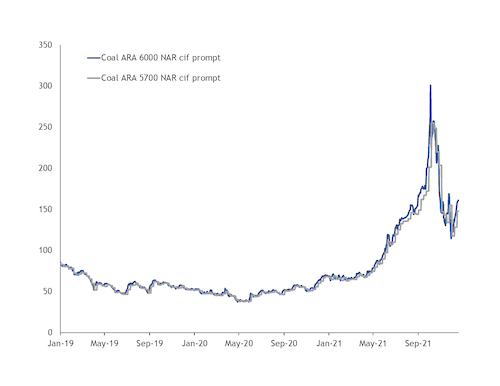

European coal prices hit new record highs in October, alongside other seaborne coal and global gas markers.

Argus' daily NAR 6,000 kcal/kg cif Amsterdam-Rotterdam-Antwerp (ARA) assessment reached an all-time high on 5 October at $301/t, more than eight times higher than the 2020 low on 26 April during the initial wave of the Covid-19 pandemic.

The premium held by the NAR 6,000 kcal/kg price over the lower calorific value (CV) NAR 5,700 kcal/kg cif ARA market also reached a record high of $30.95/t on 1 October, reflecting particularly acute high-CV coal fundamentals.

Record-high prices were also seen in the paper market, with the API 2 month-ahead swap reaching a record high in October of $269.75/t, more than six times higher than the 2020 low. The backwardation on the API 2 curve hit a record level, owing to the tight prompt fundamentals. The premium of the month-ahead over the front-year swap reached $90.50/t in October, compared to a discount of $1.50/t one year ago.

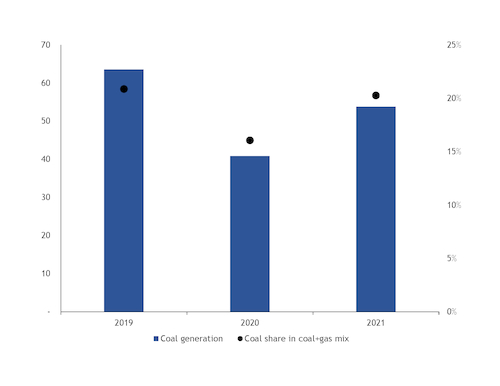

Fuel-switching returns European coal burn to pre-pandemic level

Coal-fired generation in northwest Europe hit its highest level in two years in November.

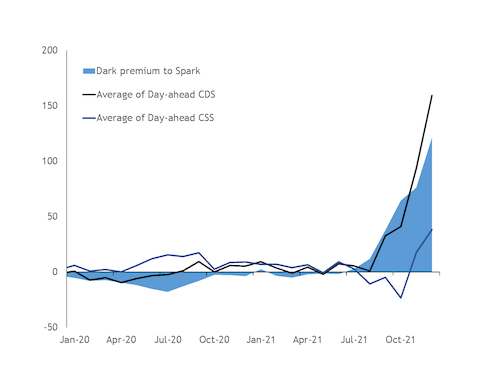

Total coal-fired generation across Germany, Spain, the UK and France in the first 11 months of 2021 rose by 37pc year on year to 53.76TWh but was still 15pc lower than over the same period two years ago. The significant increase in European coal-fired generation margins throughout 2021 supported strong utilisation of coal power plants.

The load factor at coal plants in these four countries in November, based on installed capacity, reached its highest level since January 2019 at 39pc, compared with 26pc in October and 22pc a year ago, according to Argus' analysis. Daily load factors in Germany, based on available capacity, have regularly exceeded 80pc in recent weeks.

The strong coal burn growth was driven by firm overall power demand and low renewables output, notably wind.

And a shortage of natural gas has exacerbated the need for coal-fired generation. A shortfall in European gas storage levels, intermittent pipeline imports and stiff competition from Asia for LNG propelled European gas prices to new highs in 2021 and well beyond fuel-switching thresholds. At current forward prices, coal-fired generation is more profitable than gas for generation in Germany through to 2024.

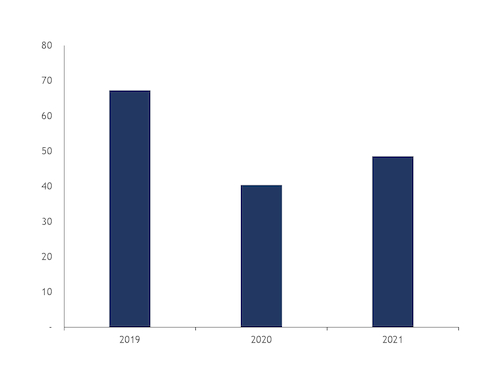

European net coal imports up

Given the increase in coal-fired generation regionally, net European coal imports in 2021 are on track to rise on the year, but further growth is likely to be capped by supply-side disruptions and a lack of spare coal-fired generation capacity in Europe, given gas-coal fuel-switching appears to have already been maxed out.

Aggregate January-October net coal imports into the EU-27 increased by 20pc on the year to 48.6mn t but remained 28pc short of the 2019 level.

[Some supply constraints from key coal-exporting countries]https://direct.argusmedia.com/newsandanalysis/article/2274807), as a result of railing issues in Russia and South Africa, and inclement weather and the prolonged shutdown at Colombia's Prodeco operation, have hampered inflows into Europe and intensified the continent's supply shortage.

As a result, coal stocks at the Amsterdam-Rotterdam-Antwerp (ARA) transshipment hub, a key indicator for the European coal balance, have trended down since October 2020 and remained at a historically seasonal low level throughout 2021.

Russia remained the leading coal exporter to Europe in 2021, followed by Colombia and the US/Canada. Russia's share of total European imports over the first ten months of the year fell by 3 percentage points on the year to 66pc. Colombia's share was almost unchanged on the year at 12pc, while imports from the US/Canada made up 9pc of imports, up from 5pc one year ago.

Outlook for 2022

Short-term European coal fundamentals point towards protracted coal market tightness.

European coal burn is expected to remain elevated into 1Q 2022 amid uncertainty over how long the acute gas market tightness will persist. Europe's Q1 coal imports could surpass the 2019 level, although the absolute level of imports will hinge on prevailing winter temperatures.

Further out, a normalisation of gas market fundamentals and associated drop in gas prices will likely be required to squeeze more coal out of the power generation mix and reduce the region's coal import requirements. Given Europe's increasing dependence on energy imports and exposure to a more globalised gas market, significant energy price volatility — particularly in the high demand winter months — could become a more common theme in the years ahead.