European physical coal prices edged down this week, although Argus' monthly cif Amsterdam-Rotterdam-Antwerp (ARA) index still reached its highest since September 2008.

Physical coal prices failed to recoup all of the value lost in the wake of last week's slump in prices triggered by indications that Russian gas could begin to flow through Nord Stream 2 (NS2) by the end of the year. But power-sector coal burn in Europe looks set to continue to grow modestly on the year in the coming months, as gas burn is cut back because of uncompetitively high prices driven by this summer's storage deficit and lacklustre pipeline and LNG imports.

European spot gas prices have been rising through coal-switching thresholds rapidly since the start of July, encouraging a drastic year-on-year reduction in German gas-fired generation and modest growth in coal burn.

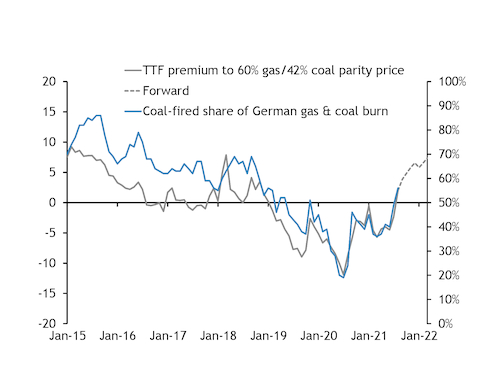

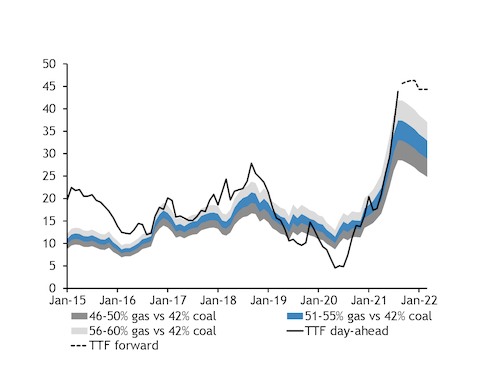

Day-ahead TTF gas prices have averaged a €1.99/MWh premium to the parity price for 60pc efficient gas-fired plants in competition with 42pc coal-fired units so far this month — the first time spot gas prices have pierced the top of this fuel-switch range since January 2019 (see chart).

The German fuel mix has been sensitive to the change in generation economics, with coal accounting for 56pc of combined generation from coal and gas in August (see chart). This is the highest share since late 2018 and the first time that coal's share has exceeded 50pc since November 2019.

In absolute terms, German coal burn has only edged higher on the year in August to an average of 3GW, with a 5.9GW collapse in average gas-fired generation the main driver of the steep increase in coal's share of the fuel mix this month.

But forward TTF gas prices for this winter sit even further above the 55pc gas/42pc parity price, suggesting that coal may further stretch its share of the fuel mix during the remainder of the year, potentially supporting more significant annual growth in monthly coal-fired generation to 7-9GW, according to Argus analysis. German fourth-quarter coal-fired generation averaged 6.1GW in 2020.

The current trend is largely the result of tight natural gas supply fundamentals in Europe, as Russian pipeline flows have failed to ramp up in response to surging hub prices and firm Asian gas demand has drawn seaborne volumes out of the Atlantic this summer. The dearth of supply has pulled the break on the rate of European storage injections into sites that started the summer season much lower than in previous years, heaping more risk onto winter contracts.

The gas market is liable to sharply change course at short notice, if and when supply to the region finally catches up with demand, but this looks unlikely in the near term, with so much uncertainty still clouding the fundamental outlook for this winter.

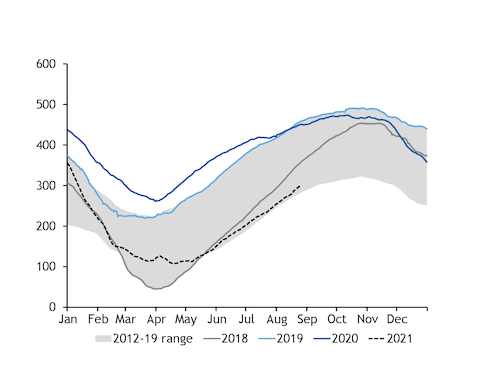

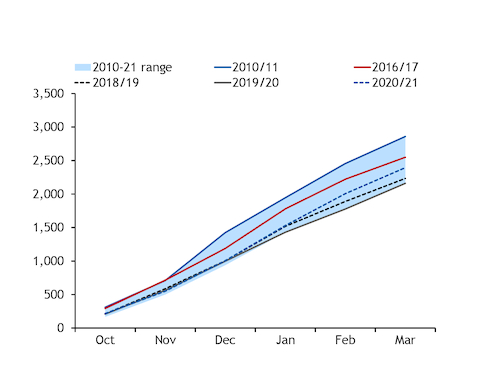

The current situation bears some resemblance to 2018 — the last time spot gas prices broke this high above coal-parity prices, and when northwest European gas stocks last lagged the long-term average (see chart). Spot gas prices fell precipitously from September 2018, as a surge in LNG supply to Europe coincided with mild winter temperatures, as measured using cumulative heating degree days in Berlin (see chart).

Russian state-controlled Gazprom's NS2 pipeline could offer similar relief through increased supply when the line finally comes on line, although the project's timeline for completion remains uncertain and the extent to which the pipeline will carry additional volumes to Europe or merely divert existing supply through a new route is not yet clear.

Last week's short-lived dive in gas prices, and the associated impact on other markets, in response to Gazprom suggesting that NS2 flows could begin later this year is an indication of how sensitive the European energy complex is to natural gas supply fundamentals. But the subsequent recovery in prices is a reminder of how fragile the balance still is ahead of the winter.

The Dusseldorf higher regional court ruled this week that NS2 is subject to German and EU gas market rules, rejecting the project developer's appeal against a previous decision that denied NS2 exemption from certain aspects of the EU gas directive.

If NS2 is subject to EU rules, its operator would need to offer third-party access on the link before it can be commissioned. And this can only happen once the project developer's operator application — filed in June — is approved.

Against this backdrop of uncertainty surrounding NS2, spot and forward gas prices are therefore likely to hold on to much of the existing risk premium until any supply recovery is realised, which if it comes, may also be deeper into the heating season than the ramp up in LNG supply to Europe was in 2018-19. And even then, the direction of European gas prices will be contingent on how harsh or mild the winter is.