The road to net-zero emissions will be an arduous one, with Biden proposing tough measures on industry for a greener future, writes Chris Knight

Achieving US "energy dominance" was easy. President Donald Trump approved a handful of pipelines, relaxed environmental rules and then largely stepped aside as oil and gas production continued on an upward trajectory. Hard choices were few and far between, since the goal was to give industry what it wanted. In instances with trade-offs, such as imposing steel import tariffs or trade wars, the oil sector prevailed in spite of Trump.

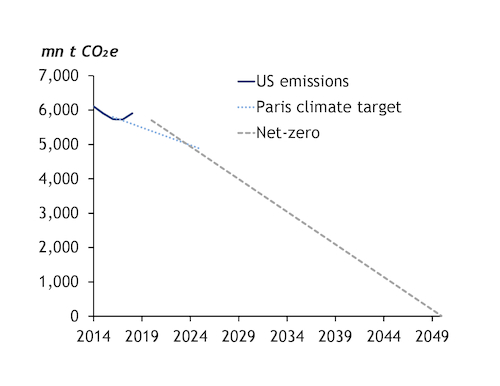

Nothing will be easy about Democratic presidential candidate Joe Biden's goal to put the US on a path to net-zero carbon emissions by 2050. His plan envisions a rapid switch to an electric vehicle fleet, banning new drilling permits on federal land and waters, reinstating climate regulations and spending $2 trillion on a transition to cleaner energy. Biden cites a motivation to address climate-fuelled wildfires and hurricanes. "If [Trump] gets a second term, these hellish events will continue to become more common, more devastating and more deadly," he says.

For Biden to succeed, it will require saying no to countless projects in states where the economic benefits are sorely needed. It will mean being attacked for every gasoline price jump or power outage, no matter the cause. Consumers may have to shoulder more of the costs of the externalities of the energy they use. It will require action from a dysfunctional Congress that since 2013 has tried — and failed — to enact a modest energy efficiency bill. All of this would need to begin as the US struggles to come out of recession and control Covid-19.

Cancel culture

Herculean efforts to achieve net-zero emissions make little sense if the government is also opening up vast areas for drilling at prices as low as $2/acre ($500/km²). That is the thinking, at least, behind Biden's vow to ban "new oil and gas permitting" and leasing on federal land and offshore waters. Although Congress requires some land to be available to industry, Biden could impose a de facto ban with endless reviews and slow-walking of permits. Such a policy, enforced strictly, could eat away at federal oil output that stood at 2.7mn b/d last year, about a fifth of total US production. It would also stymie plans for drilling in Alaska's Arctic National Wildlife Refuge.

But while Biden says he will block all drilling on federal land, his campaign's focus on blocking permitting suggests the oil sector can take those comments seriously, but not literally. A moderate interpretation of his "ban" could let firms exhaust permits they already hold, which certain operators say could sustain some drilling for four years. That would offer time to shift investment to private land, although this path would not be available offshore, where most areas are federal.

At risk of cancellation is the 830,000 b/d Keystone XL pipeline, which is just beginning construction and still lacking key permits after Trump's fast-tracked approval in 2017 ended up back in court. Biden's campaign says he would rescind the presidential permit that the pipeline needs to operate. Other oil and gas pipelines would also need to pass a heightened federal review related to their greenhouse gas emissions and effect on climate change.

Back to the future

Biden's clean energy future begins where he left it nearly four years ago, when he exited the White House with former US president Barack Obama, leaving behind a suite of ambitious climate rules. These included fuel-economy standards, the Clean Power Plan that set up carbon cap-and-trade for power plants, flaring limits on federal land and restrictions on methane leaks from new oil and gas facilities. There was also the Paris climate accord.

Trump has taken a wrecking ball to those rules and plans to have the US exit the Paris accord next month. Biden's task would be reversing those actions. He may be able to quickly reinstate methane limits and fuel-economy standards, which were in effect for years and only recently rolled back. But he would be close to starting from scratch on the other climate regulation. And it would likely take at least two years to impose tougher rules, such as plans to broaden methane emissions restrictions to cover tens of thousands of existing wells and pipelines. At the same time, Biden will have to be sensitive to promises to the oil workers that he has courted during his campaign. "I am not banning fracking," he says.

The problem for Biden is that — without action by Congress — truly ambitious climate rules will likely be blocked in court. The US Supreme Court in 2016, acting under a 5:4 conservative majority, already took the extraordinary step of suspending Obama's Clean Power Plan before a lower court had even decided on its legality. It takes little imagination to see the court repeating the action, particularly as it heads toward a 6:3 conservative majority as soon as this month. Within lower courts, rules will be reviewed in part by more than 200 federal judges newly appointed by Trump.

‘Nuclear' option

The late Democratic congressman John Dingell correctly predicted that trying to regulate greenhouse gas emissions under the Clean Air Act would be a "glorious mess". The law is vague enough that an administration can requisition it into action by spending years negotiating, writing complex rules and forcing states to put the emissions plans into action. Obama took that path after it became clear that no help was coming from Congress.

But if it can all be scuttled in an instant, by the Supreme Court or a new president, is it worth it? Biden says he is charting a path towards carbon-free power by 2035 "that no future president can turn back". How that would work is unclear, but one option to fast-track the plan would be for Congress to directly reinstate climate rules and give clear authority to cut emissions further.

That is a non-starter for many Republican lawmakers, who balk at tough climate regulations, instead offering vague support for "innovation" or emissions reductions that would only begin to apply a decade or more away. Passing a substantive bill would require Democrats, even if they take control of the Senate with 50 seats, to deploy the "nuclear option" of eliminating a 60-vote threshold to break a filibuster and pass legislation — an option that moderate lawmakers have not yet embraced.

The $2 trillion man

Biden's plan to spend $2 trillion over four years on his climate plan could attract some bipartisan support, by offering states badly needed funding for infrastructure and investments to adapt to a warming climate. The plan would involve investments in the electric grid to integrate wind and solar power, the expansion of public transit facilities, installing electric vehicle infrastructure and building out new high-speed rail. The possibility of federal funds could offer a carrot to convince states to revise policies to better plan for rising seas and stronger storms, while also injecting cash to rebuild crumbling roads and water systems.

More than that, the plan promises a needed boost to jobs given the millions unemployed because of the fallout from Covid-19. The funds could also help oil workers displaced by the economic downturn and more restrictive energy policies. Biden has touted initiatives such as plugging thousands of abandoned "orphan" wells as a way to produce 250,000 jobs and cut down on methane leaks.