Slower domestic production could boost China's LNG demand in the fourth quarter, leaving LNG import growth stronger than a year earlier and so far this year, despite a potential rebound in pipeline gas deliveries.

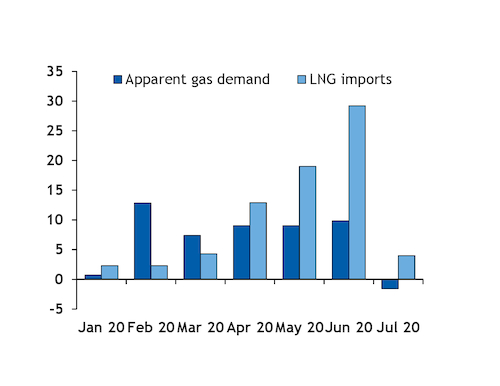

China's LNG demand has held strong so far this year despite the Covid-19 pandemic weighing on the country's gas demand. LNG imports grew by 10.5pc on average year on year in January-July, the latest available official data show, while apparent gas demand grew by 6.8pc over the same period. LNG imports could have also risen significantly in August from a year earlier, with preliminary ship-tracking data suggesting a year-on-year growth of around 20pc. Apparent demand grew by almost 7pc on the year in August.

Slower domestic production could lead to China's LNG receipts growing quicker in the fourth quarter than in recent months and in October-December 2019, when imports grew by 3pc on the year. But year-on-year growth may not surpass the 29.2pc high reached in June.

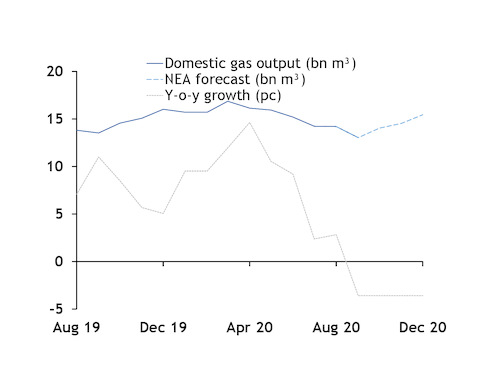

China's National Energy Administration (NEA) issued a report in June forecasting a 4.6pc increase in output this year from 2019, despite production already rising by 11.7pc in January-May. Production growth slowed to 2.4pc in July and 2.8pc in August. But output would have to fall by 3.6pc on average in September-December to reach the NEA's target, which could support LNG demand.

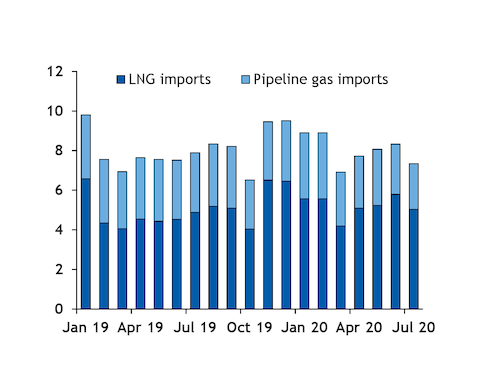

LNG imports could grow sharply on the year in the fourth quarter even assuming a smaller downturn in domestic production than in the NEA's forecast. Production growth stabilising at around 3pc would leave LNG imports at around 20mn t in the fourth quarter, almost 20pc higher on the year, assuming year-on-year demand growth in line with recent months at 7pc. This would also account for an increase in deliveries of pipeline gas, after sharp falls in oil prices earlier this year incentivised Chinese buyers to turn down volumes. Pipeline deliveries from central Asia and Myanmar could rebound to levels in line with 2019 volumes by the end of the year, while deliveries through Russia's new Power of Siberia pipeline, which started to deliver gas to China last December, could total around 5bn m³, as scheduled.

A weaker economic recovery following the coronavirus outbreak, a new wave of infections or unseasonably mild weather early this winter could weigh on China's import demand and reduce the need for additional LNG imports. But apparent gas demand growing by only 3pc on the year in the fourth quarter would leave LNG imports at almost 18mn t, around 4.5pc higher on the year and quicker than the year-on-year growth in October-December 2019.