South Korean thermal coal imports rose on the year in December, despite capacity restrictions at coal-fired plants that aim to reduce fine dust emissions.

South Korean imports rose by 10pc, or nearly 900,000t, on the year to 9.7mn t in December, according to customs data, while LNG receipts rose by 1.4pc to 4.8mn t.

The increase came despite a likely fall in coal burn following coal-fired unit closures. The government's winter shutdown policy — confirmed in November — may have given utilities too little notice to revise down their import profiles.

Imports might also have been driven by restocking. The forward curve for NAR 6,000 kcal/kg fob Newcastle swaps traded on the Ice exchange was in contango in November-December, creating incentive to store coal procured at spot levels in order to defer future purchases at potentially higher prices.

Coal-fired plant restrictions will remain in January-February and potentially tighten from March, painting a weak picture for power-sector coal demand, which should weigh on winter seaborne receipts. The government will in February announce plans for constraints in March — last year's restrictions were most severe in spring, with coal burn as low as 20.1GW in April.

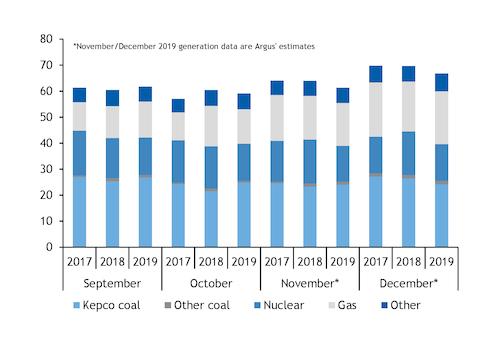

South Korean coal burn weakens

State-controlled Kepco shut 3.5GW of capacity at seven of its 58 units for all of December. A further six were shut for shorter periods, reducing operational coal-fired capacity to 29.8GW from a maximum 34.9GW.

Actual availability may have been as low as 22.7GW on some days, as winter restriction can limit a unit's output to 80pc of capacity. Kepco's coal-fired generation was 26.5GW in December 2018, with the private-sector adding 1.4GW.

December generation data will not be released until February, but there are signs that December's drop might have been modest — down by 1.5-2.2GW, or 440,000-650,000t of 5,700 kcal/kg coal burn, to as little as 7.4mn t.

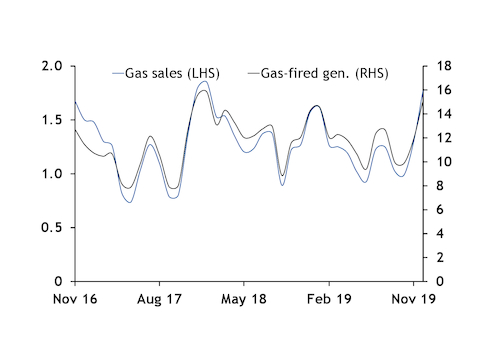

State-run supplier Kogas reported sales to the power sector of 1.77mn t last month, up from 1.57mn t in December 2018, implying overall gas-fired generation of 20.3GW, based on the historic correlation between Kogas sales and national gas burn. This would be up from 19.2GW in December 2018.

Nuclear availability was 14.1GW last month, according to Korea Hydro and Nuclear Power maintenance schedules. Argus estimates that South Korean power demand fell by 4pc on the year to 66.8GW in December, based on a 1.9GW drop in daily peak demand.

This implies a balance of 32.4GW, and coal is likely to have accounted for most of this. Output from hydro, renewables and other fossil fuels totalled 6GW in December 2018 and is likely to have grown only slightly on the year last month.

Coal burn may therefore have fallen to as low as 25.6GW last month, down from 27.8GW in December 2018, with Kepco utilities accounting for 24.2GW, assuming unchanged private-sector burn. This suggests Kepco utilities ran its units at an 81.3pc load, broadly in line with Seoul's aim to limit output to 80pc as often as possible.

This figure may be lower however depending on the actual output from gas, nuclear and other sources. Gas-fired power generation may be underestimated by looking only at Kogas' December sales if state utilities and private-sector generators opted to import more LNG directly themselves. But weak LNG imports in September-November and only a small increase in December receipts suggest soft gas demand at the end of last year.

Ten Kepco coal-fired units have been offline this molnth, including eight that are expected to be shut for at least the whole of January, although capacity is poised to recover slightly to 30.7GW across the month. If utilities ran at 81pc, this would imply output of 24.9GW, down from 27.4GW in January 2019. Power-sector consumption may therefore fall by 740,000t of 5,700 kcal/kg material to 7.6mn t.

Australian exports strong in 2019

Greater imports of Australian and Russian coal drove December's increase in seaborne receipts. Imports from Australia rose by 80pc on the year to 4.3mn t, while receipts from Russia climbed by 61pc to 2mn t.

Supply from elsewhere was steady or lower, with Indonesian imports falling by 24pc to 2.5mn t and South African and US recipts falling to zero, from 522,000t and 109,000t, respectively.

Australian suppliers enjoyed a strong year, with 2019 deliveries up by 6.9mn t to a four-year high of 40.5mn t, boosting Australia's share of imports by seven percentage points to 36.3pc.

But this was offset by lower imports from other countries, with South Korea's overall 2019 receipts falling by 4.3mn t to a three-year low of 111.5mn t. Indonesian deliveries fell by 6.5mn t to at least an eight-year low of 30.9mn t and South African volumes fell by 3.5mn t to 3.9mn t.

By Jake Horslen