The likelihood of LPG prices bouncing back as Chinese restrictions are lifted and Indian demand rises is being reduced by the battle for oil market shareThe likelihood of LPG prices bouncing back as Chinese restrictions are lifted and Indian demand rises is being reduced by the battle for oil market share

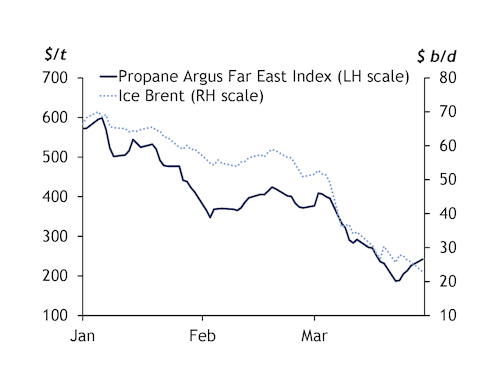

The convergence of an impending supply glut and decimated demand as a result of the coronavirus outbreak pummelled Asia-Pacific LPG prices in late March.

The prospect of regional LPG prices rebounding as consumption turns a corner, with civic and industrial activity picking up in China and government support for consumers in India, is being dimmed by continuing competition for market share by oil producers.

Asia-Pacific LPG prices fell to record lows on 23 March. The propane Argus Far East Index settled at $187/t, the lowest level since the index was launched in 2001, and down by 67pc from $571.75/t at the start of this year.

The regional demand outlook in 2020 has been shaped by the slowdown in China, the world's largest LPG market. Use in China has been hit by government-enforced lockdowns to try to stem the coronavirus outbreak. Delivered prices to China fell sharply as a result — the propane Argus South China Index hit $207/t on 23 March, down from $607/t on 2 January.

Residential use of LPG in China was traditionally the largest demand source, but this has begun to slip in recent years. It took a 48pc share in 2018, down from 52pc in 2016, while industrial and petrochemicals demand rose to 49pc from 44pc, state-owned refiner Sinopec says. Residential LPG sales were only at 60-70pc of normal levels at the end of March, but are likely to increase to 80c by late April, market participants say. Any recovery in sales will be dampened by the market entering the summer low-demand season.

Central China's Hubei province said it would remove all travel bans from 25 March. The capital, Wuhan — where the outbreak originated — will lift curbs on 8 April. Other provinces have also lowered their emergency levels.

The second-largest importer in Asia-Pacific, India, started a 21-day lockdown on 25 March to prevent the spread of the coronavirus. But this could boost consumption, with residential use for cooking the dominant form of demand, while the government will offer three free refills to those under the PMUY scheme.

The slump in LPG prices is expected to hit the revenues of India's state-controlled refiners, but state finances will benefit from lower import prices. These may rise as oil products demand in India slides owing to the lockdown, forcing refiners to reduce operational rates as storage tanks fill. This would limit the supply of domestic LPG.

Unilateral thinking

The global supply outlook for LPG is likely to be defined by geopolitics rather than market fundamentals in the coming months. Diplomatic efforts by the US over the week to 27 March to prod Saudi Arabia into resuming its and Opec's role of supply management are uncertain of success, especially without the involvement of major non-Opec oil producers such as Russia. And many signatories to the old Opec+ deal will be eyeing the opportunity to accrue larger market shares.

But the oil price slump has already started to impact US LPG exports. As many as five cargoes loading in late April were either cancelled or deferred by term lifters, market participants say — others estimate that eight cargoes could be cancelled or deferred this month. It is unclear if all the cargoes were destined for Asia-Pacific, but buyers targeting sales to the region are expected to cancel or defer US liftings if their profit from the trade falls below cancellation fees, traders in Asia-Pacific say.