Penultimate sentence clarifies Naftogaz sources of supply

Ukraine's state-owned supplier Naftogaz is importing minimal amounts of gas, given its high end-of-winter stocks, chief executive Andriy Kobolev said.

The firm believes it has sufficient stocks to cover demand for the upcoming winter, he said. It is only importing when it can sell gas immediately, but the Ukrainian market is "full to overflowing", and this is unlikely to change, Kobolev said.

The company imported about 450,000 m³/d on 1-20 April, barely more than 1pc of aggregate Ukrainian imports of 36.7mn m³/d. Aggregate imports were much higher than the 29.3mn m³/d last April, but the firm's share of these deliveries has probably fallen from last year, when it was responsible for the majority of net injections.

The firm's take was also well below the 5.7mn m³/d it imported in the first quarter to fulfil contractual obligations struck to mitigate uncertainty around its access to supply before a new, five-year transit deal involving Russia's state-controlled Gazprom was reached in late December. Ukraine imports most of its gas at border points adjacent to those where European customers receive Russian supply having transited Ukraine, some of which rely on transit flows to provide the pressure and supply necessary to redirect flows towards Ukraine. Continuation of Gazprom transit under the new deal helped Ukrainian importers maintain quick deliveries in the first quarter, and in turn call less on withdrawals.

Naftogaz earlier said it expects net drawdown from its stocks this calendar year.

But the firm may have an even greater need to call upon its carried over stocks this winter than expected, if it does not ramp up imports. A recent change in Ukrainian government policy prolonged the firm's public supply obligation (PSO). Naftogaz is now obliged to continue to supply households until 1 July and local distribution companies responsible for heating until 1 May 2021 under regulated prices.

Naftogaz supplied about 8bn m³ to households and around 7.4bn m³ to local heating companies under the PSO regime last year, which was about 51.5pc of aggregate Ukrainian demand of 29.9bn m³. The end of these obligations would have opened the sector up to competition and may have reduced Naftogaz's share of the market.

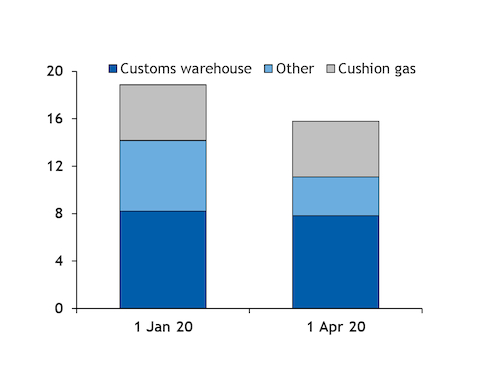

Around 6bn m³ was held in Ukrainian storage on 1 January other than through the customs-free programme, which allows firms to either sell locally or re-export to Europe, and other than as cushion gas (see graph). Much of this may have been owned by Naftogaz and stored to meet its PSO obligations. Storage movements and customs data may indicate that this figure fell to around 3.27bn m³ on 1 April, when total stocks including cushion gas were 15.8bn m³. This may indicate that Naftogaz is holding gas under the customs-free warehouse programme that it may need to clear to supply locally in support of PSO obligations, given that the firm has sufficient gas in storage — along with access to its production — to meet demand until the end of winter.

Aggregate Ukrainian stocks were 16.4bn m³ on 26 April.