Battery storage manufacturers are increasingly pushing to develop technologies using less-traditional metals including sodium, iron and antimony, in light of rising demand and prices for the widely used staples of the battery industry — cobalt, lithium and nickel.

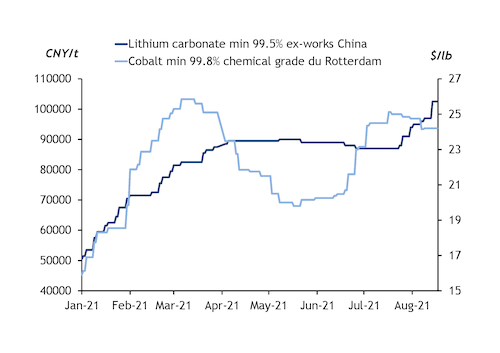

With lithium carbonate prices almost doubling since the start of 2021 and chemical grade cobalt prices surging by over 50pc in the year to date, battery storage makers and investors have looked to new patented technologies that tap underutilised and abundantly available materials.

Chinese automotive manufacturer CATL last month unveiled its new sodium-ion batteries, and expects to build an industrial supply chain by 2023. CATL's sodium-ion batteries have high-energy density, fast-charging capability, strong thermal stability and low-temperature performance, as well as high-integration efficiency, according to the company.

Last week, India's largest private-sector oil major Reliance Industries led a consortium of global investors including Bill Gates to invest $144mn in US battery manufacturer Ambri to commercialise its antimony-based liquid metal battery technology for the stationary, long-duration, daily cycling energy storage market.

Ambri is securing its antimony supply from another US company, Perpetua Resources, which will provide a portion of the antimony output from its Stibnite gold project in Idaho.

Similarly, steelmaker ArcelorMittal in July invested $200mn in Massachusetts-based Form Energy, which has developed a multi-day energy storage system that uses iron. The companies will jointly develop the iron materials for the battery systems.

ArcelorMittal would non-exclusively supply these materials for Form's battery systems, while the US company intends to source the iron domestically and manufacture the battery systems near the site. Form Energy's first project is with Minnesota-based utility Great River Energy, located near the heart of the American Iron Range, it said.

It remains to be seen how far the trend toward using alternative metals in batteries will extend. For now, it is unlikely to significantly ease demand for traditional battery metals, as most of the established supply chains catering to the automotive industry are focused on nickel-cobalt-manganese (NCM) chemistries, and are far advanced in terms of driving range longevity.