US coal-fired power plants that can stay on line through the end of this decade are likely to be called on to run at rates not seen since 2011.

Nearly 76,000MW of coal-fired generation retirements have been announced for 2021-2030, according to Argus data. Analysts at the US Energy Information Administration (EIA) are tracking another 20,000MW of additional retirements, based on the economics of utilities burning coal.

That would leave approximately 120,000MW of coal-fired generation available in the US after 2030, down from more than 300,000MW in the early 2000s.

The coal plants "that are left are all the ones that are economic," said EIA electricity analyst Laura Martin.

At the same time that coal generating capacity is shrinking, the amount of electricity demand is expected to be 4,475bn kWh in 2030, which would be about 8.5pc higher than in 2010. US generators would need to add nearly 500,000MW of capacity by 2030 to meet forecast electricity needs and cover for expected power plant retirements. Companies, as of February, had 124,143MW of planned additions, EIA data show.

So, generators may need to run remaining coal units more heavily to help bridge the difference between expected generation needs and available capacity.

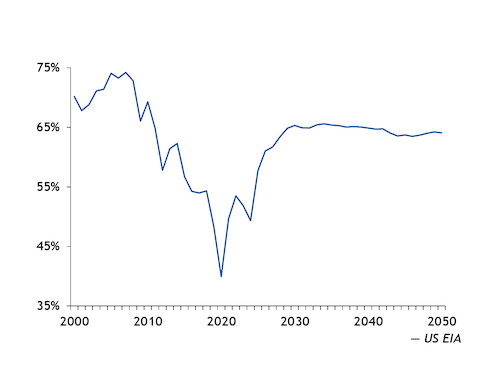

As the older, less efficient units retire, the remaining units can expect to run up to 65pc of the time by the end of this decade, EIA data show. That would be the realistic maximum capacity factor for coal units now, Martin said, meaning that coal-fired power plants at the end of this decade could be maximizing their output. And they are expected to maintain that level through at least 2050.

The percentage of run time – also called the capacity factor – for coal units fell to 40pc last year, the lowest level since at least 2000, according to EIA. The coal capacity factor had been as high as 74pc in 2007 and has not climbed above 60pc since 2014.

Even though the coal units remaining after 2030 will be running more, coal's share of total generation is still expected to shrink as more natural gas and renewable generation is added to the grid.

The remaining coal-fired power plants in 2030 are expected to produce just under 700bn kWh of power, down from as much as 2,015bn kWh in 2005, according to EIA estimates. Coal-fired generation totaled 773.8bn kWh last year

Coal is expected to account for 23pc of total generation this year, and climb to 24pc in 2022, EIA data show. It will gradually fall to 16pc in 2030 and then as low as 11pc in the mid-2040s. And coal consumption in the US electricity sector is expected to fall to 365mn st in 2030, down from 533mn st next year. Electricity sector coal demand is expected to level off near 300mn st in the mid-2040s.

Outlooks such as these are sensitive to a variety of changes, including government regulation, gas prices and incentives to build out renewables, Martin said.

Even EIA's most recent forecasts, published earlier this year, were done before the DC Circuit Court of Appeals rejected the US Environmental Protection Agency's repeal of the Clean Power Plan and its replacement the Affordable Clean Energy (ACE) rule.

The court's decision could extend the life of 10,000MW of coal-fired generation that was scheduled to retire as a result of the ACE rule beyond 2025, Martin said. But the rule is expected to be replaced with more stringent standard that could shorten the lifespan of coal-fired power plants. President Joe Biden has pledged the US will cut its greenhouse gas emissions by 50pc-52pc of 2005 levels by 2030.

Coal run rates also are at the mercy of natural gas prices. Sustained periods of low gas prices could put more coal-fired plants at risk of retiring, while higher prices would increase coal dispatch.

Last year's 40pc capacity factor was tied to natural gas prices averaging near $2/mmBtu in 2020. As gas prices rebound in 2021, the coal capacity factor is expected to climb to 50pc this year.

Some utilities, though, may decide to not run as much coal going forward. Duke Energy, which released a plan last week to retire its entire coal-fired fleet by 2048, said it does not expect the coal units still on line after 2025 will be dispatched more frequently.

"The coal units that will be in-service after 2025 will be our most efficient coal units and equipped with advanced environmental controls," Duke said. "Some will also have dual-fuel capability, giving us flexibility to produce energy using either coal or natural gas." The company said expectations for lower natural gas prices, and a growing renewable portfolio, would likely put a cap on coal-fired power.

Duke, a regulated utility, said it will "operate our system at the lowest cost, while also ensuring rate stability, reliability and minimizing environmental impacts."

But for other power producers without lower-cost options, a more efficient coal unit may be dispatchable for much of the year by the end of the decade.