Narrowing PTA margins and the start-up of new plants in China could force shutdowns of older producers. Production margins have narrowed to around 310 yuan/t ($48/t), far below the breakeven level of Yn500/t.

Market participants attribute the rapid margin erosion to massive expansions of PTA capacity, which have resulted in an inventory build-up, particularly at Zhengzhou commodity exchange (ZCE)-approved futures warehouses.

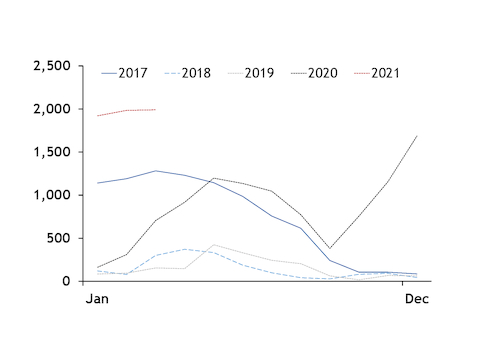

Producer Xinfengming commissioned a 2.2mn t/yr unit at Pinghu in Zhejiang province in November and Fujian Billion commissioned a 2.5mn t/yr PTA unit at Quanzhou in Fujian province in January. Shenghong Petrochemical is starting up its 2.4mn t/yr No.2 PTA unit at Lianyungang in Jiangsu province this month. PTA inventories at ZCE-approved warehouses are at a historic high of 1.99mn t, up by more than 800,000t compared with November 2020.

ZCE temporarily expanded its list of approved warehouses in November because of tight storage space. That tightness has returned now that inventories have risen to a historic high.

The PTA oversupply and tight storage space have squeezed production margins, which have declined for eight straight months to Yn900/t in August, before reaching around Yn300/t now.

There were also more maintenance closures this month because of the squeezed margins. Producer Zhejiang Reignwood shut its 1.4mn t/yr PTA unit at Shaoxing in Zhejiang province on 6 March for a month-long maintenance. There are expectations that it may not restart following the turnaround as rival producer Yisheng Petrochemical is planning to start up its 3mn t/yr No.5 PTA unit in Ningbo in late April. Xinjiang Zhongtai shut its 1.2mn t/yr PTA unit at Urumqi in Xinjiang this week because of insufficient supplies of feedstock PX. There was talk that squeezed production margins was a key factor behind the shutdown.

Even new PTA units are facing challenges, with Hengli Petrochemical, Xinfengming and Tongkun all mulling turnarounds in March-April.

Increasing new supplies are likely to continue to weigh on PTA production margins in the future, resulting in more plant shutdowns, particularly at older and standalone sites.