Differentials for off-specification South African coal have been crushed in recent weeks, as extremely tight supply, rail delivery issues in the country and emerging demand in Europe for lower-calorific-value (CV) grades have narrowed the premium held by spot NAR 6,000 kcal/kg prices.

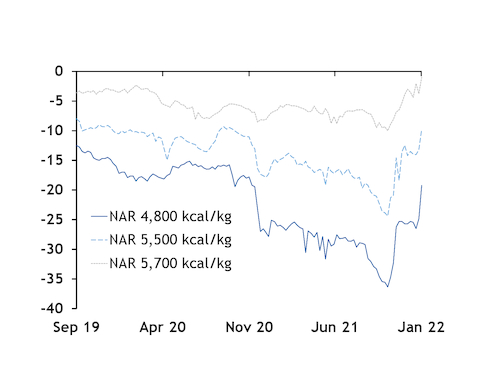

Richards Bay NAR 5,500 kcal/kg coal — South Africa's most widely exported product — was assessed at a discount to API 4 of $9.75/t on 7 January, the tightest spread between the two prices since September 2020. This week, two 50,000t March cargoes of this grade dealt on screen at a $5/t discount to API 4.

The discount for Richards Bay NAR 4,800 kcal/kg coal to API 4 has also tightened significantly, closing at $19.25/t on 7 January. The last time the spread was tighter than this was in November 2020. This week, a 50,000t March cargo of this grade traded at a $17/t discount to API 4.

The Richards Bay NAR 5,700 kcal/kg differential, meanwhile, is now close to parity with API 4, assessed at a discount of just $1/t on 7 January, the smallest spread between the two products since at least September 2019.

Indonesian ban impact muted

A ban on Indonesian coal exports announced on 31 December to address critical supply shortages has significantly constricted global supply.

But the tightening in South African off-speculation differentials has been driven mostly by factors independent of the ban, according to market sources.

"Most Indonesian coal sent to China is used as a cheap blending compound. South African coal is a relatively high-CV material. Even [NAR 4,800 kcal/kg] doesn't compete [with Indonesian off-specification coal]," a trading company source said.

"The main factor in the tightening off-specification prices has been lower volumes due to railing issues [in South Africa] and very low stocks at the port."

A second trader source said, "The off-specification [differentials] tightening has nothing to do with Indonesia. There is simply no availability of South African prompt coal."

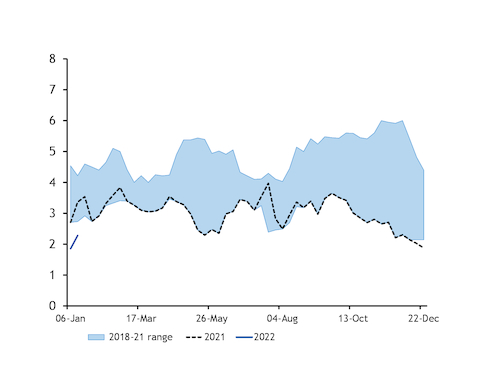

Stocks at the Richards Bay Coal Terminal (RBCT) have plummeted in recent weeks. Inventories held at just 2.3mn t on 10 January, down from 3.4mn t at the same time a year earlier and from average volumes throughout 2021 of 3.0mn t.

Ongoing rail issues in South Africa have contributed to the declining stocks, with cable theft across the country limiting the volume of coal that can be transported for export.

In a bid to tackle cable theft, South African coal industry stakeholders have offered to assist rail operator Transnet Freight Rail (TFR) in policing the network.

These measures are not expected to have a significant impact in the short term, however, given that a substantial number of locomotives used to transport coal are not running, according to a broker source.

National rail and port operator Transnet was not immediately available for comment.

Changing export markets

In addition to tight supply in South Africa, off-speculation differentials have been tightened by emerging demand for lower-CV grades in regions outside of key markets India and Pakistan.

"There has been less NAR 5,700 kcal/kg coal going to Pakistan," the first trading company source said. "South African coal is generally used for cement making there, but when the price is high they either reduce cement making or buy land-locked Afghan coal. However, there have been bits and pieces of NAR 5,700 kcal/kg coal going to west and east Africa. Some has been going to Dubai, Kuwait and the UAE, which are all relatively well-paying markets. And some has been going to Europe, to Turkey and to Spain."

One cargo of Richards Bay NAR 4,800 kcal/kg coal recently was sold to Poland, sources said, although a broker also was recently quoting sized coal to Poland and was unable to find a buyer. South Africa last exported coal to Poland in 2019, shipping data show.

Tight Russian supply has been a factor in European buyers looking to other markets to import coal.

Early in the first quarter, there has been a significant shortage of coal at northwest ports in Russia owing to logistical issues within the country, according to a producer source in the country.

This could result in the region's largest coal terminals failing to meet their annual transshipment plans, the source said.

Exports from Russia's northwestern ports — which typically target the European market — fell by 12.3pc on the year and 0.8pc on the month to 4.9mn t in November.

The global supply situation is expected to play a role in determining the direction of off-specification spreads, with European gas prices and Indonesia's coal export ban still creating significant uncertainty.

In any event, with no end in sight to South African rail delivery issues, supply of all coal grades from the country is likely to remain extremely tight in the weeks ahead.