Lithium prices could rise faster than many expect in 2026 as grid scale energy storage systems (ESS) — modular, bankable and increasingly prevalent — add a new material pull on lithium salts.

Argus-assessed prices for 99.5pc lithium carbonate were $11,600/t on 9 December — still roughly 80pc below late-2022 highs. Lepidolite project restarts and brine expansions weighed on prices in the first half of this year, and stocks were considered adequate.

While many expect gains this year, conditions in recent months appear to have shifted more dramatically.

Chinese battery makers have raised operating rates, and futures on the Guangzhou exchange climbed towards 100,000 yuan/t in November — prices not seen since early last year — signalling tighter spot availability and stronger downstream demand. Futures often lead physical prices when buyers anticipate structural demand growth.

Why modular ESS matters now

Energy storage systems are increasingly deployed in containerised blocks — most using lithium iron phosphate (LFP) — that can be installed at substations, paired with solar farms or added to peaking plants.

This design bypasses some grid bottlenecks — projects can connect at distribution level rather than waiting years for high-voltage transmission upgrades.

And construction times for large battery parks in China have been as short as 81 days from start to commissioning, compared with 5–7 years for new transmission corridors or gas plants. That speed is critical as grids face congestion and renewables curtailment.

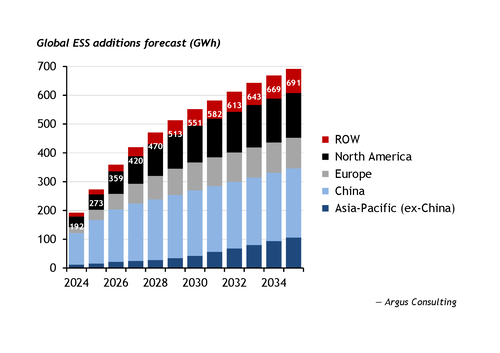

The data support this. Global ESS additions rose to an estimated 273GWh in 2025, according to Argus Consulting, and are forecast to hit 359GWh in 2026, with China alone adding 182GWh (see graph).

Procurement pipelines codified in auctions and grid connection queues are now converting into physical installations. The Italian government's Macse auction scheme and the UK's queue reform have locked in multi-GW storage capacity for delivery before 2030.

In the UK, 34.5GW of battery projects have been prioritised for connection — around one-third of the UK's current installed capacity of 110GW, according to grid operator Neso.

Europe-wide, annual installations are expected to rise from 10.1GW in 2023 to 17.6GW by 2030, driven by auctions specifying four-hour duration and co-location, according to LCP Delta, a consultancy.

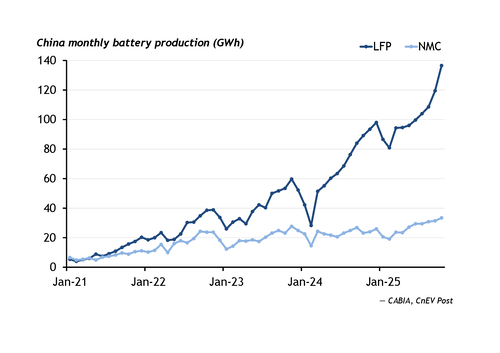

China's battery output underscores the shift. Production reached 1.29TWh in January–October, up from 843GWh a year earlier (see graph). LFP accounted for nearly 79pc of output, according to the China Automotive Industry Battery Alliance (Cabia).

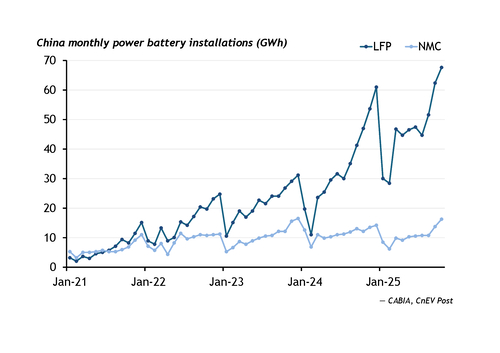

Power-battery installations hit almost 170GWh in October, with LFP near 80pc — evidence that storage demand is rising alongside transport electrification.

And the chemistry matters — LFP typically uses 30–50pc more lithium per kWh than nickel-rich systems because its lower energy density requires more cells for the same duty cycle. This amplifies the lithium intensity of ESS growth.

Grid flexibility becomes key

Lithium demand from ESS is not just about shifting cheap midday power to evening peaks. Batteries earn their keep by providing frequency regulation, inertia and congestion relief — services that gas turbines cannot deliver as quickly or at zero emissions.

These functions lock in multi-year revenue streams, making storage economical and accelerating lithium uptake.

In France, battery projects initially earn most of their revenue from ancillary services such as primary and secondary reserves, which pay for real-time frequency stabilisation of the grid.

The grid requires only 1–2GW of battery capacity before ancillary markets become saturated. Beyond that point, new projects will need to rely on wholesale opportunities — such as intra-day price arbitrage, where batteries charge and discharge within the same day — for more dependable revenue.

The sharp rise in clearing prices underscores the premium on fast-response assets like batteries as operators try to manage volatility.

Policy is reinforcing this trend. Policy makers in Europe warn of the cost of renewable generation curtailment, indicating demand for battery backup.

In China, battery energy storage systems are increasingly co-located with solar installations to provide back-up power and load balancing. Solar-plus-storage systems accounted for 34pc of the 0.61GW of newly commissioned power-side installations in June, while wind-plus-solar-plus-storage accounted for 46pc.