Lower European wood pellet prices and higher raw material costs have eroded Portuguese wood pellet production margins, with some entering negative territory in recent months. But Spain's growing wood pellet heating market could provide support.

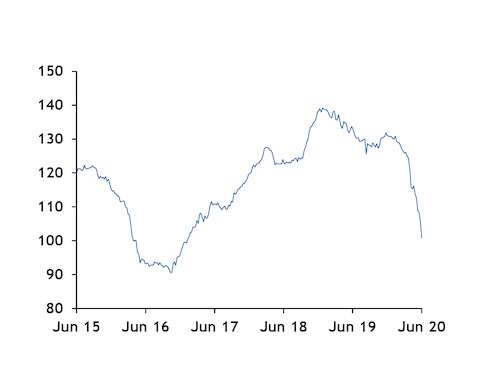

Intra-Iberian wood pellet trade grew significantly in the second half of 2019, but European industrial wood pellet demand has waned in recent months, triggering a sharp drop in prices. The Argus-assessed fob Portugal industrial wood pellet spot price fell to €100.81/t on 24 June, down by 24pc from 26 June 2019 and its lowest since February 2017. Industrial spot prices are much lower than breakeven costs for several Portuguese producers and those without long-term contracts will probably halt production until prices recover.

Meanwhile, raw material costs have risen in recent months. Covid-19 has hampered harvesting in Iberia and the Baltic states — two key regions for sourcing wood pellet raw materials — as lower timber demand has prompted sawmills to shut or cut production.

"[Portuguese] producers can't go on like this for much longer, [they] need to find an alternative [destination] for their pellets or lower production capacity," Spanish renewables developer Forestalia's director, Javier Villalta, said.

"Raw material prices have declined in the past couple of weeks, but are not falling anywhere near as fast as the cost of pellets," Portuguese producer BSL's director, Jaime Reis, said.

Support for Portugal's producers could be found in the gap between Spain's growing demand for residential-grade pellets and this year's expected decline in Spanish production.

Spain's wood pellet consumption rose to around 650,000t last year from 573,000t in 2018.

And while Covid-19 has slowed the installation of new boilers and pellet stoves, according to Spanish biomass association Avebiom, the outbreak is also likely to drag down Spanish pellet production to 650,000t in 2020 from 712,000t last year, before output climbs to 900,000t in 2022. The supply gap will probably be filled with imports from Portugal.

"[The partnership] does depend on winter conditions, but I think Spanish demand and Portuguese production are a good fit," German utility Uniper's biomass sourcing manager, Jan Groeneveld, said.

This is echoed by Danish trading firm Copenhagen Merchants' chief operations officer, Michael Christensen: "Trade will continue to rise between [Spain and Portugal], that's for certain... Spanish appetite is growing."

There is still a market for Portuguese pellets in northern Europe, given its proximity and the 3-4 day sea voyage, Groeneveld added.

But challenging industrial conditions suggest Portuguese production could increasingly be absorbed by Europe's growing residential markets.

"Going forward, I think we will see the triangle of Spain, Portugal and France as its own premium market. Very little from Portugal will be exported [outside of] this," Christensen said.

French residential demand could offer a spur from the intra-Iberian market. France imported a record 403,000t of pellets in 2019, up from 274,000t in 2018, while its production of EN plus-certified pellets was steady at 620,000t. There are 13 active EN plus-certified production plants in France.

Tough competition could limit Portuguese producers' opportunities in France to the domestic market in the south.

"There might be some opportunities in southern and southwestern France, but there is strong competition from Belgian, French and German pellet producers in northern and eastern France," Groeneveld said.