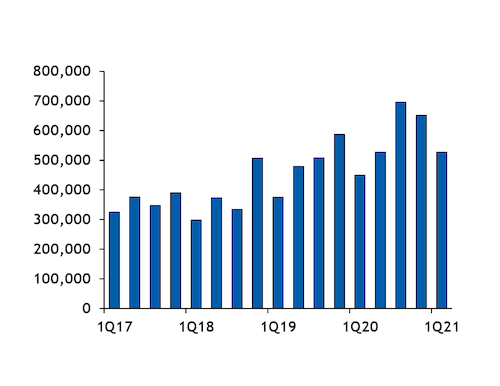

Wood pellet exports from Russia hit a new first-quarter record this year, boosted by higher deliveries to South Korea and Europe's industrial and heating sector — specifically in Belgium and Denmark.

Russia exported 527,000t of pellets in the first quarter, up from 450,000t a year earlier. Exports also hit a new March high, at 190,000t, up by 25pc on the year.

Denmark remained the largest recipient in the first quarter, as Russia upped deliveries by 19.8pc to 206,000t. Deliveries to Denmark accounted for 39.1pc of Russian exports, up by 0.9pc percentage points on the year.

The Danish voluntary energy agreement stated that utilities must ensure 90pc of their pellet supply last year was Sustainable Biomass Programme (SBP) compliant, and the number of Russian producers with SBP certification had risen — to 47 operational facilities at the end of March from 26 at the start of 2020.

Power prices in Denmark averaged €49.10/MWh ($59.50/MWh) in the first quarter, up from €21.20/MWh a year earlier, incentivising biomass-fired generation. And cold weather lifted heating demand in the first quarter. In Copenhagen, the number of heating degree days (HDDs) reached 1,468.5 in January-March, 6pc above the 10-year average and the highest since 2018.

Russian pellet exports to Belgium rose to 90,000t in the first quarter from 33,000t a year earlier. The was despite the closure of French firm Engie's 80MW Les Awirs plant in August.

Firmer power prices helped lift Belgian biomass consumption. The Argus-assessed Belgian over-the-counter (OTC) base-load day-ahead price averaged €55.11/MWh in the first quarter, compared with €32.13/MWh in January-March 2020.

Exports to Europe's other two large industrial pellet consumers — the Netherlands and the UK — fell. Russia sent 31,000t to the UK and 22,000t to the Netherlands, down from 43,000t and 27,000t, respectively, in the same period last year.

Elsewhere in Europe, Russian exports to Italy rose by 27.3pc to 28,000t. In Milan, the number of HDDs rose to 343.6 from 331.72 in the first quarter of 2020, but remained below the long-term average of 348.01.

Russian EN plus production rose through 2020, and as of April the country had more EN plus certified producers, 57, than any other country. And Russian production ranked third in 2020, at 1.1mn t, up by 44.7pc.

Russian pellet exports to South Korea rose in the first quarter, as South Korea's biomass-fired demand was supported by an increase in dedicated capacity.

Russia shipped 53,000t of pellets to South Korea in January-March, up from 42,000t a year earlier. Russia tends to compete with Canada in South Korea, given the similarities in pellet quality.

Wood pellet throughputs at the Russian port of St Petersburg reached 177,000t in the first quarter, up by 50pc on the year, the port authority said.