German gas-fired generation has been largely up on the year as lower NCG gas prices and higher carbon costs supported deeper coal and lignite-to-gas fuel switching. But a recent increase in NCG gas prices has pushed up generating costs to price more gas-fired plants out of the market.

Power sector gas burn was significantly higher from the spring, despite lower power demand given strict Covid-19 measures. A further decrease in NCG gas prices in summer combined with higher carbon costs supported German gas burn for the power sector. As a result, gas-fired plants pushed all coal out of the market and moved ahead of the highest efficiency lignite in the merit order.

But German gas-fired generation has averaged 6.51GW so far this month, slightly lower than last month and only 10MW higher on the year. Higher wind power has weighed on generation from fossil fuels, but a higher share of gas-fired plants remains embedded in the German merit order than coal units, which remain at the margin.

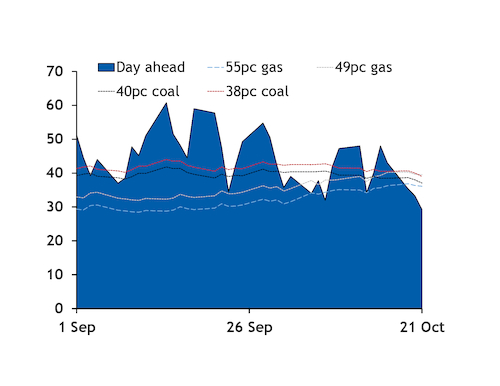

Working day-ahead break-even costs show that a unit with a 46pc efficiency or lower has been priced out of the base-load market this month, with average costs of €40.43/MWh, according to Argus assessments. The German spot index has averaged €39.09/MWh this month.

Break-even costs suggest a 43pc efficiency lignite-fired unit has entered the base load market this month, followed by 61pc and 59pc units. But a 55pc unit remains ahead of all coal-fired stack in the merit order.

Uncertain demand outlook

German power demand has increased this month to average 55.14GW — higher than a year earlier and the five-year average.

But further upside could be limited given renewed concerns as Covid-19 infections in the country have doubled in the last week. Some German states have introduced measures on social activities but these have not yet impacted industrial demand.

Generation from renewables, mainly wind, will continue to set the amount of fossil-fuel output needed to meet residual demand this winter. Wind levels were at record high in January and February, which weighed on gas-fired generation. Renewables in those months accounted for 48pc and 61.7pc of the generation mix, respectively. Germany added around 870MW of onshore wind power in January-August this year and the sector believes around 1.5GW of total new capacity will be installed this year. The share of renewables has been 45pc this month, compared with 44.8pc in October 2019.

Hydropower conditions in neighbouring countries of Switzerland and France are relatively strong, increasing in recent weeks given a wetter than normal month. Stocks in France reached a historical high last week.

French nuclear power plant availability is expected to be higher year on year this winter. The 1.4GW Brokdorf nuclear unit in Germany will return to the grid on 24 October while the 1.28GW Grundemmingen C nuclear reactor will be off line from 30 October-22 November.

On the fossil-fuel side, lignite-fired capacity available in the wholesale power market will be 300MW lower as German utility RWE's Niederaussem D plant will close on 31 December. And up to 4GW of coal-fired capacity is expected to be out of the wholesale power market from 1 January, under the rules of the first tender for closures. But capacity awarded will have to remain available to transmission system operators for balancing services until July, when they fully shutdown.

On the gas side, the return of previously mothballed units such as Irsching 4 and 5 with a combined capacity of 1.4GW, increases gas-fired capacity available in the wholesale power market this winter compared with last year.

Germany is expected to be a net exporter to neighbouring markets this winter, including flows into the Belgian market once the 1GW Alegro link launches commercial operations on 18 November.

Outlook

Current power prices suggest the German merit order for winter will be different from the summer given the increase in NCG gas prices.

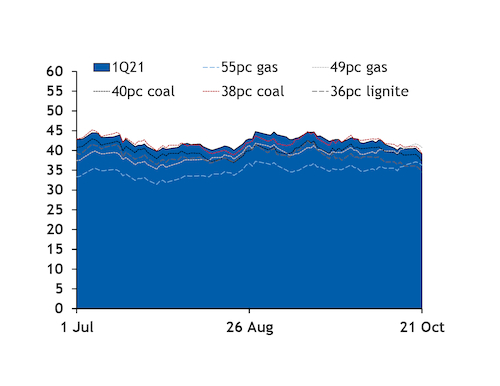

Not all German gas-fired stack is priced in for base load next quarter. Break-even costs for a 49pc unit closed yesterday at €40.74/MWh, compared with the power contract at €39.10/MWh. These units have struggled to enter the day-ahead market next quarter in recent sessions.

Prices also suggest that a lignite-fired unit with an efficiency of 43pc is ahead in the merit order next quarter followed by 61 and 59pc efficient gas-fired plants, while a 55pc unit is behind a 46pc coal-fired plant but ahead of a 40pc coal-fired unit that is also priced in. Even 34pc-efficient lignite-fired plants are priced on a base-load basis, ahead of 49pc gas-fired units.

This narrowly compares with last winter. The first quarter 2019 base-load contract expired at prices where a 46pc gas-fired unit or lower was priced out of the base-load market. A coal-fired unit with an efficiency of 40pc or lower expired priced out, while a 43pc lignite-fired unit expired behind 61pc gas-fired plants for the merit order and 36pc lignite was behind 55pc gas-fired plants.