Traded volumes of API 4 paper contracts rose by 13pc on the year in June, spurred mainly by a rise in API2-API4 spread trading, according to market sources.

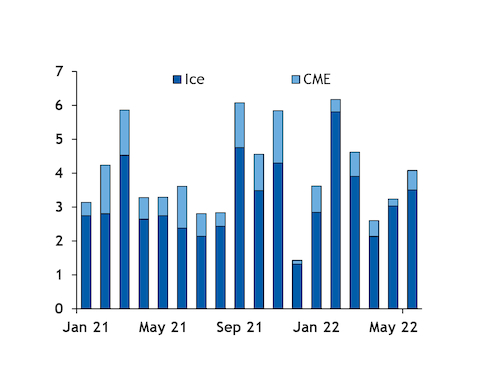

A total of 4.08mn t of API 4 volumes traded in June, with 3.51mn t transacting on Ice and 0.57mn t on CME. Combined volumes on both exchanges were up 13pc from a total of 3.61mn t in the same month a year earlier and up 26pc on the month from 3.24mn t in May.

API 4 traded volumes on Ice and CME rose by 4pc to 24.33mn t in January-June (see chart).

The improved API 4 liquidity on the year and on the month in June has coincided with a sharp drop in volatility since spiking in March and April. Volatility in the fob Richards Bay NAR 6,000 kcal/kg physical market has also fallen significantly since hitting a record high in March.

The reduction in volatility in the paper market since a spike in March and April has led Ice to reduce its coal margin requirements in the past few weeks, a factor which could support a further increase in trade.

Spread trading on the rise

Participants are increasingly trading API 2-API 4 spreads including implied freight rates as a means of hedging physical cargoes booked from South Africa to Europe, sources said.

"Recently, [the] Implied [spread] is trading but API 4 isn't. Glencore has bought some [tonnage] on an implied basis," one broker said.

High-CV South African and Colombian product have emerged as preferred options for many buyers in Europe following the Russian embargo, given the respective material's suitable specifications for coal burn at European power plants.

Availability of South African product remains hampered by railing problems, but supply should improve in the weeks ahead, with maintenance on Transnet Freight Rail's north corridor export coal line set to end on 22 July.

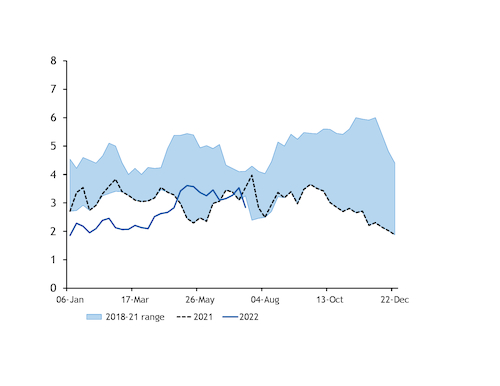

But stocks at the Richards Bay Coal Terminal totalled just 2.84mn t on 18 July, down 20pc from this time a year earlier and below the 2018-21 range (see chart).

API 2 June volumes recover from recent lows

Traded volumes on API 2 paper contracts rose on the month in June, continuing a tentative rebound after liquidity crashed to a multi-month low in April.

A total of 38mn t transacted in June, up by 19pc from May and 52pc from the April low.

But volumes were still down by 49pc on the year in June, reflecting the continued impact that the Russia-Ukraine conflict and the associated withdrawal of Russian banks from the European market have had on overall liquidity.

The recent tentative recovery in liquidity could be boosted in the fourth quarter, when sources expect European coal demand could improve significantly.

But demand expectations in the very short term have been revised lower by extremely low water levels on the Rhine, which are set to limit coal barging activity possibly until the end of July.