UK LNG imports for March could fall short of meeting demand, judging by forward NBP premiums to northwest European LNG prices not pricing in enough LNG, according to Argus calculations.

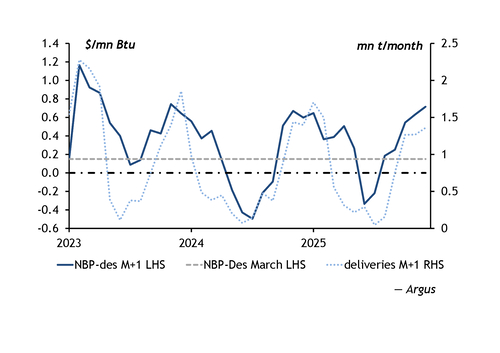

The UK could be short around 40mn m³/d of pipeline-equivalent LNG in March, with present NBP premiums to northwest European LNG prices at 15¢/mn Btu only enough to price in around 25mn m³/d of regasification, based on historical price spreads and resulting deliveries (see table).

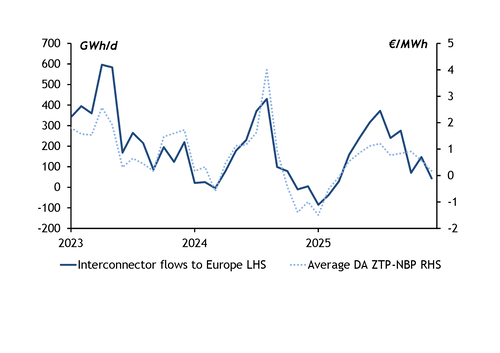

This scenario assumes UK March gas demand will hold in line with the four-year average of 201mn m³/d. UK pipeline exports to Belgium could average 21mn m³/d, with ZTP premiums to the NBP for March at 82¢/MWh — more than the variable costs to flow on the Interconnector for firms that have booked transmission capacity between the two countries. In May, August and September last year, ZTP day-ahead premiums to the NBP averaged the same as the forward March 2026 spread at 82¢/MWh, and flows to Belgium averaged 21mn m³/d in those months. There has been a 0.82 positive correlation over the last three years with day-ahead price spreads and flows to Belgium.

This scenario excludes flows on the BBL interconnector to the Netherlands, which may not reverse flows to the continent for March, based on historical flow patterns despite price incentives. But should the pipeline switch direction, it could pull a further 13mn m³/d of demand away from the UK. The limited flow direction flexibility has led to a lower 0.5 positive correlation between day-ahead price spreads and flows to the Netherlands.

This would equal 222mn m³/d when combined with assumed UK demand.

On the supply side, domestic production could average 85mn m³/d, based on the yearly 1.9pc decline rate in 2025.

And Norwegian flows via the St Fergus and Easington receiving points could be similar to March 2023, when higher continental European hub prices pulled some supply away from the UK, but not all because there is limited flexibility in the Norwegian supply system. Combined with present flows at Norway's Segal fields which can only deliver to the UK, Norwegian imports could average 74.3mn m³/d.

This leaves a 63mn m³/d gap to be filled by LNG imports to meet demand and onward flows to Europe.

But NBP month-ahead premiums to front half-month European delivered prices within a 10¢/mn Btu range of the 15¢/mn Btu March last closed at have only attracted an average of 25.5mn m³/d of LNG in six analogous months since the start of 2023. There has been a 0.77 positive correlation between the two prices since the start of 2023.

For sendout to reach 63mn m³/d, six import months similar to this had NBP-des spreads at an average of 53¢/mn Btu the month prior — much wider than the 15¢/mn Btu at present.

Beyond the pure price incentive, UK February-March backwardation is reaching historically high levels, providing an incentive for quick storage withdrawals from already depleted levels in February, shifting more risk onto March.

Should the UK indeed require more LNG than is being priced in at present, the NBP-des spread would have to widen.

But it is unclear exactly how this would take shape — through either wider des-TTF spreads or narrower NBP discounts to the TTF.

Market participants may have expected QatarEnergy to sell its first cargoes from the 18.1mn t/yr Golden Pass terminal into the UK in March because the firm has regasification capacity at the UK's 14.8mn t/yr Grain terminal. But some market participants are predicting the start-up slipping to April, which could reduce UK LNG expectations in March.

Should the NBP narrow relative to the TTF, this could both price in more LNG and reduce pipeline exports to the continent, shoring up the UK's gas balance.

But northwest Europe is facing very depleted stocks at the end of the heating season, so may require quick UK flows to meet demand.

This suggests that the des-TTF spread may have to widen to price in more LNG into the UK. Deals earlier this week were concluded in the 60-70¢/mn Btu range for March, market participants said, but bids have been heard as wide as $1/mn Btu.

| Assumed UK March gas balance | mn m³/d |

| Demand | |

| Domestic | 201 |

| Interconnector | 21 |

| Total | 222 |

| Supply | |

| Domestic | 85 |

| Norway | 74 |

| LNG | 23 |

| Total | 182 |

| Balance | -40 |

| — Argus | |