Combined Finnish and Baltic gas consumption rose by roughly 12pc on the year in August, a second consecutive month of year-on-year increase.

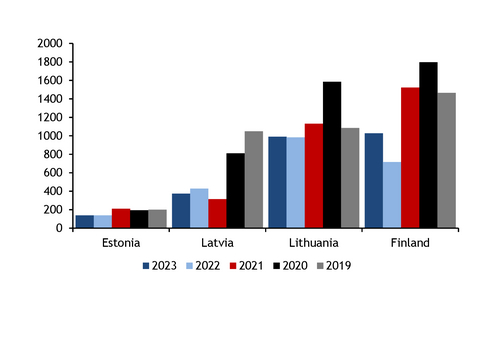

Overall consumption rose to 2.53TWh from 2.27TWh in August 2022 and 2.1TWh in July. However, the combined number masks a large discrepancy between Finnish and Baltic data — for the fifth consecutive month, Finnish consumption increased significantly compared with the previous year, fully accounting for the overall increase and more than offsetting stable consumption in Estonia and Lithuania, and a slight decline in Latvia (see graph).

Finnish consumption jumped by 43pc on the year to 1.03TWh, and was also up more than 100GWh from July, but remained well below the 2019-21 average for August of 1.59TWh.

Higher Finnish demand was at least partly driven by stronger gas-fired power generation, which stepped up to an average of 171MW last month from 148MW in August 2022, and 158MW in July. Stronger gas generation may have been incentivised by the jump in power prices towards the end of the month, which rose to their highest for any point this year, a trend which has continued into the beginning of September. The increase on the month was only fairly marginal, however, with coal instead coming into the generation mix.

In the Baltic countries, gas-fired generation fell by roughly a quarter in both Latvia and Lithuania, while holding stable in Estonia (see table). Gas was pushed lower in the generation mix in Lithuania because of strong wind generation, among other factors, as onshore wind output rose to 206MW in August from 97MW the year previously. Lithuanian solar output also rose to 115MW from 72MW, as renewables in total made up nearly 73pc of the Lithuanian generation mix. In Estonia, both biomass and oil shale plants were mostly pushed out of the generation mix, dropping to 36MW and 141MW, from 188MW and 307MW respectively in August 2022. In August last year gas prices reached an all-time high, making alternative fuels far more attractive than gas for power generation.

The average gas price on the GET Baltic exchange increased by 16pc to €42.69/MWh in August from €36.81/MWh in July, but was 82pc lower than a year earlier, the exchange said. The increase in prices on the month was because of the increase in electricity prices, "which has favoured electricity generation in the Baltic States using natural gas", GET Baltic said.

Traded volumes nearly doubled to 683GWh from 358GWh in July, and was also higher than the 394GWh traded in August last year. Lithuania accounted for the majority of trades at 45pc of total volume, while Finland made up 34pc and the Estonia-Latvia common area market the remaining 21pc. Of the total traded volume, 13GWh was sold on a month-ahead basis, up from 4GWh in July, with the rest sold as daily products.

Maintenance to hit gas consumption in September

Maintenance at ammonia and combined heat and power plants (CHPs) in September could weigh on industrial and power sector gas demand this month.

The region's largest single consumer, Lithuanian ammonia producer Achema, on 5 September announced unplanned maintenance at its plant at Jonava, which will limit its gas consumption by roughly 40pc on 1-21 September. This suggests Lithuanian industrial consumption is likely to remain muted for much of this month, although the plant has already long been operating at reduced rates.

Similarly, extended maintenance announced yesterday at Latvian and Finnish CHPs could keep power sector gas demand low this month.

That said, power sector gas demand particularly in Finland, but also by extension in the Baltics, is typically dictated by nuclear and renewable generation. Finnish nuclear output has averaged roughly 3.1GW on 1-7 September, down from the 3.5GW average in August and 4.2GW in July. However, onshore wind production has increased considerably, rising to 1.6GW from 1.1GW in August, more than offsetting the lower nuclear output.

This has limited room in the generation mix for gas, with Finnish gas-fired generation averaging 164MW on 1-7 September. In the same period, Lithuanian gas-fired output dropped to just 51MW, although Latvian generation increased to 154MW from 119MW in August.

| Baltic August average gas-fired power generation | MW | ||

| 2023 | 2022 | ± | |

| Estonia | 4 | 4 | 0 |

| Latvia | 119 | 152 | -33 |

| Lithuania | 86 | 113 | -27 |

| Finland | 171 | 148 | 23 |

| Total | 380 | 417 | -37 |

| — Entso-E | |||