Higher heavy sour crude supply on the US Gulf coast may lead to increased high-sulphur fuel-grade petroleum coke output in 2026, potentially pressuring fob 6.5pc sulphur prices.

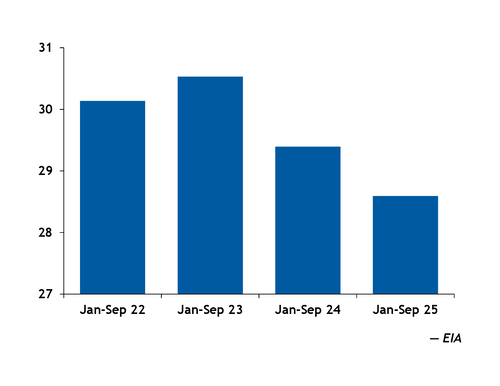

Limited supply largely bolstered fob US Gulf coast 6.5pc sulphur coke prices in the second half of 2025, despite a turbulent freight market throughout most of the year. Refinery upsets and closures, a shift to lighter crude slates and a lack of high-sulphur fuel oil (HSFO) to run in cokers caused much of the supply tightness. US Gulf coke production was down by 4pc on the year in January-September, according to the latest data available from the US Energy Information Administration.

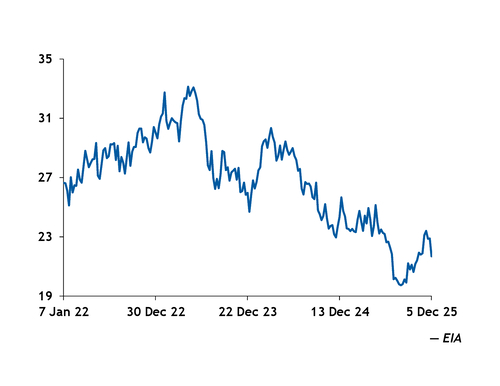

Crude supply dynamics have now changed, because of easing sanctions on Venezuela, a recovery in western Canadian crude production and ample global supply. Three new projects in the US Gulf of Mexico have also helped to boost US sour crude output since mid-year, and production is expected to top 2mn b/d by the end of 2025. US sour crude values in November fell to their lowest level in over a year. US Gulf refiners are shifting to heavy sour crude feedstocks as a result, according to market participants, which produce higher volumes of coke with higher sulphur contents.

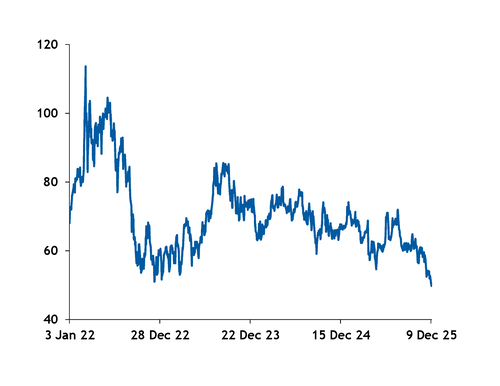

At the same time, HSFO prices at the US Gulf coast have been falling since mid-November, after stocks reached a five-month high. Prices neared a five-year low on 16 December and are expected to remain weak into the first quarter of 2026. This is likely to prompt refiners to use more HSFO in their cokers.

Freight rates out of the US Gulf coast are also expected to remain firm into 2026.

"Freights are higher for the end of this year and early next year," a trader said. "We haven't seen any relief in the freight market for sure."

Cfr markets absorbed increases in freight rates throughout most of 2025 because of tight supply of US Gulf coke. If supply increases, the fob 6.5pc sulphur coke price would likely fall to balance the additional freight cost.

Freight costs are expected to rise, in part because China has pledged to purchase 12mn t of US soybeans, cargoes that would compete for dry bulk vessel space. US trade representative Jamieson Greer in early December said China's deadline to buy this volume is February-March, and that China is on track to meet it pledge. But final trade volumes are still to be seen.

The increase in heavy crude runs in cokers and the rise in US Gulf high-sulphur supply may come at the expense of mid-sulphur coke availability, which is produced from lighter, sweeter crudes. Mid-sulphur coke output on the US Gulf coast has already started to tighten in recent months, according to market participants, and this will likely persist just as interest in US Gulf coke from China, a key mid-sulphur buyer, has rekindled.

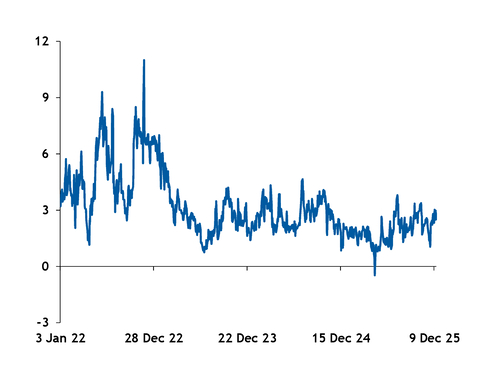

This could boost fob US Gulf coast 4.5pc sulphur coke prices in 2026 and could increase that grade's premium to high-sulphur coke. The US Gulf 4.5pc sulphur premium to 6.5pc sulphur more than doubled between the weeks of 7 July and 22 September, rising to $7.50/t from $3/t, because of limited spot supply. The spread has been steady at $6.50 since 20 October.