Narrow and at times inverted seasonal spreads have weighed on the uptake of capacity and profitability of Europe's slower-cycling storage facilities, which has led to applications to close sites, and may lead to more in the coming years.

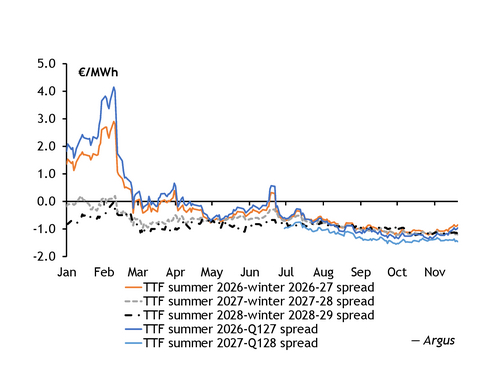

TTF summer-winter spreads for gas year 2026-27 and 2027-28 have improved in recent months but remained narrow at -€0.97/MWh and at -€1.25/MWh, respectively, at the last close (see summer-winter spread graph). And the 2028-29 summer-winter spread closed at -€1.185/MWh. Narrower and even inverted summer-winters spreads limited storage capacity bookings in Europe last year.

The 16.5TWh Rough storage site in the UK closed in 2017 because of high operational costs, before reopening during the energy crisis of 2022. At the time of operator Centrica's closure application, the front-summer contract was at a 6.78p/th — €2.56/MWh — discount to the following winter contract across the month of June. The spread between these two contracts had held at an average -4.615p/th or -€1.72/MWh throughout 2016.

Since the reopening of the site, Centrica has repeatedly called for regulatory support to "upgrade and redevelop" the facility, while the profits from its storage-focused subsidiary plummeted last year. It has also stressed the need for a "regulatory support model" from the government to prevent Rough's closure given its low profitability.

While fast-cycling sites retain a comparative advantage in their capacity to provide quick injections into the grid in moments of peak demand, and allow firms to take advantage of short-term price differentials the inflexibility of slow-cycling sites limit the attractiveness of purchasing and making use of capacity.

The slow-cycling 45TWh Rehden storage site is struggling to sell storage capacity for the second year in a row.

The site has a maximum 353 GWh/d firm injection capacity and 543 GWh/d firm withdrawal capacity, giving it a churn rate — injection and withdrawal capacity relative to its storage size — of 1.75. This is the fourth-lowest churn rate of any storage site in Germany, and below the 4.9 average rate in the country. Comparatively, the Rough storage site has a 103 GWh/d and 126 GWh/d firm injection and withdrawal capacity, with a 1.25 churn rate. This is below the 8.46 average rate in the UK.

Rehden's operator Sefe Storage was only able to sell 30pc of capacity ahead of this winter, after it had to adjust the "product structure" by increasing injection capacity on offer but reducing storage capacity to 24.6TWh. Sefe Storage also indicated in August that it would need government intervention to be able to fill the site to legally-required levels. The company pointed to "unfavourable market conditions" and an "exceptional market situation" as their reason behind its failure to sell storage capacity.

The "facility has not been in as high demand on the market as other storage facilities in Germany", BMWE told Argus. "Rehden no longer has the same significance for security of supply as it did previously" because of changes in gas supply since 2022, including the expansion and heavy use of LNG, the ministry added.

"There are currently no plans to close UGS Rehden," Sefe said when asked for comment on the matter.

And the operator of slow-cycling Breitbrunn applied in October for approval to decommission the site on 31 March 2027 after it had struggled to sell capacity this summer. The site has a technical capacity of 11.5TWh, of which only 6.8TWh was booked for the 2025-26 storage year.

Breitbrunn has 69 GWh/d of firm injection capacity and 144 GWh/d of firm withdrawal capacity, with 1.48 churn rate, making it the slowest cycling site in Germany.

Bayernugs also announced its intention to close its 4.1TWh Wolfersberg storage site — with a 2.36 churn rate. The site has been unable to sell any capacity over the past storage year and has not sold any capacity for the coming storage year so far.

The Uelsen, Inzenham-West, Frankenthal and Schmidhausen storage sites in Germany all have a churn rate below 2, making them the slowest-cycling and potentially most-at-risk sites in the country.

That said, any storage closure must receive receive government approval beforehand. A possible decommissioning of the Breitbrunn storage site "would not jeopardise the security of supply in Bavaria, Germany or our neighbouring countries", the German economy and energy ministry BMWE told Argus. A good supply balance in Germany and the connection of Austrian storage facilities Haidach and 7Fields to the German grid further support this conclusion, the ministry added.

In the Netherlands, the government has yet to take a decision regarding operator Nam's phase-out plan for the 59.3TWh Norg low-calorie site. Nam envisions a halt to summer injections and the drawdown of stocks during the winter as part of the plan. The closure of the Norg storage site has been projected as part of plans to phase out large underground gas infrastructure in the Groningen region.

The site has a maximum 449 GWh/d firm injection capacity and 733 GWh/d firm withdrawal capacity, with a 1.71 churn rate.

Storage closures in Europe might nevertheless allow governments to produce or use the remaining cushion gas as emergency stocks.