Turkey's cement production may increase slightly in the first half of this year because of improving exports to key destinations and growing seaborne markets for the material.

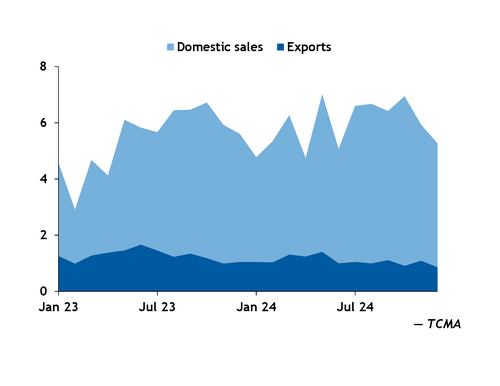

Some market participants expect cement firms in Turkey to produce about 41-43mn t of cement in the first half of this year to support an increase in exports and the potential for some buyers to return to the country's cement market. In contrast, the country produced 40.6mn t in January-June 2024, the latest data from the Turkish Cement Manufacturers' Association (TCMA) show.

Low prices for fuels like petroleum coke and coal are likely to contribute to firm cement output and a rebound in exports after a sharp reduction a year before. The Turkish lira has also continued to weaken against the US dollar since March, which may help offset a decrease in export prices, making exports more profitable for cement makers.

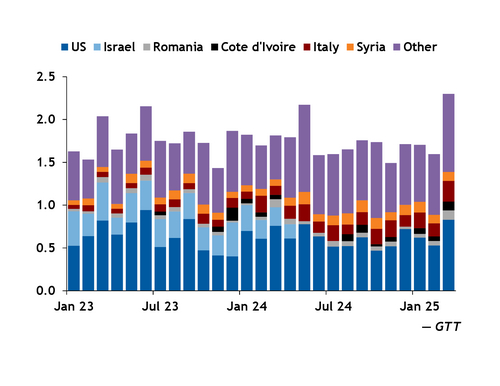

While Turkey's cement exports declined slightly to 3.74mn t in the first quarter from 3.96mn t the same quarter in 2024, sales to markets such as Italy, Syria, Albania, Guyana, Haiti and the UK were on the rise, according to data from Global Trade Tracker (GTT). And it is possible that Ukraine could become a potential destination for Turkey's cement exports, as demand from the country's construction sector may grow sharply on the beginning of talks of an end to Russia's invasion.

Some stabalisation of the conflict in Gaza may also boost trades to the region and could lead to the cancellation of the country's Israel trade ban from April 2024, many market participants said. Turkey's total cement exports fell by 15pc on the year in 2024 to 13mn t following the country's ban on cement sales to Israel, one of its largest consuming markets. The country's cement sales to Israel fell to 926,000t in 2024, down from 3.48mn t in 2023, according to GTT. But limited cement sales to Israel may still happen this year through longer supply chains involving third-party countries, according to some market participants.

Clinker exports also increased to 1.8mn t in the first quarter, up from 1.4mn t a year before, because of high demand from Europe and Africa.

But high interest rates at 46pc and expected inflation rates at 36pc in May could still limit the uptick in Turkey's cement production and sales, as they continue to pressure domestic demand for cement. Uncertainty surrounding government and private spending on construction and infrastructure projects could also contribute to lower domestic cement demand.

Cement production rose by about 6pc on the year in 2024 to 84.8mn t, while clinker production picked up by 6pc to 77.53mn t, according to TCMA. Total domestic sales for these materials grew by 9pc year on year in 2024 to 71mn t because of rebuilding in the southern regions after two major earthquakes struck Turkey in February 2023.