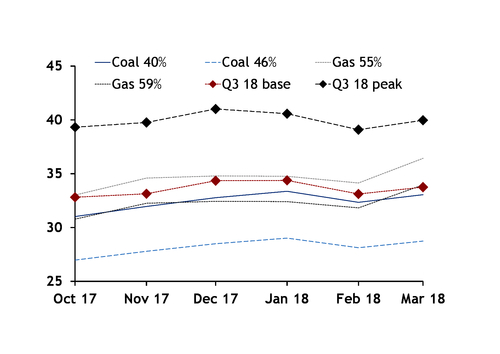

German second and third-quarter 2018 power contracts have largely decoupled from steady costs for power sector coal burn and rising costs for gas-fired power generation as an outlook of a strong hydropower generation and higher nuclear plant availability in central west Europe have lowered expectations for the need of German fossil-fuel generation.

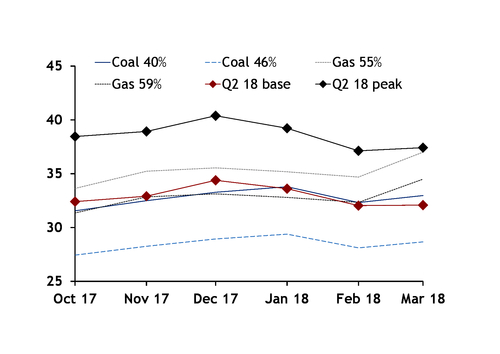

Marginal costs for operating a coal-fired power plant with an efficiency of 40pc in the second quarter have averaged €33/MWh so far this month, compared with an average of €33.05/MWh in January-February, based on Argus assessments for API 2 coal swaps and EU ETS carbon allowances. Costs or operating gas-fired units have increased sharply to an average of €37.05/MWh so far this month from €34.93/MWh in January-February, based on a plant efficiency of 55pc and on Argus NCG front-quarter assessments.

But the German base-load second-quarter power contract has trended lower over the same period, to €32.08/MWh on average this month from €32.82/MWh in January-February, rendering all of Germany's gas-fired power plants, even those with an efficiency of 61pc, unprofitable for base-load operation this summer, while coal-fired units with an efficiency below 42pc would also not be able to break even on a marginal cost basis in the next quarter at prevailing prices. A similar situation is prevalent at present for the third quarter as market participants have priced in expectations of limited need for German fossil-fuel generation this summer.

Supply glut

French hydro stocks last week fell to an 11-year low while Swiss reservoir levels at the start of week 12 had fallen to the second-lowest level for this time of year in 21 years. Spells of below-average temperatures and subsequently higher demand for heating increased the call on hydropower plants late in February and earlier this month. An outlook of unseasonably cold conditions this week could potentially draw stocks down further, although lower industrial demand over the Easter break is likely to limit the impact of persistent demand for heating.

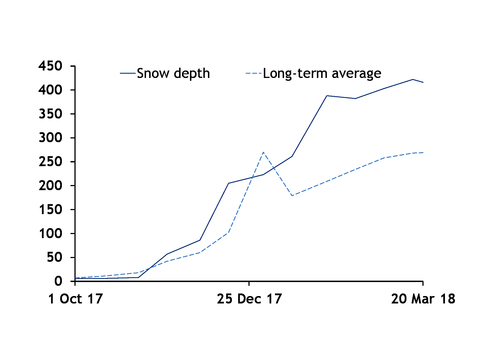

The currently tight hydrological situation in central west Europe is masking the potential of strong hydropower output this spring and summer as snowpack in the wider region is well above historical highs. In Montana, in the hydro-rich Swiss canton of Valais, snow depth yesterday was measured at 402cm compared with a previous high for this time of year of 398cm and a long-term average of 276cm, SFL institute for snow and avalanche research data show. In Champery, on the Swiss border with France, snow depth was measured at 247cm, exceeding the previous high of 177cm and more than double the long-term average of 129cm.

Swiss run-of-river hydropower generation, which is uncontrollable output beyond shutting damns once exceedingly high water supply risks flooding, fell to 5TWh in the second quarter of last year and to 5.4TWh in the third quarter, by 7.9pc and 6pc year on year, respectively. But above-average snowpack in the Swiss Alps could lift run-of-river generation well above the 10-year average of 5.3TWh in 2007-17 for second-quarter generation and of 5.6TWh over the same period for third-quarter generation. Pumped storage power generation is more sensitive to price signals in the wholesale power market but could also exceed the 10-year average generation of 5.1TWh for the second quarter and 5.9TWh for the third quarter, given the abundance of water in the Swiss Alps.

Added to the potential of strong hydropower generation this summer, nuclear plant availability is scheduled to be higher year on year in the wider central west European (CWE) market area. The permanent closure of Germany's 1.3GW Gundremmingen B reactor on 31 December means that German nuclear plant availability will fall to an average of 7.9GW in the second quarter and to around 9GW on average in July-September, compared with 8.2GW and 9.8GW in the same quarters a year earlier. But only 14.2GW of French nuclear capacity is currently earmarked to be off line in April-June and 11.7GW in the third quarter, compared with 20.2GW and 21.5GW, respectively, last year. Even on days with lower renewable energy generation in Germany, imports from more amply-supplied French and Swiss markets are likely to meet at least some of the higher residual demand — consumption not met by renewable generation.

Flexibility glut

Germany's four transmission system operators (TSOs) last week announced that they seek to secure 1,876MW in positive and 1,820MW in negative secondary control reserve in the weekly tenders for delivery in the second quarter, which marks the lowest need for second-quarter secondary reserve energy since at least 2015. Providers have to increase their output for positive and scale back generation for negative balancing energy, compared with a previously agreed baseline. Minute reserve needs will fall to 1,419MW for positive and 991MW for negative balancing energy compared with 1,506MW and 1,072MW, respectively, in the second quarter of last year and also the lowest level since at least 2015, TSOs said.

Falling tender volumes for balancing energy in the second quarter suggest that TSOs have confidence in the day-ahead and intra-day power market to balance the German power system. TSOs' view on a high availability of flexible generation assets to the wholesale market is, in turn, is reflected in depressed clean dark and spark spreads for delivery in the next quarter.

Fuel-switch

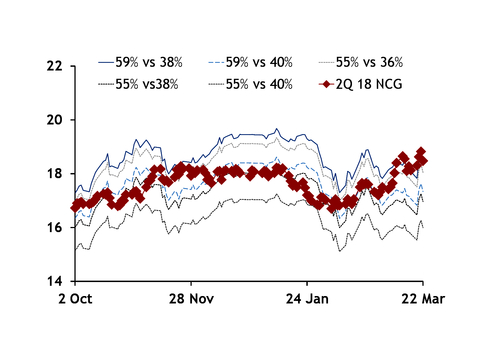

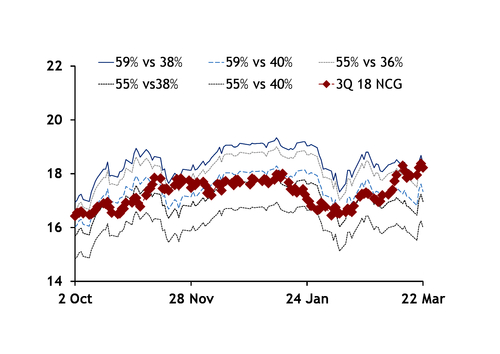

That said, Germany will still rely on some coal and gas-fired generation, but output will be volatile depending on wind and solar power generation this spring and summer. On days and in hours with lower intermittent renewable energy generation, coal-fired plants will be the first units to come on line at prevailing prices as NCG second-quarter prices hold firmly above levels at which even a modern 59pc-efficient gas-fired plant could replace a 38pc-efficient coal-fired unit in the German merit order.

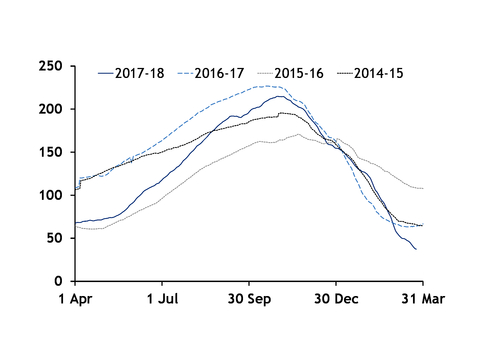

Gas may have to remain mostly uncompetitive with coal to allow for brisk injections this summer. Inventories have fallen to the lowest in recent years, having been heavily depleted this winter. And at 37.4TWh yesterday morning they were less than half of the three-year average of 79.3TWh.

Gas stocks were also considerably below the 63.9TWh a year earlier, when the summer stockbuild had been the quickest in recent years. While deliveries from Russia, Norway and the UK through Belgium could again be brisk this summer, power sector gas burn may have to step considerably lower to leave more supply to be added to storage, especially as injection demand in most other European countries will be strong.

German power sector gas burn fell to a decade low of 4.55TWh in the second quarter of 2015, and to 4.47TWh in the subsequent quarter at a time when forward and working day-ahead clean spark spreads were deeply in negative territory. Combined heat and power (CHP) plants supplying process steam and hot water will again provide a bottom for gas-fired power generation this summer as these units have to run at minimum load even if clean spark spreads do not recover in delivery in April-September.

But in a reversal to the situation in summers 2016 and 2017, coal-fired plants look likely to claw back some market share in the German generation mix from gas units.

Price volatility

With load factors for even highly efficient gas-fired plants likely to increase this summer compared with 2016-17 — assuming that current expectations of strong hydropower generation and higher nuclear supply will materialise — price volatility in the German day-ahead and intra-day market could increase. Idled fossil fuel plants would have to come on line on days or in hours with lower wind and solar generation and recoup start-up and marginal costs over a few hours — rather than being able to hedge base-load generation on a forward basis for in the day-ahead auction.

The second-quarter 2018 off-peak contract, which includes the morning hours between midnight and 8:00 CEST (06:00 GMT) and the evening period between hours 20-24, last traded at €29/MWh in the German over-the-counter market, which is around the break-even costs for 46pc-efficient coal-fired units but would render all other coal and gas-fired plants unprofitable. And on days with forecasts of high solar power generation and subsequently depressed peak-load day-ahead auction settlements, lower-than-forecast renewable supply or plant outages could offer upside support and price volatility to peak-load products in the intra-day market.

The level of standard deviation — which measures variations from the mean — for hourly products in the German-Austrian day-ahead auction has stepped up to the highest level in five years so far this month. Outright German-Austrian base-load prices have settled at an average of €38.05/MWh on the Epex Spot exchange compared with an average of €31.70/MWh throughout March 2017, despite combined wind and solar power generation averaging 19.3GW on 1-25 March compared with 17.4GW throughout March last year. Gas-fired plants having to recoup higher costs over fewer hours is likely to have contributed to the price upside. Hourly power sector gas burn stood at 4.6GW on 1-25 March compared with 6GW on average throughout the same month last year.