An early analysis of peak power demand during the recent polar vortex shows power grids were able to perform without major issues. That could provide a compelling argument against maintaining coal-fired generation to guarantee fuel security.

Temperatures fell to record lows in parts of the midwest and eastern US at the end of January and early February. Other regions also were significantly colder than normal.

But forced outages in the PJM Interconnection — the country's largest power grid — during the peak of the cold snap in January were well below those seen during the 2014 polar vortex. That occurred despite more than 18,000MW of coal-fired generation being retired in the grid operator's footprint since the start of 2015.

The grid performed "with flying colors," a PJM spokesman said this week. The initial analysis of grid performance "reinforced our preliminary findings in the fuel security report." That report, which PJM released in December 2018, showed the grid generally was in a good position to handle extreme weather events over the next few years but still should find a way to value fuel security.

Some of the reason power grids performed better than they did in 2014 may be that electricity demand was not as great. Even as low temperatures in the ComEd transmission zone in Northern Illinois fell to -24° F (-31° C) on 31 January, peak power demand in PJM was 139,452MW, the fourth highest on record.

In the Midcontinent Independent System Operator (MISO), peak demand hit 100,900MW on 30 January, below the all-time winter peak of 109,300MW on 6 January 2014.

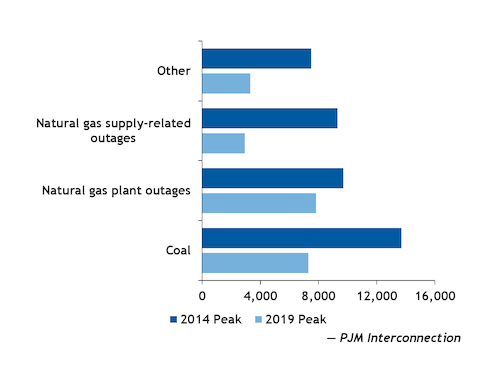

Improvements in grid management, including how the grids respond to outages, also probably helped resiliency and reliability. PJM had 21,359MW of forced outages during the recent winter peak, or 10.6pc of total capacity. During the 2014 polar vortex, it had 40,200MW — 22pc of total PJM capacity — of forced outages.

Previous winter peaks showed there were linkages between the systems along the grid that needed to be maintained, said Joshua Rhodes, a research fellow at the University of Texas at Austin's Energy Institute. Those connections include maintaining power supply to gas line compressors.

"It is important to keep those critical pathways open," Rhodes said. Doing so would reduce the competition between residential and power demand for natural gas — or at least keep natural gas flowing — he said.

But as power grids such as PJM and MISO transition away from coal and nuclear generation, and more toward natural gas and renewables, they could become more susceptible to fuel shortages, said Eric Hittinger, an associate professor of public policy at the Rochester Institute of Technology.

"In the midwest, the conjunction of three factors — sufficient natural gas supply, lower reliance on natural gas generation, and lower reliance on electric heating — makes extreme cold less of a reliability issue," Hittinger said.

But as the fuel slate shifts toward natural gas in the region, the competition for fuel would likely increase.

"The solution for that would be more pipelines," Hittinger said.

PJM has 47,930MW of natural gas generation in its queue for delivery in coming years and MISO has 20,454MW. PJM also has planned additions of 18,925MW of solar and 5,003MW of wind.

Meanwhile, more coal and nuclear plant retirements are on the way. PJM is expecting more than 7,000MW of coal-fired capacity to retire through 2022 and 4,750MW of nuclear generation through 2021, while Argus has 9,932MW of coal generation going off line in MISO over the next 10 years.

The North American Electric Reliability Corporation (NERC) published a risk assessment in December that found fuel supplies in PJM, MISO and Southeast Electric Reliability Council – East (SERC-E) were vulnerable to extreme winters, particularly during prolonged periods of cold weather, if power plant retirements are accelerated.

The risk assessment led a group of power executives to ask the PJM board of directors to address urgent fuel security issues stemming from the loss of coal-fired and nuclear power plants. Executives from utility holding companies Public Service Enterprise Group, Duke Energy, Exelon and First Energy in a 29 January letter to PJM chastised the grid operator for failing to respond the potential risks associated with accelerated plant retirements.

Exelon, which owns the ComEd system in Northern Illinois, said its nuclear plants in Illinois, New York and Pennsylvania were running at full power during the cold snap in January. The company's 837MW Three Mile Island unit 1 in Pennsylvania is scheduled to retire at the end of September.

Fuel security has been a frequent item of discussion for the coal industry and the administration of President Donald Trump. In September 2017, the administration proposed compensating coal and nuclear plants for their contributions to "grid resiliency." The US Federal Energy Regulatory Commission rejected that proposal in January 2018.

The administration tried again in June, with Trump ordering US energy secretary Rick Perry to prepare steps to stop impending plant retirements, arguing the retirements are making it harder for the grid to recover from natural disasters, cyber intrusions or physical attacks on energy infrastructure.

But retirement announcements have continued. And grid infrastructure may be more stable than some expected.

While NERC warned about accelerated retirements, it also said lessons learned from the 2014 polar vortex about preparation for extreme weather improved reliability during the recent cold snap.

MISO said it is continuing to evaluate data for the recent winter peak, and will comment once the study is completed.

No matter what the final analysis shows, the resiliency debate is likely to continue with a White House keen on protecting coal and nuclear generation.