The strong La Nina event that caused significant disruption to coal markets during the northern hemisphere winter is in the process of dissipating, according to forecasters.

And with neither La Nina nor El Nino conditions likely over the northern hemisphere summer, a normal southwest monsoon season is expected across the Indian subcontinent. This is the scenario likely to cause the least disruption to coal supply and demand fundamentals in the second and third quarters.

A transition from La Nina to neutral conditions is likely in the next month or so, with an 80pc chance of neutral conditions in May-July, according to the US-based Climate Prediction Centre (CPC). The Japan Meteorological Agency (JMA) is making a similar forecast, noting that "La Nina features are decaying" and that neutral conditions are likely this summer.

Based on CPC records, this past winter saw the strongest La Nina since 2010-11, prompting climate patterns that caused significant disruption to Asia-Pacific energy and coal markets. This included a particularly cold winter in northeast Asia — Japan, South Korea and China — that boosted heating demand, drove an LNG supply squeeze and aided a recovery in coal prices from their mid-2020 lows. And heavy rainfall across key coal-exporting countries Australia, Indonesia and South Africa tightened Asia-Pacific coal supply in the first quarter.

The worst of this supply disruption now appears to be over, and global coal prices have begun to ease. Argus' NAR 6,000 kcal/kg fob Newcastle assessment slipped by $5.57/t last week to $92.03/t, while Argus' fob Richards Bay assessment is $90.20/t, down from $100.60/t in late March.

Looking to the second and third quarters, the intensity of the southwest monsoon in the Indian subcontinent, as well as the level of cooling demand during the peak summer months in northeast Asia, are likely to be the key drivers of global weather-related coal consumption.

Monsoon rains to support hydro

Privately owned meteorologist Skymet forecasts a "healthy monsoon" for the June-September season, with rainfall at 103pc of the long period average (LPA) of 880.6mm, factoring in a margin of error of +/-5pc. Monsoon rainfall within a 96-104pc range is considered normal.

"The occurrence of El Nino which normally corrupts the monsoon is ruled out," Skymet said. An El Nino event is typically associated with below-average rainfall and has historically caused drought conditions in India. Conversely, a La Nina event can correlate with above-average rainfall.

While monsoon rains are monitored extensively by agriculture markets because of India's abundant grain production, they can also exert a strong influence on commodity markets as a whole and energy markets in particular. A high level of monsoon rain can disrupt port logistics and coal mining in India, but also help to ensure plentiful hydropower generation.

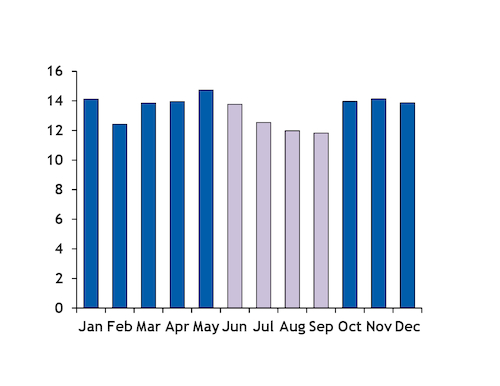

India's coal imports in June-September are usually lower than at other times of the year (see chart). This is partly because buyers look to avoid the monsoon deluge, but also as this is when hydropower generation peaks, which can trim fossil fuel demand.

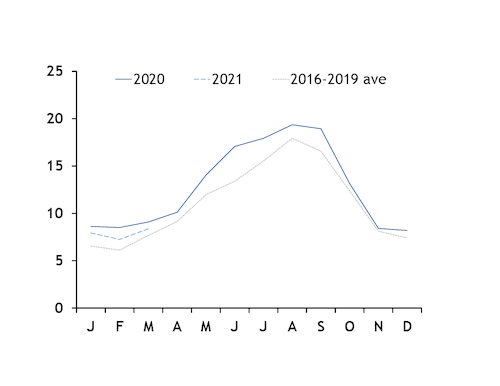

Hydro accounted for 153TWh of Indian power generation last year, or a 12.7pc share of overall output, up from 120TWh and a 10.5pc share in 2016, according to Central Electricity Authority figures. And generation in the past couple of years has been aided by particularly strong monsoon conditions.

Monsoon rainfall for the past two years was very high, at 109pc of the LPA in 2020 and 110pc in 2019 — the highest levels since 112pc of the LPA in 1994 — according to the India Meteorological Department.

Water levels in India's 130 monitored reservoirs stood at close to 174bn m³ on 8 April, or 67.6pc of capacity. This is lower than a year earlier but higher than the 10-year average, Central Water Commission data show.

A normal monsoon this year, coupled with strong stocks heading into June-September should mean there is ample water availability for hydro generation and could weigh on the power sector's coal demand.

NE Asia temperature outlook

The summer outlook for South Korea and Japan appears tilted towards above-average temperatures, which could support thermal generation for cooling purposes, particularly in South Korea given the expected year-on-year decline in nuclear availability.

The country's meteorological agency forecasts a 40pc chance of above-normal temperatures in April and June, as well as a 60pc chance of above-average temperatures in May.

This is similar to the JMA, which forecasts a 40pc chance of above-normal temperatures in Japan for most of May-September, with a 40pc chance of normal and 20pc chance of below-normal temperatures.