Strong biomass-fired generation in 2021 combined with supply shortages in the second half of the year lifted biomass prices to record highs, and the current forward curve shape for power markets in northwest Europe (NWE) suggests demand may hold strong in 2022.

The benchmark cif NWE wood pellet spot index reached fresh highs on 15 December, as strong heating and power sector demand continued to support the market, while spot supply availability remains tight.

Record-high power prices throughout Europe have bolstered biomass burn for power since the start of the summer 2021 season, which is also expected to reach a record high this year. Around 420MW of new biomass-fired capacity is expected to be commissioned in 2022, which combined with capacity expansions in late 2021 will further support biomass burn for power next year.

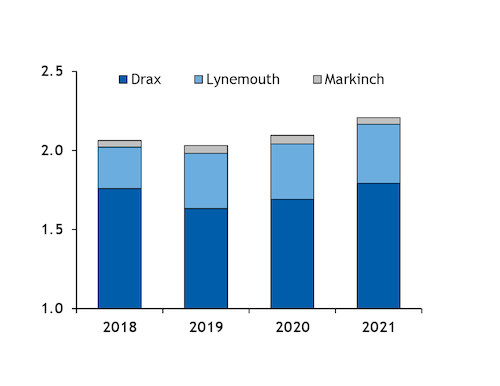

UK's biomass-fired generation is due to rise to 2.2GW on an hourly average — assuming output for all of December in line with the average so far for the month — from 2.1GW a year earlier, which would be the highest for any year. And demand for pellets will increase further in 2022 as UK developer MGT's Teesside 299MW dedicated combined heat and power (CHP) plant is expected to start operations on 17 January. MGT is expected to consume 1mn t/yr.

Dutch demand for pellets may also increase, following German utility RWE's doubling of the biomass co-firing allowance to 30pc, or by 225MW, at its Dutch co-fired 1.5GW Eemshaven plant from November 2021. That said, the utility may not be able to fully use the newly added capacity from the legal permit because of physical limitations at the power plant.

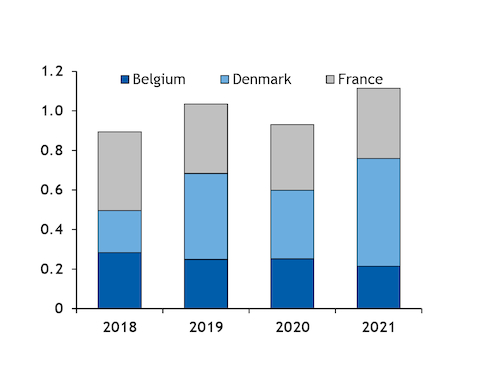

Danish biomass-fired generation is also likely to remain strong in 2022, given the strong forward power prices, after reaching a record high this year. Danish state-controlled utility Orsted significantly increased the share of its heat and power generation from biomass this year, bolstered by higher power prices and a cost advantage over coal. The power prices rose sufficiently to even allow the utility to sell a part of its output to the free market, without receiving any state-backed support.

Elsewhere, Polish utility Ze Pak's 100MW Konin plant in central Poland plans to bring on line its second 50MW biomass-fired unit by January 2022, converted from lignite-fired. Ze Pak is likely to feed the added unit on wood chips — the primary feedstock for most Polish power plants that run on biomass. And the 70MW Vilnius CHP in Lithuania, which will be fed on wood chips and wood waste, is expected to start operations in the fourth quarter of 2022.

These will add to pressure on wood chip supplies in 2022, as the market has already tightened significantly in the second half of 2021 because of lack of raw material, ever-rising freight rates, logistic disruptions and a halt in imports from Belarus amid political tensions between Minsk and the EU.

And while residential demand for pellets will strongly depend on weather conditions, demand for certified premium pellets could continue to grow in 2022 should pellets maintain their strong competitiveness to other alternative fuels, such as power, natural gas or heating oil. Sales of pellet-fired boilers and stoves rose significantly in central and southern European countries this winter, and are said to have boosted residential consumption by more than 650,000t in Austria, Germany and France combined this winter season.

Supply tightness may hold

On the supply side, tightness may continue well into 2022, barring any further delays to the start-up of the UK's 299MW Teesside power plant, unplanned outages at major utilities or unusually warm weather through next year.

Expansion works at Enviva's Northampton, North Carolina, and Southampton, Virginia, plants for a combined 400,900 t/yr were completed earlier this year, the company said in November.

The firm's 750,000 t/yr Lucedale production plant is expected to begin production by the year's end. The plant includes an option to expand production capacity by about 300,000 t/yr, for which the necessary permits have been granted. Enviva's expansion by 100,000 t/yr at its Greenwood, South Carolina, plant to 600,000 t/yr of pellets is also scheduled to be commissioned by year-end.

That said, some of the new production will be absorbed, following a five-year agreement Enviva signed with UK utility Drax in October for 200,000 t/yr, with deliveries beginning in 2022.

And the permanent shutdown of Canadian wood pellet producer Pacific BioEnergy's 350,000 t/yr plant at Prince George early next year is expected to leave the market around 300,000t short of wood pellets in 2022. The firm sold 2.8mn t/yr through contracts for delivery in 2022 to the mid-2030s to UK Drax Group's Canadian wood pellet producing subsidiary Pinnacle, with the deal expected to be finalised by year-end.

Elsewhere, Russian wood pellet producer Segezha's 60,000 t/yr Sokolsky plant in Vologda Oblast, became operational on 26 November.

| North American wood pellet capacity | t/yr | ||||||

| Country | Plant | Company | Added capacity | Capacity | Status | Actual/planned start date | Notes |

| Canada | Prince George, British Columbia | Pacific Bioenergy | -350,000 | 350,000 | Permanent Closure | Early 2022 | Shutdown date to be finalised early 2022 |

| US | Northampton, North Carolina | Enviva | 200,400 | 750,000 | Operational | 2H21 | Expansion completed 2H21 |

| US | Southampton, Virginia | Enviva | 200,500 | 760,000 | Operational | 2H21 | Expansion completed 2H21 |

| US | Greenwood, South Carolina | Enviva | 100,000 | 500,000 | Operational | End 2021 | Upgrade to 600,000 t/yr ongoing |

| US | Lucedale, Mississippi | Enviva | 750,000 | 750,000 | Construction | End 2021 | Commissioning expected late 4Q21 |