The first three months of Canada's Trans Mountain Expansion (TMX) have sent a surge of crude to refiners in California and China, shifting tanker demand in the Pacific basin.

The 590,000 b/d TMX project nearly tripled the capacity of Trans Mountain’s pipeline system to 890,000 b/d when it opened on 1 May, linking Alberta's oil sands to Canada's west coast for direct access to lucrative Pacific Rim markets, where buyers are eager for heavy sour crude.

Between 20 May, when the first TMX cargo began loading, and 20 August, about 165,000 b/d of Vancouver crude exports landed at ports on the US west coast, primarily in California, up from about 30,000 b/d in that same span last year, according to data from analytics firm Kpler.

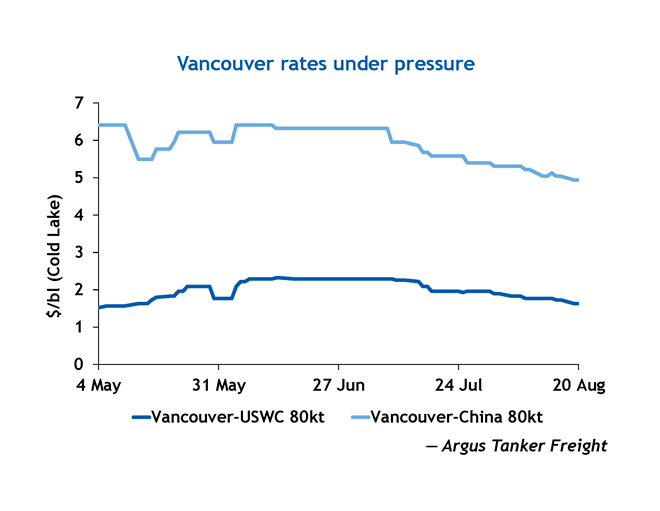

The freight rate for a Vancouver-US west coast Aframax shipment averaged $1.98/bl for Cold Lake between 1 May and 20 August. This ranged from a low of $1.50/bl from 1-3 May when shipowners repositioned to the region in anticipation of TMX to a high of $2.32/bl from 13-14 June, according to Argus data.

The new oil flow into the US west coast has displaced shipments from farther afield in Ecuador and Saudi Arabia. Crude exports from those countries into the US west coast averaged 110,000 b/d and 25,000 b/d, respectively, between 20 May and 20 August, down from 155,000 b/d and 135,000 b/d over the same stretch in 2023, according to Kpler.

The growth of the Vancouver market, which benefits from its proximity to California, has reduced tonne-miles, a proxy for tanker demand, into the US west coast. This has outpaced slightly lower crude demand, which fell in part due to Phillips 66 halting crude runs at its 115,000 b/d refinery in Rodeo, California, in February to produce renewable fuels, as well as weaker-than-expected road fuel demand this summer.

Tonne-miles for US west coast crude imports fell by 14pc to 106bn between 20 May and 20 August 2024 compared with the same period a year earlier, Vortexa data show, while overall crude imports declined just 8.6pc to 1.37mn b/d, according to Kpler.

PAL-ing around with VLCCs

Though much of Vancouver’s exports have been shipped to the US west coast, Canadian producers have found ready buyers in Asia-Pacific as well, where about 160,000 b/d of Vancouver exports went between 20 May and 20 August, compared with none a year prior, Kpler data show.Buyers and sellers have displayed a preference for using ship-to-ship transfers onto very large crude carriers (VLCCs) at the Pacific Area Lightering zone (PAL) off the coast of southern California, rather than sending Aframaxes directly to refineries in east Asia. Of the 30 Vancouver-origin Aframax cargoes that have landed in China, South Korea and India, 19 were transferred onto VLCCs at PAL, Kpler data show. Seven cargoes were sent directly to east Asia on time-chartered Aframaxes — the majority by Suncor — and just four were sent using spot tonnage, likely due to the expensive economics of trans-Pacific Aframax shipments.

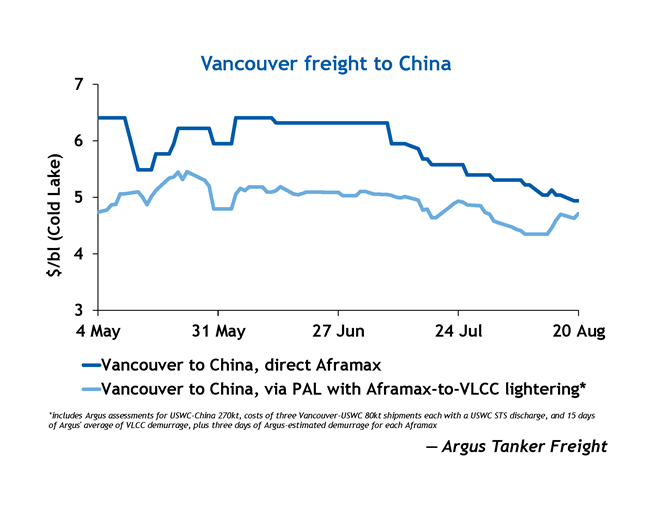

The Vancouver-China Aframax rate between 1 May and 20 August averaged $5.90/bl, with a low of $4.94/bl from 19-20 August and a high of $6.41/bl from 1-10 May and again from 4-12 June, according to Argus data.

Over the same time, the cost to reverse lighter, or transfer, three 550,000 bl shipments of Cold Lake crude from Vancouver onto a VLCC at PAL averaged about $8.055mn lumpsum, or $4.92/bl, with a low of $4.35/bl from 8-13 August and a high of $5.45/bl on 22 May, according to Argus data. This includes $150,000 ship-to-ship transfer costs at PAL, 15 days of VLCC demurrage and three days of Aframax demurrage for each reverse lightering.

VLCC costs could change preferences

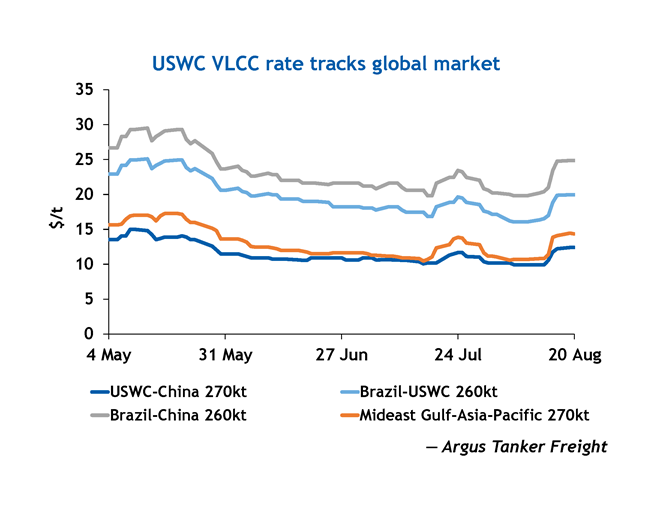

Though it may have been cheaper to load TMX crude on VLCCs at PAL since May, volatility in the VLCC market — which often falls to yearly lows in summer before climbing to seasonal highs in the winter — could entice traders to opt for direct Aframax shipments if VLCCs hit their expected peak in the winter.

VLCC costs for shipments from the US west coast to China are influenced by the VLCC markets in the Mideast Gulf and Brazil, where ships look for their next voyage after discharging on the US west coast.

For now, Vancouver-loading Aframax rates are under pressure from the reemergence of VLCCs in what had become an Aframax trade in Thailand, boosting Aframax supply in the Pacific and pulling the class’s rate to ship crude from Vancouver to the US west coast to its lowest level in more than three months on 19 August.

In mid-July, VLCCs resumed discharging via single point mooring (SPM) at Thailand's port of Map Ta Phut for the first time since January 2022, ship-tracking data from Vortexa show. Prior to the SPM's return to service, VLCCs could discharge cargoes only by lightering onto smaller Aframaxes, which would then unload at a different berth in the port.

This created demand for about eight Aframax lighterings each month, but with VLCCs in Thailand again able to discharge directly, that demand is effectively halted, putting downward pressure in the broader southeast Asia Aframax market.

Since July, two Aframaxes have left the southeast Asia market for Vancouver, according to ship tracking data from Kpler: the Eagle Brisbane, which previously was used in lightering operations at Map Ta Phut, and the Blue Sea, which recently hauled fuel oil from nearby Singapore to China.