A narrowing spread between US and European LNG prices and high freight rates in the Atlantic basin have pushed the front-month indicative long-term LNG contract cost above the spot Gulf coast fob price for the first time in two years.

But the premium over the spot price will likely be brief, and limited flexibility in annual delivery plans will likely leave export schedules unchanged, with the impact solely on profit margins rather than fundamentals. A steeper backwardation in the US' Henry Hub forward curve compared to the northwest European LNG forward curve beyond February, as well as a steep backwardation in charter rates, means US LNG offtakers likely will not need to alter export plans.

Liquefaction fees are also considered a sunk cost, and the Henry Hub remains comfortably below European LNG prices to more than cover the shipping cost between the two markets. This means there is still a strong financial incentive to maximise US LNG export volumes.

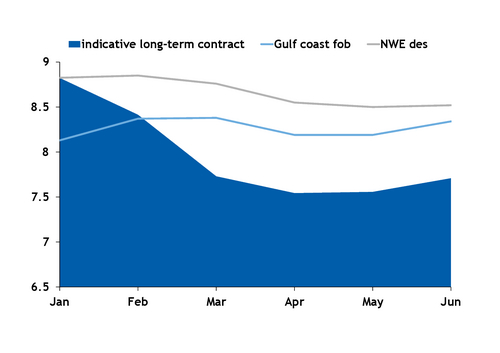

The indicative long-term LNG contract price — 115pc of Henry Hub plus a $3/mn Btu liquefaction fee — has exceeded the Argus Gulf coast (AGC) spot fob price since 28 November, climbing to a premium of 69¢/mn Btu on 4 December. That premium came with the front-month Henry Hub price at a nearly three-year high of $5.06/mn Btu on forecasts for cold weather and US LNG exports at a record high.

At the same time, the front-month NW Europe LNG des price was at $8.83/mn Btu, the lowest since May 2024, with warmer-than-normal weather forecast in Europe and EU underground storage well-supplied.

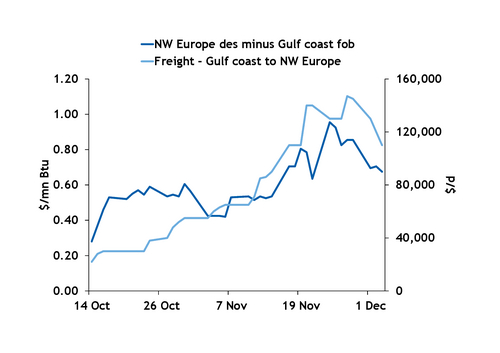

A surge in freight rates, primarily driven by higher Atlantic basin loading demand, including at the 27.2mn t/yr Plaquemines plant, widened the spread between the AGC fob price and delivered spot prices in northwest Europe. The spread grew to 96¢/mn btu on 24 November, near the peak of the freight rally, up from 28¢/mn Btu in mid-October (see spread chart). The wider spread pushed the AGC fob price for January loading below the indicative long-term LNG contract price for the same month.

Forward freight rates are in steep backwardation in the first quarter of 2026, which is reflected in a tighter AGC-NW Europe spread over that span, as are Henry Hub futures contracts. This puts AGC prices above the indicative long-term contract prices from March through June (see forwards chart).

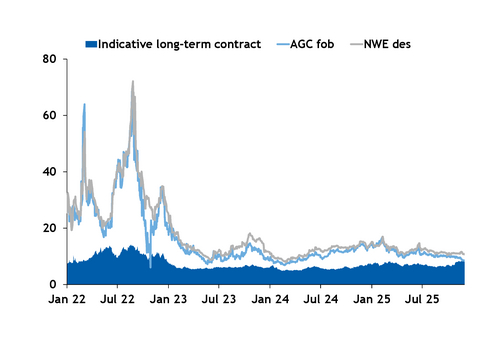

Although exports are unaffected because of liquefaction costs being considered sunk, the dynamic highlights the tightening margins for US LNG as a supply wave brings more liquefaction capacity on line through the end of the decade. The AGC fob's premium over the long-term indicative contract averaged $4.11/mn Btu through 4 December this year, down from $4.63/mn Btu, $5.37/mn Btu and $20.13/mn Btu in 2024, 2023 and 2022, respectively (see margins chart).