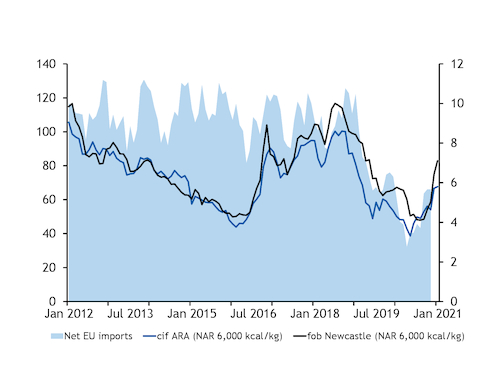

Rallying European coal prices and a brief convergence with Asia-Pacific markets in late 2020 has supported a modest recovery in EU imports this winter, but widening premiums in Asia should keep seaborne arrivals in Europe under pressure again this year.

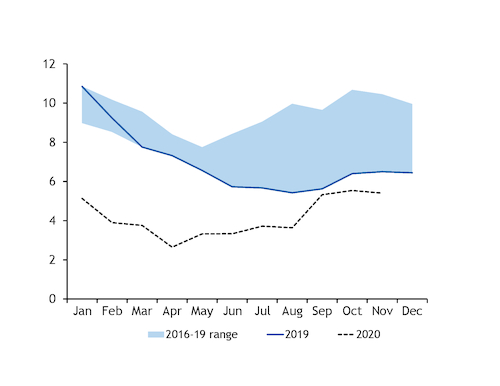

Net EU 27 coal imports fell by 1.1mn t on the year to 5.4mn t in November — the 21st consecutive month of annual declines — provisional Eurostat figures show. But the receipt represented a recovery from the historic low 2.6mn t imported in April 2020 and from average receipts of 4.2mn t/month in the third quarter.

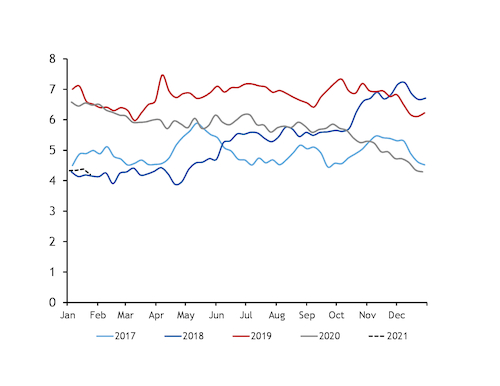

The modest month-on-month increases in imports in the second half of last year followed a recovery in European physical coal prices from below $40/t in May to more than $50/t in September, although the more decisive driver may have been the temporary convergence of Atlantic and Pacific coal prices.

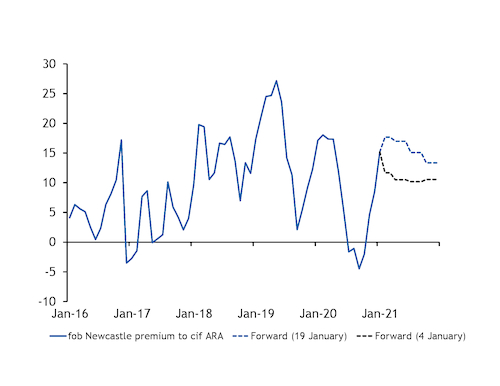

Argus' NAR 6,000 kcal/kg cif Amsterdam-Rotterdam-Antwerp (ARA) price assessment fell to a discount against the equivalent fob Newcastle market in Australia over July-October 2020, effectively closing the arbitrage into Asia for Atlantic-facing producers and making Europe a default destination for spare volumes delivered at the end of 2020.

European physical coal prices have continued to firm since November and reached as high as $71.29/t on 13 January, giving producer margins a further boost this winter. But the strength in Europe has been surpassed by gains in Asia, which has reopened the Atlantic-Pacific arbitrage and may increasingly draw available supply away from Europe again as suppliers refocus on Asia.

Argus' NAR 6,000 kcal/kg fob Newcastle assessment on 15 January held a $17.85/t premium to the cif ARA market. This was up from $12.43/t in late December and $6.49/t during November, as an unseasonably cold winter in northeast Asia has rattled energy markets.

Firmer outright prices may boost total exports from some corners of the Atlantic early in 2021, but the overall picture remains tight because of the continuing suspension at Colombian mining firm Prodeco, which produced 1.3mn t/month in January-March 2020.

From a demand perspective, month-ahead clean dark spreads in Germany and coal's relative competitiveness against gas are both at around a two-year high, creating potential for modest annual growth in coal burn in the near term. This follows an 11pc year-on-year increase in coal-fired generation in northwest Europe in December and a possible 17pc increase this month, based on the rate of output in recent weeks.

Any drop-off in imports could thereby keep the supply-demand balance in Europe tight in the short term and potentially weigh on stocks across the continent.

Port stocks in the ARA region are already down by 2.3mn t on the year having been drawn 1.5mn t lower since October, and the incentive to restock is much weaker than last year as strength in spot prices has flattened the contango on the forward curve compared with early 2020. Physical spot prices are currently $3/t lower than the front fourth-quarter API 2 swap, compared with nearly $9/t this time last year.

Changing price spreads

A period of sustained fundamental tightness in Europe early in 2021 could have implications for price spreads on the API 2 forward curve. A further drawdown of stocks in the near term could see additional risk premium built into forward contracts for delivery next winter, potentially boosting premiums to API 2 swaps delivering this summer and narrowing winter discounts to Asian markets in order to attract more volume to Europe.

The API 2 second-quarter 2021 swap currently holds a $2.35/t discount to the fourth quarter, down from more than $6/t on the equivalent pair last year. And the fourth-quarter API 2 coal swap is $13.35/t lower than equivalent derivatives for high-CV fob Newcastle coal traded through the Ice platform, which is out from a $5.70/t discount in early October, creating a strong incentive for Atlantic suppliers to divert flexible supply into the Pacific early next winter.

EU receipts from Colombia and the US both halved on the year to 621,000t and 321,000t, respectively, in November. This extended the 2020 trend, with EU receipts from Colombia down by 42pc on the year in the first 11 months of 2020 at 5.5mn t and imports from the US down by 52pc at 3.1mn t.

Weaker transatlantic supply in November was only partly offset by a 19pc or 683,000t increase from Russia to 4.3mn t. Imports from Russia were still down by nearly a quarter on the year for the January-November period at 33.8mn t.