Aggregate German underground gas storage sites are likely to meet the 30pc fill level target for 1 February, regardless of temperatures in the early winter period.

German law dictates a combined 30pc fill level for underground storage sites by the start of February 2026, except for facilities in Bierwang, Breitbrunn, Inzenham-West and Wolfersberg, which would need to be 40pc full because of their importance for supply security in southern Germany and the wider region.

Underground storage sites in Germany were 76.7pc filled as of Wednesday morning, GIE transparency data show. And there is little scope for stocks to rise as German booked storage capacity is at 78-80pc — 194-203TWh — according to Argus and GIE transparency platform data. If storage sites reach booked capacity this could halt storage injections.

Sites are markedly more depleted that they were on 1 November 2024 at 98.2pc, and 1 November 2023 at 99.8pc. In any case, despite storage sites not being as full as they were in previous years, Germany may be able to reach the 30pc target, even if injections slow down significantly over October.

Gas demand in the coming winter

German consumption could be lower than last year in November 2025-January 2026 if temperatures stay in line with average minimum temperatures from November-January in the past four years.

German aggregate consumption could fall if the relationship between temperatures and consumption in November-January remains identical to a year earlier. Minimum temperatures in Essen averaged 2.5°C, and 1.9°C in Berlin over November 2024-January 2025.

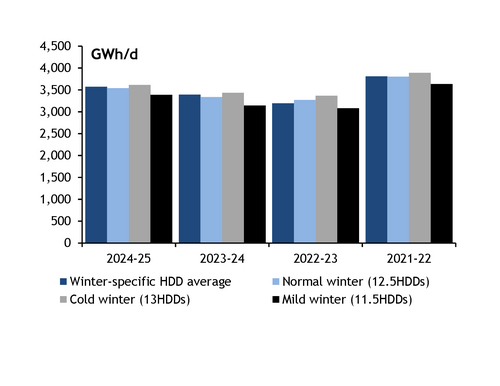

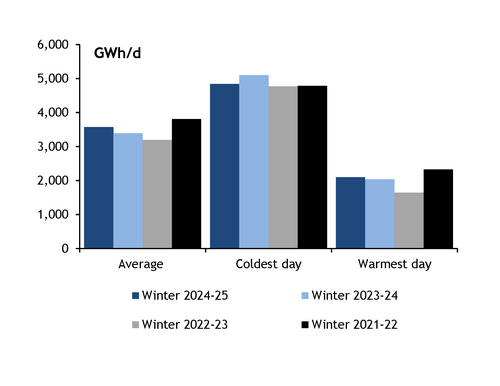

If temperatures rise this coming winter — returning to the norm from last year's cold winter — heating degree days (HDDs) would be in line with the average over the past four years, and aggregate consumption would fall to 3.54 TWh/d (see aggregate consumption scenarios graph). This would be 1pc lower than the 3.57 TWh/d in November 2024-January 2025, when the weather in January was colder than in the previous two winters (see aggregate consumption graph).

If the weather diverges from that of the past four years over November-January, aggregate consumption could increase or decrease substantially with respect to last year. Under a cold winter scenario, with 13 HDDs, aggregate consumption could rise by 1pc to 3.61 TWh/d. And under a mild winter scenario, with 11.5 HDDs, aggregate consumption could fall to by 5pc to 3.39 TWh/d.

Weather-adjusted demand dropped in 2022, when high energy bills drove customers to restrict their consumption. There have now been three consecutive winters of weak weather-adjusted demand, suggesting that this is the new reality in Europe. And heat pump installations as well as insulation measures could further reduce weather-adjusted demand in the coming years.

Effect on storage

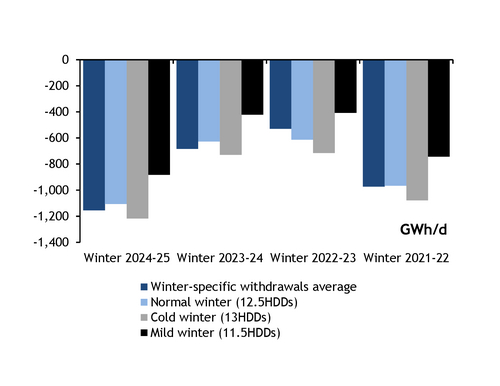

Withdrawals could also fall over November 2024-January 2025 if the relationship between consumption and net withdrawals over November-January remains identical to that of a year earlier.

Under the average-temperature scenario in line with the HDD average over the past four years, withdrawals would fall by 4pc to 1.11 TWh/d in the coming winter period from 1.16 TWh/d in November 2024-January 2025 (see net withdrawals scenarios graph). And withdrawals could also step up or down if the weather diverges from that of the past four years. Under a cold winter scenario, net withdrawals could rise by 5pc to 1.22 TWh/d. And under a warm-winter scenario, aggregate consumption could fall to by 24pc to 883 GWh/d.

Assuming a 78-80pc fill level for 1 November, storage sites would be 37-39pc full on 1 February in a normal winter scenario. And a mild winter scenario would leave storage sites at 45-47pc of capacity. Even a cold winter scenario would leave stocks at 33-35pc, comfortably above the target.

But there is a possibility storage sites would not be filled by 78-80pc on 1 November. Net injections have averaged 63 GWh/d over the past 10 days — firms net withdrew 48 GWh/d on 23-24 September and 16 GWh/d on 29 September-1 October. If these storage injections are maintained through October, storage sites would be 77pc filled by 1 November. Even in this case, storage sites would be filled above 30pc, regardless of the weather scenario.