Overview

Airlines, aviation fuel suppliers and corporate customers are increasingly turning to sustainable aviation fuel (SAF) to meet carbon reduction targets as well as environmental, social, and governance (ESG) commitments.

SAF policies are advancing at different speeds across the world: Europe leads with binding mandates, Asia-Pacific is gradually introducing SAF targets, while the U.S. is incentivising production growth through tax credits.

For airlines, SAF producers and stakeholders across the aviation value chain, transparency into SAF pricing and feedstock dynamics is essential.

With HEFA SAF prices in Europe, Asia and the Americas as well as e-SAF production costs in Europe, Argus leads the way in providing this market transparency.

By delivering trusted, independent pricing data, Argus empowers market participants to make informed decisions, manage risk, and support the transition to more sustainable aviation.

HEFA SAF

Built on a robust methodology grounded in real market activity – including verified trades, bids and offers, our global suite of SAF price assessments reflect the supply and demand fundamentals of this renewable fuel around the world.

As the EU and UK are driving global SAF consumption, Argus’ well established HEFA SPK SAF prices in the Amsterdam-Rotterdam-Antwerp (ARA) hub are central for global values.

These prices, assessed using a robust methodology grounded in real market activity, are underpinned by growing liquidity on the Argus Open Markets (AOM) platform and provide true visibility on real market values for this commodity.

e-SAF

Argus also provides crucial visibility into synthetic aviation fuels with mass-balanced modelled production costs. Despite the sector still being in early development stages, e-SAF is baked into European policy. Argus prices, based on the cost of renewable hydrogen produced with electricity supplied under power purchase agreements (PPAs) and the Fischer-Tropsch synthesis process, are critical for investment and strategic planning for the development of the e-SAF industry.

Argus Open Markets® for European SAF

The first real-time spot pricing platform for SAF is taking off! Trades occurring daily for SAF fob ARA on Argus Open Markets®.

Spotlight content

Global SAF Market Deep Dive: Regional Developments, Corsia, and 2026 Outlook

We have gathered our global market experts to present a two-part webinar series that delivers a comprehensive market analysis and the opportunity to join live Q&A sessions.

Insight PapersSpotlight on the European SAF market: Countdown to 2025

An Argus overview on SAF regulations, market fundamentals, and prices.

Insight PapersUS renewable feedstocks

From Fossil Fuels to Renewable Sources: The Future of US Feedstocks. Get insight into the feedstocks market as US production continues to shift toward renewable fuels.

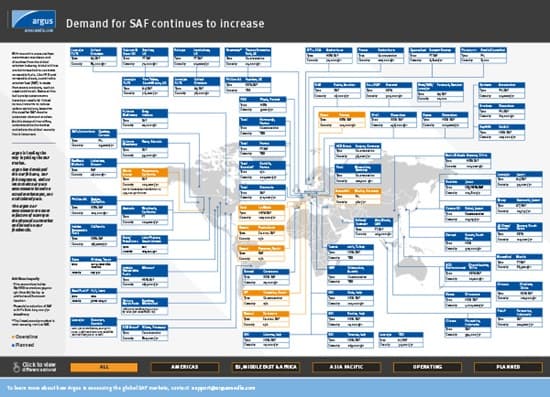

Global SAF capacity

The data behind the map is also available in Data and Downloads on Argus Direct for subscribers.

Download now