Spanish gas-fired power generation in April fell by nearly 40pc year on year as a 19-year record low in electricity demand due to the Covid-19 pandemic, combined with higher renewables output, pushed spot gas margins to the first negative monthly average in two years.

Combined-cycle gas turbine (CCGT) output reached 1.63TWh, or a 2.27GW hourly average, in April, down from 3.93GW in the same month last year, provisional data from power grid operator REE show.

This was despite significant year-on-year output drops in nuclear and wind, the two biggest technologies in the Spanish mix. Nuclear generation dropped by 11.3pc to 5.69GW, while wind output moved down by 20.1pc to 5.1GW. Coal-fired generation plunged by 54.2pc to only 460MW and net power imports reached just 333MW, down by 78pc on the year.

A sharp reduction in Spain's electricity consumption combined with stronger hydropower and solar photovoltaic (PV) output to weigh on thermal generation in the month, particularly CCGT. Hydro generation rose by 49.2pc to nearly 4GW, while solar PV output spiked by 74pc to 1.61GW.

Electricity demand in mainland Spain moved down by 17pc to 22.49GW, the lowest for any month since April 2001, at 21.57GW.

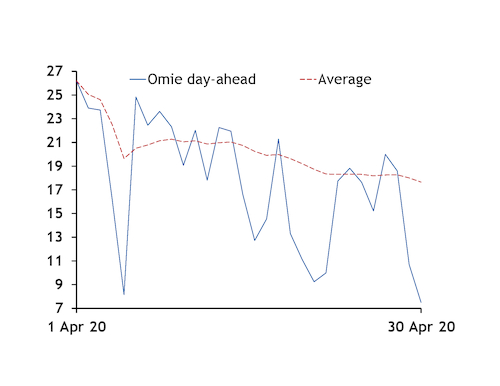

Omie day-ahead prices averaged €17.65/MWh in April, the second-lowest monthly average since the joint Mibel Iberian wholesale electricity market fully launched in July 2007, only behind €17.12/MWh in February 2014. Prices averaged €27.74/MWh in March, making it the lowest monthly average since May 2016.

Delivery prices were €2.15/MWh below April's expiry price of €19.80/MWh on 31 March, which was the lowest of any front month since Argus started assessing the contract in February 2003. The contract was seen changing hands at prices of as low as €19.50/MWh on 31 March.

Average settlement prices were in line with April's expiry until 20 April, moving down especially in the last days of the month amid a pick-up in Spanish wind power output (see Omie day-ahead chart).

But a stronger-than-anticipated recovery in hydropower reserves also pressured day-ahead prices in the Iberian market. Hydro stocks rose by an accumulated 6.9 percentage points from the end of March until the week ending on 26 April, when they reached 66.6pc of capacity, the highest in almost two years, according to the latest available data.

Strong rainfall supported inflows to reservoirs, especially across the Duero river system in the northwest and Ebro basin in the northeast. At the end of March, Zamora, part of the Duero, was expected to record 52mm of rainfall in April but ended up receiving 90mm — double the 45mm seasonal norm. Rainfall was also forecast at 74mm in Tortosa, in the Ebro, but actual figures reached 109mm, considerably above the historical average of 46mm.

Hydro operators entered the day-ahead market in high volumes over the past two weeks, due in part to strong run-of-river generation, although most Spanish capacity is made of reservoirs. With reserves at high levels and prospects of further increases amid persistent strong precipitation, reservoir operators needed to offer at low prices to enter the day-ahead mix, displacing fossil-fuel units.

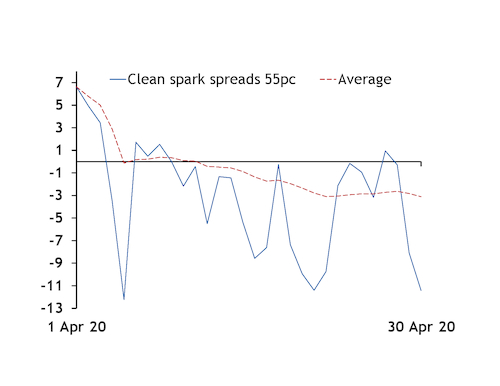

Day-ahead clean spark spreads for a 55pc-efficient plant averaged minus €3.11/MWh in April, the first negative monthly average since April 2018 at minus €0.26/MWh. The figures are based on Omie day-ahead power prices, PVB prices on the Mibgas exchange and Argus assessments of API 2 coal swaps and EU emissions trading system allowances (see Spanish day-ahead chart).

Renewables generation — chiefly wind and solar — was the main technology setting day-ahead hourly prices on Omie last month, at about 47pc of all hours. This was up from 31.5pc in March and the highest share since at least January 2017. Hydro, excluding pumped storage, set the prices for almost 42pc of the hours.

CCGTs set the price for only 9pc of all hours in April, down from a 12pc share in March and the lowest share since December 2018 at 4.1pc.

The front-month clean spark spread for a 55pc efficiency closed at as low as €1.03/MWh on 26 March and expired at €1.21/MWh on 31 March, according to Argus calculations. For May, clean spark spreads were seen as low as €2.05/MWh on 22 April and expired at €3.13/MWh, suggesting another weak month for CCGTs.