1,361.25/t fca ARA in the third quarter, down from $1,393.25/t in the second quarter and $1,519.50/t in the first, and from $1,599/t a year earlier. This was partly owing to lower propane prices, with large cargo cif ARA below $500/t for most of June-August. Northwest Europe has absorbed increased flows of US LPG even during periods of lacklustre demand, while Chinese demand eased and US-China tariff uncertainty persisted.

The biopropane premium to propane large cargoes at ARA slipped by $24/t on the quarter and $117/t on the year to just over $900/t in July-September. Biopropane is predominantly produced as a by-product of hydrotreated vegetable oil (HVO) and hydrotreated esters and fatty acids synthetic paraffinic kerosene (HEFA-SPK) sustainable aviation fuel (SAF) output. Global SAF and HVO output capacity has expanded over the past two years, while European refineries are increasingly co-processing renewable feedstocks. These have boosted biopropane supply but demand is limited without mandated use. Some producers have opted to recycle biopropane in refining processes to improve greenhouse gas savings in final HVO and SAF output. Divergent buying and selling positions have kept premiums from following the recent rise in northwest European HVO and SAF prices.

Some governments are introducing legislation that could support adoption. The EU's Packaging and Packaging Waste Regulation sets packaging reduction targets of 5pc by 2030, 10pc by 2035 and 15pc by 2040, with all packaging to be recyclable. The EU will decide in 2028 whether to let bio-based plastics count toward recycled content targets, a change that could substantially increase biopropane demand.

In heating, the Irish government has approved a renewable heat obligation scheme requiring suppliers to replace a share of fossil heating fuels with renewables. Although primarily designed to support biomethane, biopropane uptake could rise under the measure, which runs in 2026-45, starting with a 1.5pc obligation in 2026 and 3pc in 2027. LPG association Liquid Gas Ireland released a goal of transitioning the industry to 100pc renewable supply by 2050 last month.

Germany's buildings energy act requires new buildings to install heating systems using at least 65pc renewable energy while Sweden exempts biopropane from energy and CO2 taxes when used in motor fuel and heating. Transport remains the main area for renewable mandates, but some countries, such as France, are moving toward sector-specific targets.