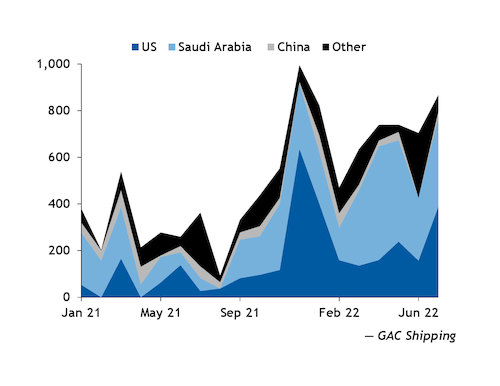

India's petroleum coke imports reached a 2022 high in July of 866,500t, the largest volume since December and more than double the 362,300t received in the same month a year earlier.

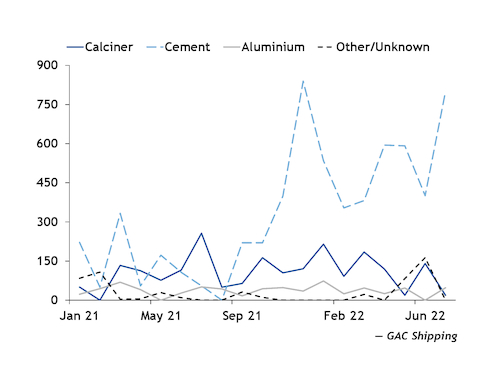

Cement makers received nearly 800,000t of coke during July, also the highest since the end of last year, according to data from GAC Shipping. Indian demand had picked up by early May, when many of the July-arrival cargoes would have been booked.

But the flurry of buying activity was short lived. By the middle of May many cement makers said they had covered their fuel needs as their consumption was below expectations. Discounted Venezuelan coke offers were also beginning to weigh on interest for US and Saudi Arabian supply by mid-May.

Some of the high import total in July could be a result of slower unloading because of monsoon rains and a large amount of coal imports that were given priority at the ports. Argus considers a cargo imported as of the date the ship departs, as this reflects when it would have completed unloading. At least three cargoes that were unloaded in July had arrived at port as early as 20-24 June, and under typical circumstances these would likely have been June imports.

The US overtook Saudi Arabia as the top origin, with 388,400t of imports, followed by 383,200t of Saudi imports.

The US imports were the highest volume since January, when India received 402,000t. India had imported just 27,100t of US coke in July 2021.

Saudi imports were up almost sevenfold from just 55,000t a year earlier, although they were down by 12pc from May and 21pc from April.

Venezuela shipped a 50,200t cargo, while China supplied 25,700t and Kuwait 19,000t.

Only 19,000t of green coke arrived for a calciner in July, down from 256,500t in July 2021. Aluminium smelters received 47,700t of calcined coke.