Freight rates for the coal-carrying Panamax route from Indonesia to China have stabilised and could move higher on increased Chinese coal demand as summer temperatures rise.

Rates for 75,000t coal shipments on the route increased marginally by $0.20/t to $10.05/t on 19 July, after a continuous decline for the past two weeks. Spot chartering activities were reportedly higher and offer levels from shipowners were reportedly more resistant as demand for Indonesian coal had firmed. Panamax vessels were also the vessel of choice for most of these shipments, as freight rates for the larger vessels remained comparatively cheaper than Supramaxes.

Demand for low and ultra-low calorific value (CV) Indonesian coal mainly came from Chinese utilities which needed lower-CV coal for blending against high-CV Russian coal and domestic coal, as temperatures rise ahead of the peak summer season.

Chinese buyers are expected to stay active in the spot market for at least the next two weeks, with a focus on securing cargoes that could arrive by the third week of August to cater to the further uptick in coal consumption at utilities, a market participant said. Coal consumption at utilities in eight coastal provinces rose on the week by 290,000 t/d to 2.23mn t/d as of 13 July. Coal stocks at these utilities were at 28.6mn t on 13 July, down by 1.2mn t from a week earlier.

Freight rates for Panamax vessels could also receive further support, as congestion at Chinese ports has increased. The total number of vessels at Chinese ports was 238 on 14 July, a 20pc increase from May, according to data from Signal Ocean.

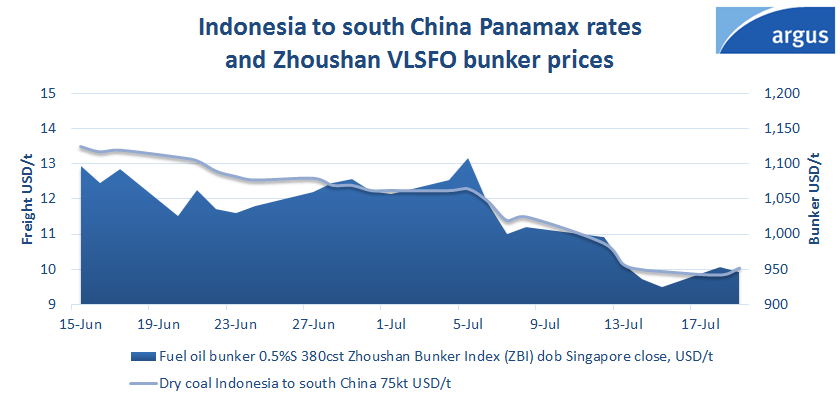

Panamax freight rates for the route had fallen by 27pc to $9.85/t on 18 July from $13.35/t on 15 June. Demand for low CV Indonesian coal was subdued earlier, as China's economic recovery had been slow. China's Covid-19 lockdown measures have eased, but the country's economic recovery was curbed by sporadic increases in Covid-19 cases. Initial summer demand was also curtailed by higher rainfall and typhoons.

Frieght rates over the past month have also been subdued by a surplus of vessels. High bunker prices compelled many shipowners to keep their vessels in the region, as they were reluctant to ballast towards the east coast of South America (ECSA). There was also a surplus of old vessels in the region competing for shipments, participants said.

The price for very low-sulphur fuel oil bunker with 0.5pc sulphur in Zhoushan has risen by an average of $425.28/t, or 64.43pc, from January to June. But bunker prices have fallen from its peak at $1,140.74/t on 10 June to $946/t on 20 July, on prospects of rising crude supplies.