Gas prices in central and eastern Europe have become increasingly disconnected from each other and their more liquid counterparts in northwest Europe, as diverging supply dynamics have driven changes in regional flows.

Hungarian prices — which traditionally hold premiums to Austrian prices to attract spot gas — began flipping to a discount on 11 September and have maintained an average discount of €1.12/MWh for the past seven sessions. With full storages and relatively muted consumption, Hungary no longer required spot imports, so Hungarian buyers instead chose to maximise imports from Romania and Serbia.

Less than 1 GWh/d flowed from Austria to Hungary on 19-25 September, down sharply from 81 GWh/d in August and 141 GWh/d in July. During that same period, receipts from Serbia and Romania averaged 244 GWh/d and 73 GWh/d, respectively, both just under maximum capacity.

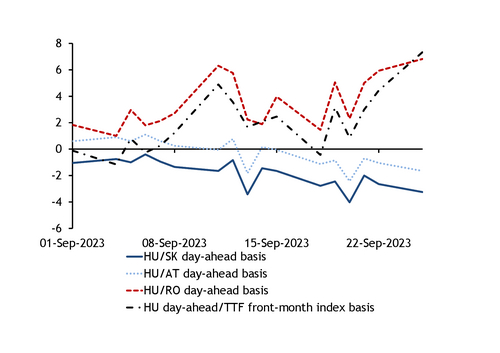

Argus' Romanian day-ahead price on average closed €6.36/MWh below its Austrian counterpart on 19-25 September, incentivising Hungarian buyers to prioritise imports from Romania over Austria (see basis graph). Romanian prices have frequently diverged from surrounding markets in recent months, as the country produces significantly more gas than it consumes in the summer months and weak domestic demand this year meant storages filled quickly.

Capacity at Csanadpalota is due to increase by roughly 5 GWh/d from 1 October. And brisk flows towards Hungary appear likely to continue, as 99pc of capacity at the point is booked until October 2024 and significant discounts to competing sources such as Austria could continue. That said, Romanian fertiliser producer Azomures plans to increase output, which would increase domestic gas demand and support prices. The plant consumes roughly 1bn m³/yr at full capacity and the company plans to raise output to 50pc of capacity next month.

Hungarian receipts from Serbia are driven by different factors including imports of Azeri gas, as well as Russian imports, which are predominantly linked to the TTF front-month index. The Hungarian day-ahead price held an average premium of €3.76/MWh to last month's TTF front-month index settlement on 19-25 September, giving a strong incentive to maximise Russian imports. And delivery of 50mn m³ of Azeri gas for injections in Hungary has also boosted deliveries from Serbia. Hungarian state-owned utility MVM in June agreed to import 100mn m³ of Azeri gas in October-December this year, meaning strong inflows from Serbia could continue. Supporting this, capacity at Kiskundorozsma 2 is fully booked for October, as it was for September.

Slovakia maintains premium

While Hungarian prices have flipped to a discount to Austria, Slovakian prompt prices still hold a noticeable premium, leading to significant regional spreads.

Hungarian day-ahead prices held a significant €2.88/MWh discount to Slovakia on 19-25 September (see basis graph), encouraging outflows of 39 GWh/d, using most of the 51 GWh/d technical capacity at Balassagyarmat. Slovakian day-ahead prices have maintained large premiums to Austria despite nearly full storages and weak demand, suggesting its prices are driven more by trading.

Exports towards Ukraine from Slovakia have continued at a high level in September but this could change next month, judging by current capacity bookings. While 185 GWh/d of exit capacity from Slovakia at Budince was booked for September, just 5 GWh/d is booked for October and nothing was booked at Velke Kapusany for virtual backhaul. Traders can still book these capacities on a more prompt basis, but the latest capacity bookings still suggest that exports could fall next month, particularly as state-owned Ukrainian supplier Naftogaz said it has already reached its storage target and does not plan to import gas in winter. Naftogaz has accounted for the large majority of trading activity on the Slovakian VTP in recent months, as it built stocks ahead of winter.

Conversely, 70 GWh/d of capacity towards Ukraine at Hungary's VIP Bereg was booked for October at auctions last week, which could allow outflows from Hungary to remain strong next month. This suggests that Hungarian buyers are relatively confident they will have supply to export in October, particularly as consumption remains weak and storages full.

Separately, 22 GWh/d of interruptible capacity from Romania to Ukraine at Isaccea 1 was booked this morning at auction, which could relate to Moldovan state-owned supplier Energocom booking capacity to import and store supply secured from Greek seller Depa. Flows from Romania to Ukraine have already stepped up in recent days, rising to 68 GWh/d on 22-25 September from 40 GWh/d earlier in the month.