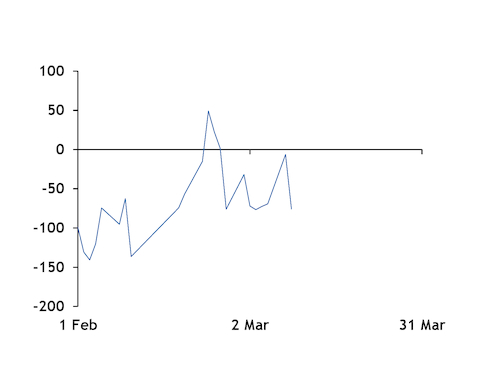

Chinese soybean board crush margins have remained negative since February, amid weak local demand for soymeal combined with high prices for imported soybeans.

China's soybean crush margins have fallen back into negative territory following a short-lived rebound after the lunar new year holiday, with the crush margin for April shipment of Brazilian soybeans having narrowed to minus 76 yuan/t (minus $11.70/t) this week.

The soymeal futures contract for May closed at Yn3,348/t yesterday, having fallen by 7pc from the Yn3,592/t when trading resumed following the holidays, data from Dalian Commodity Exchange show.

Soymeal prices have come under pressure from sluggish domestic demand from the Chinese animal feed sector in recent weeks, amid low hog inventory following the end of the peak season of pork consumption. Slower-than-expected pig restocking in early 2021, following a new outbreak of African Swine Fever in northern and southwestern regions of China, has also limited buying interest.

Any further decline in pig inventory could further reduce soymeal demand over the next few months, with the US Department of Agriculture having already lowered its estimate of Chinese soybean crush for the 2020/21 marketing year (October 2020-September 2021) to 98mn t, down by 1mn t from its previous estimate released in February.

The rising cost of soybean imports also pulled down board crushing margins, with soybean prices for Brazilian products having increased from Yn4,074/t at the beginning of February to Yn4,233/t this week, following an upward trend in soybean futures prices on the Chicago Board of Trade.