Scroll down or navigate to each regional commentary using the buttons above.

Asian propane prices dropped 11% in October on lower Saudi CP postings but rebounded 17% after the US-China tariff truce boosted Chinese demand. LPG weakness widened the propane-naphtha discount to $78/t, encouraging crackers to switch feedstocks. Saudi Aramco cut November CPs for propane and butane amid strong buying from China and India. European CIF ARA propane hit $398/t before recovering to $449/t, pressured by record US arrivals. US propane averaged 65.69¢/USG as inventories reached all-time highs. Outlook: muted winter demand, but stronger crude and naphtha in late 2026 could lift LPG prices.

Asia-Pacific

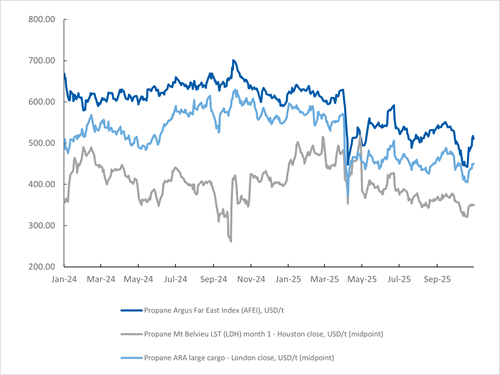

Global Propane Prices

- The average delivered propane price into Japan in October fell by nearly 11pc from the previous month, following the lower October CP posting by Saudi Aramco, which impacted valuations in Asian markets.

- Prices rebounded by nearly 17pc in the two weeks to end-October after the US-China tariff truce extension, which renewed spot demand from Chinese petrochemical makers.

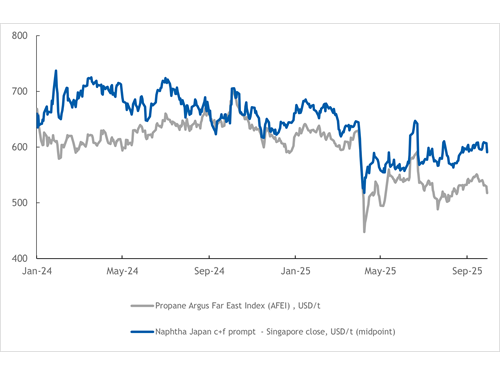

LPG versus Naphtha

- Weakness in the LPG complex drove regional crackers to maximize the switch to propane and butane.

- Front-month propane swaps averaged a $78/t discount to naphtha in October, compared with a $52/t discount the previous month, as naphtha supply tightened in the fourth quarter.

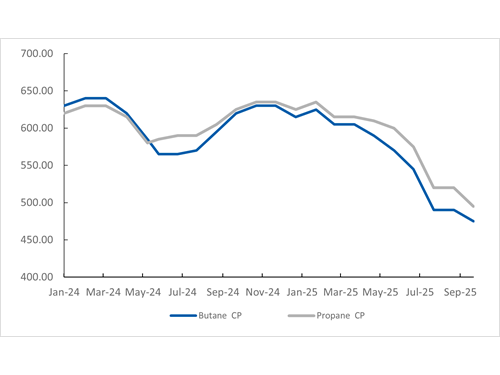

Saudi Aramco Posted Propane & Butane CP

- Saudi Arabia’s state-controlled Saudi Aramco lowered the November Contract Prices (CP) for propane and butane to $475/t and $460/t respectively, down by $20/t and $15/t from last month, alongside lower crude values.

- Strong demand from China and India underpinned the November CP postings, as Chinese importers increased spot purchases of non-US origin cargoes, while Indian buyers built stockpiles ahead of festivities.

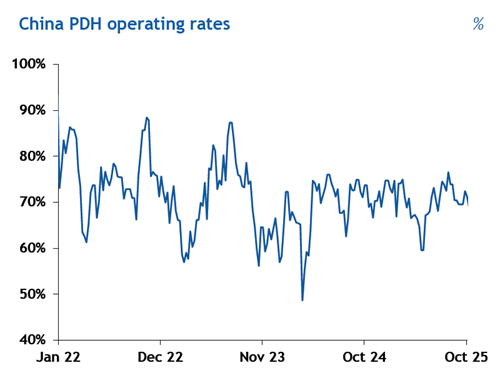

Chinese PDH Performance

- Run rates at Chinese PDH plants rose to 74pc at the beginning of November after securing propane feedstock at favorable prices last month.

- Falling Chinese polypropylene futures prices, coupled with rebounding propane prices, could cap demand from Chinese PDH operators.

Europe

The large cargo propane CIF Amsterdam-Rotterdam-Antwerp (ARA) market saw limited spot activity in October, with sentiment weighed down by geopolitical uncertainty surrounding the US-China tariff war. The lighter grade fell to a multi-month low of $398/t in the second half of October but gradually recovered after the announcement of a one-year trade truce between the world’s two largest economies, reaching $449/t by the end of October.

Market sentiment in Europe remained bearish as record US arrivals kept supply ample and prices under pressure. In October, the US delivered 603,000t of product to European shores, 22pc more than the 496,000t sent in October 2024, according to shipping data from Kpler.

The truce may eventually divert more US cargoes toward Asia, but any rebalancing in Europe is likely to be slow.

Americas

LST propane prices at Mont Belvieu, Texas, fell from 69.4375¢/USG to as low as 60¢/USG in the second half of October before rebounding to 67¢/USG by month-end as US inventories swelled to record highs. Average LST propane prices stood at 65.69¢/USG last month, down from 71.57¢/USG a year earlier, as a slowdown in US exports left stocks 15pc above the five-year average by the end of October. The US Energy Information Administration (EIA) reported propane stocks hit 106.1mn bl in the week ended 31 October, an all-time high.

At the same time, the EIA estimated US propane exports fell to 1.6mn b/d in the week ended 24 October, in line with 1.58mn b/d during the same period last year, as a narrower arbitrage to Asia and weaker Chinese demand weighed on shipments. US propane production from gas processing stood at 2.85mn b/d at the end of October, slightly above the 2.7mn b/d reported last year.

Mont Belvieu EPC butane prices averaged 83.68¢/USG in October, down 27pc from 114.63¢/USG in October 2024.

Only US ethane remains higher versus last year, as expanded export capacity following the commissioning of Enterprise’s Neches River terminal this summer has bolstered shipments to China. Mont Belvieu EPC ethane averaged 26.52¢/USG in October, up from 21.16¢/USG last year, as steady exports and higher natural gas prices supported front-month pricing.

Outlook

The quarter ahead

- Warm weather and struggling petrochemicals keeps demand muted despite weak LPG prices

- The Saudi CP continued to price level with the AFEI netback in November, we expect this to continue for the near future

- Butane is the lone bullish area, strong gasoline blending demand and shifting trade flows are the main supportive factors

- While prices will recover from the lows in October, expect little strength over the winter months compared to previous years

The next 6 months and longer term

- Stronger crude and naphtha prices towards the end of 2026 will boost LPG

- Growing Middle East production and muted Asia demand increases will keep LPG weak relative to naphtha

- VLGC freight rates are expected to weaken over 2026, narrowing regional spreads

Argus Market Highlights LPG

If you have been forwarded this newsletter, sign up to receive the next issue, including the latest news analysis from Argus LPG World, podcasts and market insights.

Sign-up