Production has risen in recent years, but increased domestic consumption has absorbed more of the offtake

Algeria's state-owned Sonatrach may have limited scope to ramp up pipeline gas and LNG exports substantially in the coming years, if rising domestic consumption largely offsets a potential increase in production.

The firm's aggregate LNG and pipeline gas exports fell in 2018 from a year earlier as domestic demand increased. Aggregate LNG and gas exports were 137,126t of oil equivalent/d (toe/d) last year (165mn m³/d of gas), down from 145,602 toe/d (175mn m³/d) in 2017. In contrast, Sonatrach's sales to the domestic market rose to 120mn m³/d from 113mn m³/d.

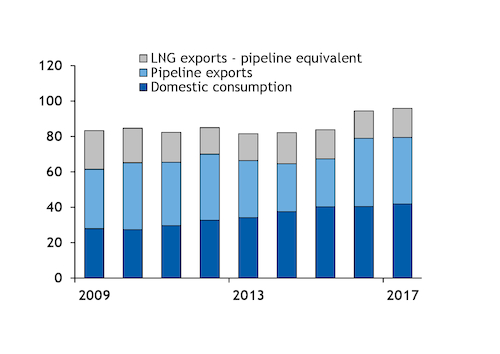

Algerian production has increased in recent years — although output data for the full year 2018 are not yet available — and Sonatrach plans to further ramp up offtake. But higher domestic consumption in recent years has absorbed more supply as Algeria's grid has expanded and new gas-fired power plants have been installed, leaving less supply available for exports.

Aggregate commercial production rose to 96.6bn m³ in 2017, from 95bn m³ a year earlier. But most of the additional output was absorbed by the domestic market, with only a minimal year-on-year increase in exports.

And Algeria plans to further develop its domestic market, connecting additional customers to the grid and installing new gas-fired generation capacity. New plants that are to be brought on line could increase gas-fired generation capacity to 24.4GW from 15.5GW at the end of 2017, the government says.

Algerian state-owned utility Sonelgaz has reached only 57pc of potential gas customers, the government said last year, providing ample scope to expand the grid and connect additional customers.

Power sector gas burn was 18.5bn m³ in 2017, the latest full-year data available, accounting for almost half of Algeria's aggregate consumption of 41.8bn m³. Households and the service sector consumed a combined 9.7bn m³. Most of the gas left available for export is sold to Europe, which imported around 70pc of aggregate Algerian gas exported in 2017.

Italy and Spain are the largest importers of Algerian supply. Italy received 23pc of aggregate gas and LNG exported by Algeria in 2017, and Spain 16pc. Italy receives Algerian gas through the Transmed pipeline, while supply is delivered to Spain through the Maghreb-Europe and Medgaz pipelines.

| Sonatrach export and domestic sales | ||||||

| 4Q18 | 3Q18 | Total 2018 | 4Q17 | 3Q17 | Total 2017 | |

| Export | ||||||

| Pipeline - mn m³/d | 106 | 88 | 105 | 124 | 76 | 104 |

| GNL - '000m³ | 9,915 | 3,632 | 24,924 | 3,347 | 6,655 | 22,922 |

| Domestic sales - mn m³/d | ||||||

| 123 | 102 | 120 | 126 | 101 | 113 | |

| — Sonatrach | ||||||