Australian Carbon Credit Unit (ACCU) supply in 2025 rose by 15pc on the year, hitting a new record, despite issuances slowing down sharply in December from the previous three months.

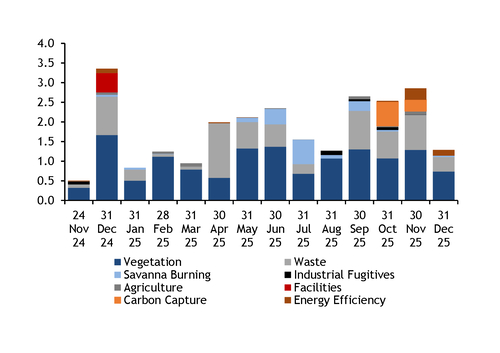

Issuances totalled 1.29mn ACCUs in December, down from 2025's monthly high of 2.85mn units in November and from strong volumes in October and September, according to data from the Clean Energy Regulator (CER) released on 19 January.

Despite the slowdown, issuances in 2025 reached 21.64mn, up from the previous all-time high of 18.78mn in 2024. The final figure was at the mid-point of the CER's forecast 19mn-24mn range.

The December issuances were the lowest since August's 1.26mn units. Vegetation methods — mainly from human-induced regeneration (HIR) projects — accounted for 736,834 ACCUs in December, or 57.2pc of the total, up from 45.1pc in November. Waste methods, mostly from landfill gas projects, made up 369,587 units, down from 889,704 the month before (see chart).

Australia's largest landfill gas operator LMS Energy led issuances last month at 176,687 ACCUs. It was followed by Australian gas pipeline operator APA's Newman power station in Western Australia, which received 122,845 ACCUs for its energy efficiency project. Environmental market investor GreenCollar's subsidiary Terra Carbon and EDL Energy's subsidiary Landfill Gas and Power came next with 84,884 and 83,911 ACCUs, respectively.

Out of the total 2025 issuances, 11.8mn ACCUs came from vegetation projects, making up 54.6pc of the total. This was followed by ACCUs from waste methods at 6.22mn units, or 28.7pc of the total, and by ACCUs from savanna fire management methods at 1.59mn, or 7.3pc of the total.