Paragraph 2 corrected, see 'European 0.5pc fuel oil in demand in Asia-Pacific' article published on 21 June 2019

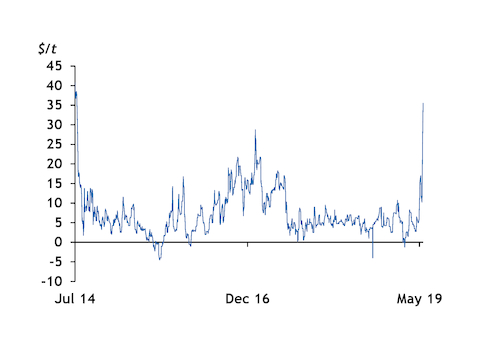

Low-sulphur fuel oil (LSFO) cargo swaps in northwest Europe yesterday traded at their widest premium to high-sulphur fuel oil (HSFO) barge swaps since July 2014. Values were close to recent 0.5pc sulphur trade levels, potentially signalling a pricing shift ahead of the implementation of the sulphur cap on shipping emissions.

LSFO front month cargo swaps — with a 1pc maximum sulphur content — traded at $435/t at 16:30 BST (15:30 GMT) yesterday, a $35.50/t premium to high-sulphur barges. In comparison, shipping company Euronav bid around a $30-40/t premium to to low-sulphur west Mediterranean cargoes to secure 0.5pc fuel oil for floating storage off Malta, market participants told Argus.

LSFO cargo swaps prices typically move in line with HSFO swap owing to lower demand for the former, since only power plants in European islands such as Cyprus and Malta burn 1pc fuel oil.

But both prices recently started diverging, likely because of changing market fundamentals ahead of the implementation of the International Maritime Organisation's (IMO) sulphur cap on 1 January 2020. And the wider premium recorded this week, could signal low-sulphur fuel oil (LSFO) cargo swaps include a higher proportion of product with a lower sulphur content, as market participants transitions to very low sulphur fuel in preparation for the IMO cap.

Under the new IMO regulation, vessels must limit sulphur emissions in exhaust fumes to 0.5pc, down from a current maximum of 3.5pc. Shipowners will either have to burn new 0.5pc sulphur fuel oil blends, use marine gasoil (MGO) or run LNG to comply. They can also fit ships with exhaust scrubbers to continue to burn high-sulphur fuel oil.

Euronav started storing IMO compliant fuels and blending products in its 443,000t ultra large crude carrier (ULCC) Oceania off Malta, as part of its strategy for the sulphur cap. The company already purchased at least five 30,000t cargoes of very low sulphur fuel.

The Argus calculated assessment of 0.5pc Rotterdam barges reached 590.50/t yesterday.

Meanwhile, a well-supplied high-sulphur market owing to rising Russian Baltic exports weighed on Rotterdam barges prices and also contributed to widen the HSFO discount to LSFO.

High-sulphur fuel oil cracks against Ice July Brent hovered around their weakest levels since October recently, reaching a discount of $10.11/bl yesterday, on weaker demand for exports to the Asia-Pacific region.

Sulphur content of marine fuels will drop to 0.5pc globally in 2020, from 3.5pc today.