The first three months of Canada's Trans Mountain Expansion (TMX) have sent a surge of crude to refiners in California and China, shifting tanker demand in the Pacific basin.

The 590,000 b/d TMX project nearly tripled the capacity of Trans Mountain’s pipeline system to 890,000 b/d when it opened on 1 May, linking Alberta's oil sands to Canada's west coast for direct access to lucrative Pacific Rim markets, where buyers are eager for heavy sour crude.

Between 20 May, when the first TMX cargo began loading, and 20 August, about 165,000 b/d of Vancouver crude exports landed at ports on the US west coast, primarily in California, up from about 30,000 b/d in that same span last year, according to data from analytics firm Kpler.

The freight rate for a Vancouver-US west coast Aframax shipment averaged $1.98/bl for Cold Lake between 1 May and 20 August. This ranged from a low of $1.50/bl from 1-3 May when shipowners repositioned to the region in anticipation of TMX to a high of $2.32/bl from 13-14 June, according to Argus data.

The new oil flow into the US west coast has displaced shipments from farther afield in Ecuador and Saudi Arabia. Crude exports from those countries into the US west coast averaged 110,000 b/d and 25,000 b/d, respectively, between 20 May and 20 August, down from 155,000 b/d and 135,000 b/d over the same stretch in 2023, according to Kpler.

The growth of the Vancouver market, which benefits from its proximity to California, has reduced tonne-miles, a proxy for tanker demand, into the US west coast. This has outpaced slightly lower crude demand, which fell in part due to Phillips 66 halting crude runs at its 115,000 b/d refinery in Rodeo, California, in February to produce renewable fuels, as well as weaker-than-expected road fuel demand this summer.

Tonne-miles for US west coast crude imports fell by 14pc to 106bn between 20 May and 20 August 2024 compared with the same period a year earlier, Vortexa data show, while overall crude imports declined just 8.6pc to 1.37mn b/d, according to Kpler.

PAL-ing around with VLCCs

Though much of Vancouver’s exports have been shipped to the US west coast, Canadian producers have found ready buyers in Asia-Pacific as well, where about 160,000 b/d of Vancouver exports went between 20 May and 20 August, compared with none a year prior, Kpler data show.Buyers and sellers have displayed a preference for using ship-to-ship transfers onto very large crude carriers (VLCCs) at the Pacific Area Lightering zone (PAL) off the coast of southern California, rather than sending Aframaxes directly to refineries in east Asia. Of the 30 Vancouver-origin Aframax cargoes that have landed in China, South Korea and India, 19 were transferred onto VLCCs at PAL, Kpler data show. Seven cargoes were sent directly to east Asia on time-chartered Aframaxes — the majority by Suncor — and just four were sent using spot tonnage, likely due to the expensive economics of trans-Pacific Aframax shipments.

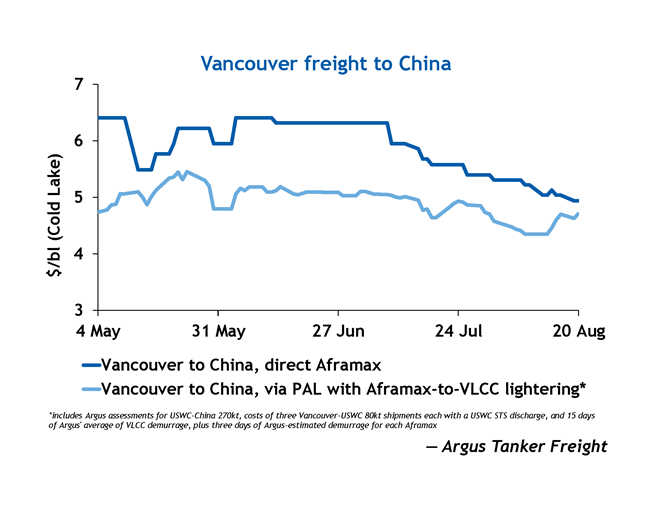

The Vancouver-China Aframax rate between 1 May and 20 August averaged $5.90/bl, with a low of $4.94/bl from 19-20 August and a high of $6.41/bl from 1-10 May and again from 4-12 June, according to Argus data.

Over the same time, the cost to reverse lighter, or transfer, three 550,000 bl shipments of Cold Lake crude from Vancouver onto a VLCC at PAL averaged about $8.055mn lumpsum, or $4.92/bl, with a low of $4.35/bl from 8-13 August and a high of $5.45/bl on 22 May, according to Argus data. This includes $150,000 ship-to-ship transfer costs at PAL, 15 days of VLCC demurrage and three days of Aframax demurrage for each reverse lightering.

VLCC costs could change preferences

Though it may have been cheaper to load TMX crude on VLCCs at PAL since May, volatility in the VLCC market — which often falls to yearly lows in summer before climbing to seasonal highs in the winter — could entice traders to opt for direct Aframax shipments if VLCCs hit their expected peak in the winter.

VLCC costs for shipments from the US west coast to China are influenced by the VLCC markets in the Mideast Gulf and Brazil, where ships look for their next voyage after discharging on the US west coast.

For now, Vancouver-loading Aframax rates are under pressure from the reemergence of VLCCs in what had become an Aframax trade in Thailand, boosting Aframax supply in the Pacific and pulling the class’s rate to ship crude from Vancouver to the US west coast to its lowest level in more than three months on 19 August.

In mid-July, VLCCs resumed discharging via single point mooring (SPM) at Thailand's port of Map Ta Phut for the first time since January 2022, ship-tracking data from Vortexa show. Prior to the SPM's return to service, VLCCs could discharge cargoes only by lightering onto smaller Aframaxes, which would then unload at a different berth in the port.

This created demand for about eight Aframax lighterings each month, but with VLCCs in Thailand again able to discharge directly, that demand is effectively halted, putting downward pressure in the broader southeast Asia Aframax market.

Since July, two Aframaxes have left the southeast Asia market for Vancouver, according to ship tracking data from Kpler: the Eagle Brisbane, which previously was used in lightering operations at Map Ta Phut, and the Blue Sea, which recently hauled fuel oil from nearby Singapore to China.

Spotlight content

Related news

Venezuela reviewing latest ad-hoc oil contracts

Venezuela reviewing latest ad-hoc oil contracts

Caracas, 27 February (Argus) — Venezuela's state-owned oil firm PdV is reviewing 26 joint ventures granted from 2024-2025 to align them with changes to the hydrocarbons law or cancel them after the US has demanded reforms for investors. Now president Rodriguez began implementing new types of joint ventures, including some known as productive participation agreements (CPPs), after she took on the role of oil minister in October 2024 as part of her vice presidency. The arrangements could be retrofitted to match provisions under the recently modified hydrocarbons law, one PdV source told Argus , but more likely they may be cancelled. The 26 oil contracts granted after the ouster and arrest of former oil minister Pedro Tellechea in October 2024 and before the US seized former Venezuela leader Nicolas Maduro on 3 January are being reviewed, the PdV source said. Of those, 13 are CPPs. The PdV source said the US is pressuring Rodriguez to end those contracts since most of the other partners are non-US or little-known entities. "I think they will all be suspended," the source said. "What the Americans have told us is [any deals] need to be authorized by us." Rodriguez and Maduro granted the 26 deals in the two years but provided few public details. Even after Maduro was arrested on 3 January, Rodriguez still described the CPPs as a way forward to increase Venezuelan oil production. But once the law was modified the government and its partners were granted six months to adopt the contracts to the new law or cancel them. Sources say the arrangements were doomed to fail, since they were laboring from the beginning under the weight of US sanctions that are only now beginning to be lifted. "She granted two dozen contracts, but only five of those ... are in actual production", a former Venezuelan oil minister said. "Eliminating or retooling those contracts will have zero impact on production." Retooling those agreement or granting new ones may instead help to increase Venezuela's production from its plateau of about 1mn b/d in recent months. By Carlos Camacho Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Argentina's YPF leans further into shale in 4Q

Argentina's YPF leans further into shale in 4Q

Montevideo, 27 February (Argus) — Argentina's state-owned YPF advanced its transformation into a shale company in the fourth quarter of 2025, as it completes its divestment of conventional blocks. "We are committed to becoming a significant shale producer," chief executive Horacio Marin said during a quarterly investor report on Friday. Shale oil production rose by 35pc to 165,000 b/d in 2025 from a year before. Output surged in the fourth quarter, quickening to a 42pc increase to 196,000 b/d from the same period in 2024. The company forecasts shale oil output at 215,000 b/d in 2026. Conventional production fell to 90,000 b/d in 2025, a 32pc drop from 2024. Output was down sharply in the final quarter at 68,000 b/d, a 48pc decline from the same period a year prior. Shale gas production reached 23.3mn m³/d in 2025, up by 14pc from the previous year. It averaged 19.5mn m³/d in the fourth quarter, up from 19.3mn m³/d in the same period a year before. The jump in shale production was offset by a decline in conventional production. The drop in conventional production translated into a 3pc overall decline in gas production to 36.2mn m³/d in 2025 and a 14pc decline to 29.6mn m³/d in the fourth quarter. Conventional and tight gas production was 13mn m³/d in 2025, down from 17mn m³/d a year before. The drop was more pronounced in the fourth quarter, with conventional output at 10.1mn m³/d, down from 15mn m³/d in 2024. The pivot toward a full shale company includes the sale or transfers of all conventional assets. YPF has unloaded 45 of the 48 conventional blocks in the first phase of its divestment. It plans to get rid of the rest this year, with 13 blocks in a second phase in the transfer process. YPF will not produce conventional oil or gas in 2027, Marin said, adding that he does not expect an overall increase in production this year. But that would change in 2027 with the completion of new midstream and downstream infrastructure. YPF leads the Vmos consortium that is building a new 430km (260-mile) oil pipeline from the Vaca Muerta unconventional formation to the southern coast. It will start moving 180,000 b/d in the final quarter of 2026, increasing to 555,000 b/d next year and, potentially, 700,000 b/d by 2030. Meanwhile, the Southern Energy consortium is working on a 6mn metric tonne (t)/yr LNG export project that will use two floating LNG vessels. Operated by Argentina's Pan American Energy and Norway's Golar LNG, it will start commercial operation in 2027. YPF and two partners, Italy's Eni and XRG — the investment arm of Abu Dhabi's National Oil Company — are working on a 12mn metric tonne/yr LNG project that will start exports in 2030-2031. By Lucien Chauvin Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

US asks court to allow sale of Venezuela cargo, tanker

US asks court to allow sale of Venezuela cargo, tanker

Washington, 27 February (Argus) — US federal prosecutors are asking a federal court to approve the sale of a tanker seized near the coast of Venezuela in December and the 1.8mn bl cargo of Venezuelan crude it was carrying at the time. The US Coast Guard seized the Skipper on 10 December, as the first step in an operation that eventually resulted in the ouster of Venezuelan president Nicolas Maduro and the US takeover of Venezuelan oil exports. US naval vessels have seized nine other Venezuelan crude-laden tankers since then. The cargo aboard the Skipper is the first to face formal action in the US District Court for the District of Columbia. The US justifies the seizure of the tanker by its association with Iranian oil trade since 2023, even though it was last transporting Venezuelan crude meant to be delivered first to Cuba and then to a destination off the coast of Malaysia. Tankers carrying Venezuelan and Iranian crude frequently use international waters near Malaysia for ship-to-ship transfers to facilitate deliveries to independent refiners in China. The Skipper is currently anchored off the Texas coast, according to the Department of Justice and ship tracking services. The Justice Department emphasized the Iran connection in the court action it is requesting. "This forfeiture complaint for the M/T Skipper and its oil cargo demonstrates the FBI's unwavering commitment to enforcing US sanctions and thwarting hostile regimes who exploit the global oil trade," FBI director Kash Patel said. US courts in recent years approved the sale of Iranian cargoes aboard tankers seized by the US Navy, but the US authorities typically released those tankers to their ultimate owners. The federal court will set a precedent if it approves the sale of the tanker as well. US courts have approved warrants to seize the Skipper and the other nine tankers carrying Venezuelan crude, but it is not clear if the US will ask the courts to sell all of them. The US has been returning tankers seized since Maduro's ouster to ports in Venezuela, US secretary of state Marco Rubio told a Senate panel last month. By Haik Gugarats Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.

Cop 30 presidency opens call for roadmaps

Cop 30 presidency opens call for roadmaps

Sao Paulo, 27 February (Argus) — The UN Cop 30 climate summit's presidency has opened a public call for proposals for its two roadmaps, on ending deforestation and phasing out fossil fuels. The Cop 30 presidency pledged at the summit held in November in Brazil to create the two roadmaps and present them at Cop 31, which will be held in Turkey in November this year, after both topics failed to appear in any of the conference's final texts. Countries and civil society members have until 31 March to answer four questions laid out by the Cop 30 presidency on the two topics: What are the main barriers to achieve deforestation and the fossil fuel phase-out; What are the political, economic and financial levers that would allow the two transitions; What are the examples of countries, regions or sectors that have advanced toward either goal; How to reflect the diversity of countries and national circumstances regarding fossil fuel dependence or the degree of forest conservation. Those who wish to participate in the open call must send their contributions directly to the UN Framework Convention on Climate Change secretariat. The Cop 30 presidency is working on having the technical documents for the roadmaps ready by October. The fossil fuel roadmap will have seven chapters: systemic physical risks, economic and financial risks, institutional and social risks, fossil fuel demand, fossil fuel supply, an economy in transition, and a final chapter of recommendations. The layout of the deforestation roadmap is less clear. Another important step in the drafting of the fossil fuel roadmap will be the global summit planned by Colombia and the Netherlands in April, which will be held in Colombia. Cop 30 president Andre Correa do Lago had previously said that an initial draft of the roadmap could be ready by then . Do Lago has also tapped groups such as the International Energy Agency, Opec+ and the International Renewable Energy Agency to contribute to the roadmap to phase out fossil fuels. The Brazilian government is also working on its own roadmap to phase out fossil fuels, but has not presented it yet. Brazilian president Luiz Inacio Lula da Silva called for a global roadmap on the topic during a global summit days prior to Cop 30 , which brought much momentum to the conversation. Around 80 countries declared their support for the roadmap during Cop 30 . But phasing out fossil fuels could seem to run counter to Brazil's plans to continue to increase crude production. It produces around 4mn b/d of crude, making it one of the 10 largest producers globally, according to its hydrocarbon regulator ANP. Furthermore, Brazil plans to expand crude output to 5.3mn b/d by 2030, according to energy research bureau Epe, hinging on new exploratory frontiers such as the southern Pelotas basin and the environmentally sensitive equatorial margin. By Lucas Parolin Send comments and request more information at feedback@argusmedia.com Copyright © 2026. Argus Media group . All rights reserved.