What has happened?

On 15 November, the European Court of Justice (ECJ) suspended the UK's capacity market on procedural grounds. The UK is working to secure state aid approval for a T-1 auction that will cover 2019-20, and it is trying to reinstate the full capacity market regime. But in the meantime, current contracts are suspended and payments are halted.

Will plants close?

Maybe, but this is unlikely in the short term. The most vulnerable are coal-fired plants, which have been pushed to the margins by carbon costs and are no longer running as base-load generation. They now only run for short periods at times of high demand, which may not be enough to cover their costs.

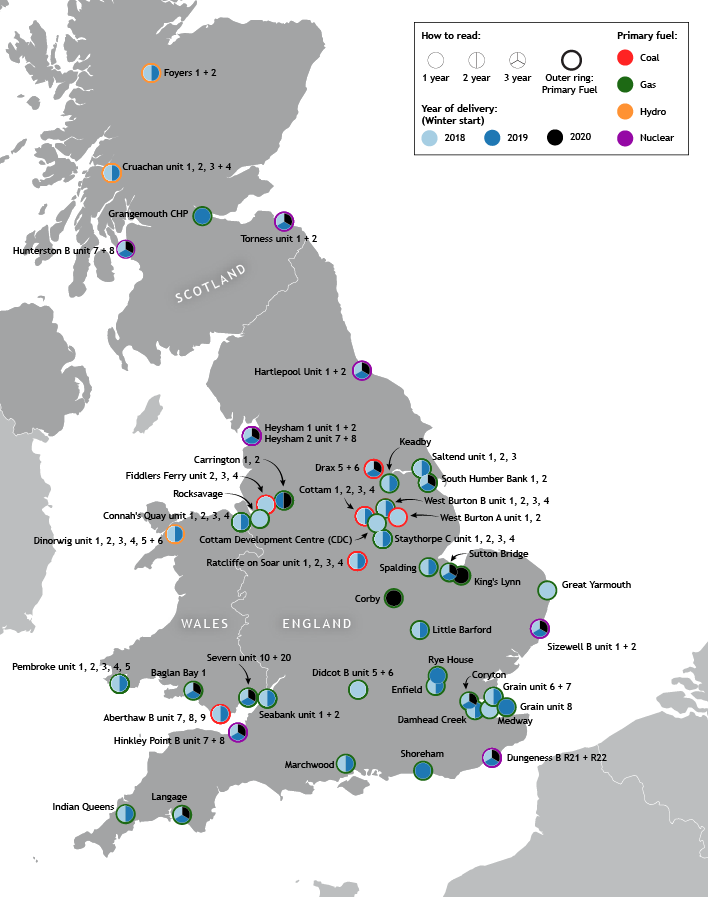

Base-load carbon tax-adjusted clean dark spreads for the first quarter 2019 are currently at £9.10/MWh for a 36pc-efficient coal-fired plant, which is a strong incentive to stay on line for the rest of this winter. But without capacity payments, several older coal-fired plants with relatively low efficiencies are likely to find it unprofitable to operate beyond this winter. Coal-fired plants with capacity contracts for winter 2019 include the four Ratcliffe-on-Soar units, the four Cottam units, Drax 5 and 6, and Aberthaw B's units 7, 8, and 9. Of these, only Drax 5 and 6 have contracts for winter 2020.

What does this mean for the wholesale market?

Generating power for the wholesale and ancillary markets is the only income stream for power plants, while capacity payments are frozen. They need to recoup all operating costs through the wholesale market, rather than receiving a guaranteed minimum income through capacity payments.

This could mean higher wholesale prices and stronger price spikes at times of high demand as the most marginal plants that run for only a small number of hours seek higher prices to cover the missing capacity market income.

UK system prices are already expected to be more volatile this winter because of changes to cash-out arrangements. The ECJ capacity ruling may exacerbate this further.

Does this have an impact on other power markets?

The UK already imports from France and the Netherlands at times of peak demand in winter. A new interconnector with Belgium will begin commissioning later this month and be launched commercially in the first quarter of next year. In theory, the UK can use this to import more power. But Belgium has its own supply problems owing to several long-term nuclear outages and currently Belgian prices are at a premium to the UK, suggesting the UK would instead export power to Belgium. There are also interconnectors to the single Irish electricity market, but demand here tends to peak at exactly the same time as in the UK market, and the UK is often a net exporter.

Could payments restart soon?

Possibly. The government is looking urgently at the ruling and says it is confident that security of supply will be unaffected. The ruling suspends the capacity market on procedural grounds only — it has not ruled against the concept of capacity payments. The case at the ECJ was brought by Tempus Energy, which specialises in demand-side technologies. The ECJ ruling annuls the European Commission's decision in 2014 not to object to the capacity market on the basis that the commission should have extended its analysis of the scheme and not simply relied on the information provided by the UK government. The ruling said "It can and, where necessary, must seek relevant information so that, when it adopts the contested decision, it has at its disposal assessment factors that can reasonably be considered to be sufficient and clear for the purposes of its assessment." The commission's initial investigation lasted only a month despite the capacity market being "significant, complex and novel". "The commission simply requested and reproduced the information submitted by the relevant member state without carrying out its own analysis," the ECJ said.

What about plants under construction?

Some plants and batteries under construction could be put on hold until there is more clarity. But holders of capacity contracts face fines if they fail to make their plants available at the start of their contract period, meaning that if the scheme is restored shortly, they will need to make sure the projects are completed on time.

What is the impact on household bills?

Households pay for the capacity mechanism through a levy on their bills. With the capacity mechanism suspended, this levy can be removed from household bills. But wholesale prices may well be higher overall as a result of the halt to the capacity mechanism, so this may offset the removal of the levy. The total amount of payments allocated in the capacity market auctions that have taken place is £5.6bn.

Does this mean more batteries and demand-side technologies will be built?

Maybe. Tempus Energy said the capacity market did not allow new technologies — including demand-side response and batteries — to compete with established fossil fuel-fired generation. But in the short term, it means that battery developers which were expecting capacity market payments face a freeze in their income, which may prevent them from completing their projects. And the suspension of the next auction means that potential projects face delays in securing finance.