Historically high aluminium pricing is keeping the market firm for anode-grade petroleum coke, an essential feedstock for primary aluminium smelting, with calcined coke prices in China reaching fresh highs.

Prices of Chinese calcined petroleum coke (CPC) with 3pc sulphur and meeting the required metals specifications for exports were heard to have risen to about 4,000 yuan/t ($618/t) on an ex-works basis at the beginning of last week, the same day spot prices for A00 grade aluminium in east China rose to a peak of around Yn23,400/t ($3,618/t). This compares with the Argus assessment for this CPC specification last month of $490-$550/t on an fob basis.

China is usually a key supplier of CPC to markets such as India, the Middle East and Oceania. But few export deals have been heard recently, as prices within China are exceeding those in most other production hubs. The elevated Chinese domestic prices may give calciners in other regions more room to negotiate price increases.

CPC supply remains relatively constrained globally. While one new calciner is scheduled to come on line in Oman next month, there have also been a number of supply disruptions. Almost 700,000t/yr of calcining capacity was significantly affected by Hurricane Ida, which hit the Louisiana Gulf coast late last month. And while these facilities were largely able to restart within about a week, key green petroleum coke suppliers in the US Gulf are still off line, which could continue to limit CPC production. A small calciner in Germany also went off line in July and is expected to remain down for the rest of this year. And some calcining capacity in India has been operating at lower rates over the past year because of challenges created by Covid-19 lockdowns and frequent maintenance shutdowns.

Chinese calcining capacity may be cut early next year, with provinces near Beijing expected to restrict industrial activity to improve air quality during the Winter Olympics. The city of Tangshan in Hebei province circulated a draft plan that would require companies to reduce pollutants such as SO2 and NOx by as much as half from late January to early March compared with the same period in 2021. The main calcining province of Shandong is expected to also issue restrictions over this timeframe. The upcoming capacity restrictions could explain why Chinese CPC demand remains so strong, even as curbs on the top producer's smelting are helping to drive up Chinese aluminium prices.

China cracks down on smelting to cut energy use

China has been clamping down on industries like aluminium that use a large amount of electricity, in part to meet environmental goals, but also because of a shortage of hydropower and coal.

China's top economic planning body the NDRC last month issued energy use warnings to nine provinces, including top aluminium producers Yunnan and Xinjiang.

The warnings likely contributed to Yunnan's provincial government on 11 September imposing a strict energy consumption control policy applying to industries like aluminium, silicon and fertilizer. The policy instructs aluminium smelters to keep operations for the rest of the year no higher than August's levels of 2.75mn t/yr, compared with total capacity of 4.48mn t/yr. Producers of silicon metal, which is used for alloying purposes and also uses petroleum coke as a feedstock, were instructed to cut production by 90pc from August's levels. Following the news, silicon metal prices jumped to their highest levels in Argus assessments going back to 2006.

The NRDC issued another policy document on 16 September saying it plans to further intensify efforts to clamp down on industrial energy consumption.

China's demand boosts global aluminium prices

China emerged last year as a net importer of aluminium for the first time since 2009, after previously weighing on the global market with massive exports.

This was even as China's production of primary aluminium continued to reach new highs.

The shift pushed up prices for smelters in the rest of the world.

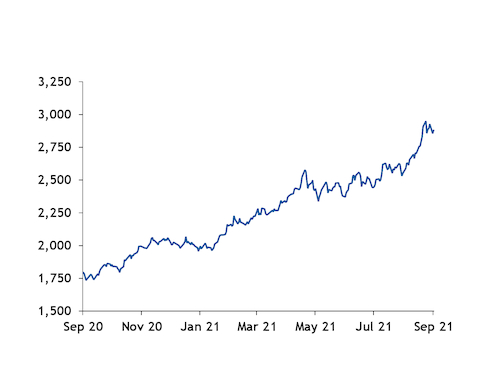

Aluminium prices on the London Metal Exchange (LME), the main price reference for the rest of the world's smelters, recently reached the highest levels since 2008. LME aluminium briefly touched $3,000/t on 13 September following the jump in Chinese prices. It is now hovering at around $2,900/t, up by 15pc from the start of the quarter and well into profitable territory for nearly all global smelters.

And the firm global pricing looks likely to continue. Forward spreads on the LME moved into a strong contango in recent weeks, and stocks started to fall at LME warehouses. On-warrant aluminium stocks dropped by almost 15pc in the first two days of this week alone.

The stronger global aluminium market has already spurred some new smelting capacity that will require additional CPC supply.

US aluminium producer Alcoa on 20 September said it plans to restart 268,000t/yr of capacity at the Alumar smelter in Brazil, which has sat idle since 2015.

India-based natural resources company Vedanta said in late July it plans to expand its Balco aluminium smelter by 414,000t/yr to about 1mn t/yr, as well as building carbon anode production capacity that will require additional CPC.