South Korea delivered coal prices rebounded this week on the back of a tighter Australian supply outlook amid weather-related disruptions across Queensland and New South Wales.

Argus assessed NAR 5,800 kcal/kg coal at $131.15/t fob Newcastle and $161.05/t cfr South Korea this week, up by $1.44/t and $7.43/t on the week, respectively.

The delivered price rose more sharply than the loaded price owing to firmer freight rates. The average Capesize freight rate between Australia's Newcastle port and China's Zhoushan increased to $20.99/t during 6-9 December, compared with $19.58/t a week earlier and $10.10/t a year earlier.

But the current price level does not align with South Korean utilities' demand, as they have ample coal stocks until at least early next year, market participants said. State-owned Korea Western Power (Kowepo) was scheduled to close a five-year term tender on 9 December seeking up to 310,000t of minimum NAR 4,000 kcal/kg coal for delivery in the second-third quarters of 2022, but this was reportedly cancelled because of high prices.

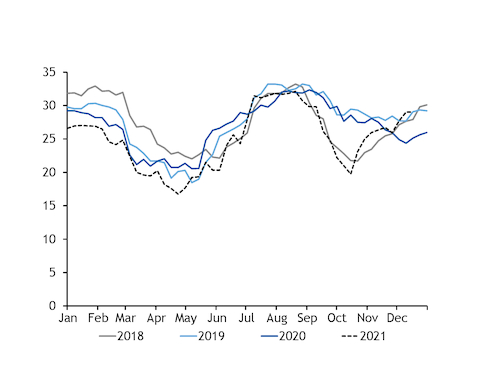

On the coal burn demand side, there were no additions to the restriction plan across Kepco's coal-fired plants this week, according to the latest power plant maintenance schedule published by the Korea Power Exchange (KPX). An average of eight coal-fired units are scheduled to be off line during 1-18 December, with daily availability averaging 28.05GW for the whole month. By comparison, an average of 16 coal-fired units were taken off line in December 2020, setting average availability at 25.01GW with actual output averaging 21.1GW.

The government has not imposed more stringent restrictions on its coal-fired plants so far this year, despite the potential to suspend up to 18 coal-fired units a day and a warmer-than-expected weather outlook across northeast Asia. Seoul's temperatures are forecast to remain above the historic norm for most days over the next fortnight by as much as 9.5°C, Speedwell Weather data show. South Korea's seven-day average peak power demand fell back to the seasonal range last week, although it remains higher than last year's level (see chart).

The real-time power data provided by KPX shows that coal-fired generation had a flat profile on 10 December running at a consistent 23-24GW intra-day, as of 22:00 local time (13:00 GMT), remaining unchanged from the level a week earlier. Nuclear output was around 1GW higher at 22GW this week, but gas-fired generation fluctuated in an 11-25GW range, compared with a 13-28GW range on 3 December.

This suggests utilities are either reluctant to burn more gas with generation economics favouring coal or are reserving gas stocks for the peak demand season, which typically occurs during the end of December.

State-owned Kogas reportedly procured on 8 December 8-11 LNG cargoes for delivery in January-February, possibly at an average premium of around $2/mn Btu to the Dutch TTF gas price, market participants said. This compares with a premium of around $5.50/mn Btu to the TTF that the company paid on 24 November, for around 12 LNG cargoes for delivery in the December-January period.

Meanwhile, the South Korean government announced on 10 December a more detailed energy plan to achieve 2050 carbon neutrality. The plan includes retiring a total of 24 old coal-fired units to convert to LNG-fired plants by 2034 and extending both voluntary and seasonal coal-fired plant restrictions measures to private-sector utilities.

Ample fuel, power supply weigh on Japan prices

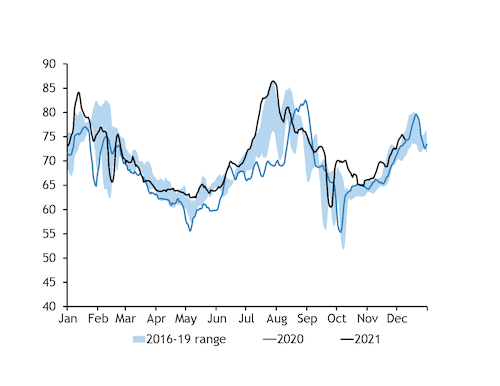

Ample power supply in Japan amid warmer-than-expected weather weighed on wholesale power prices on the Japan Electric Power Exchange (Jepx), eroding margins for thermal generators.

The average price of day-ahead power contracts trading under Jepx dropped by 10.6pc on the week to ¥17.14/kWh ($149.84/MWh) over 4-10 December, with net thermal and nuclear availability increasing by 1.12GW and 890MW on the week, respectively.

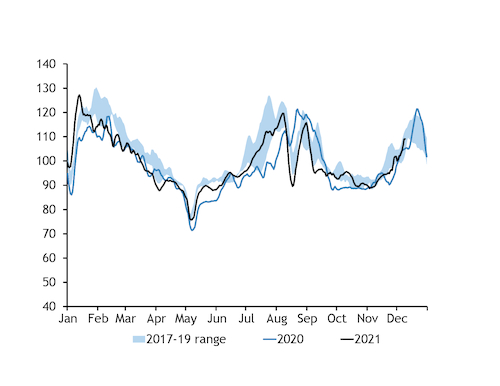

Based on these prices, the theoretical margins for a 44pc-efficient coal-fired generator decreased by 15pc on the week to ¥10,583/MWh over 3-9 December, using Argus' NAR 6,000 kcal/kg fob Newcastle assessment. The 44pc-efficient dark spread now holds a ¥777/MWh premium against the most efficient gas-fired unit running on oil-linked LNG, compared with an ¥88/MWh premium it held a week earlier.

Despite generation economics tilting towards more coal burn, Japanese utilities continued to increase their LNG stocks this week in a bid to prevent a fuel shortage on an unexpected power increase. The government report shows that Japanese utilities held around 2.33mn t of LNG as of 28 November, up by 12.6pc on the month.

The Japanese power agency forecasted on 26 November that the country will have around a 12.6-14.6TWh power surplus over 27 November-26 January, based on the outlook for utilities' fuel inventories and procurements. This is equivalent to around 4.8 days of power consumption, which is up from the previous projection of 3.8 days.